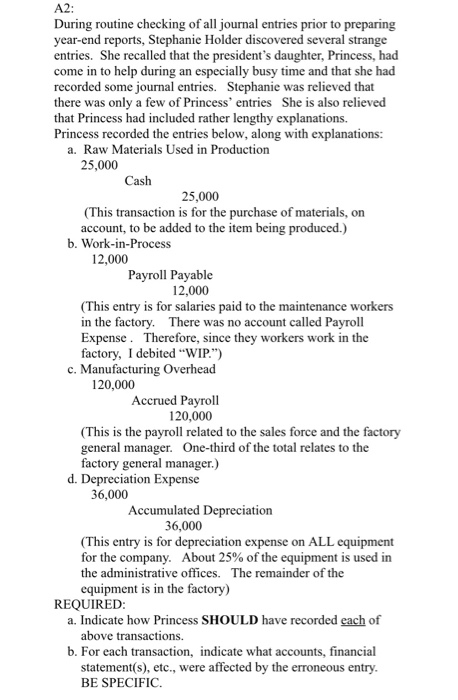

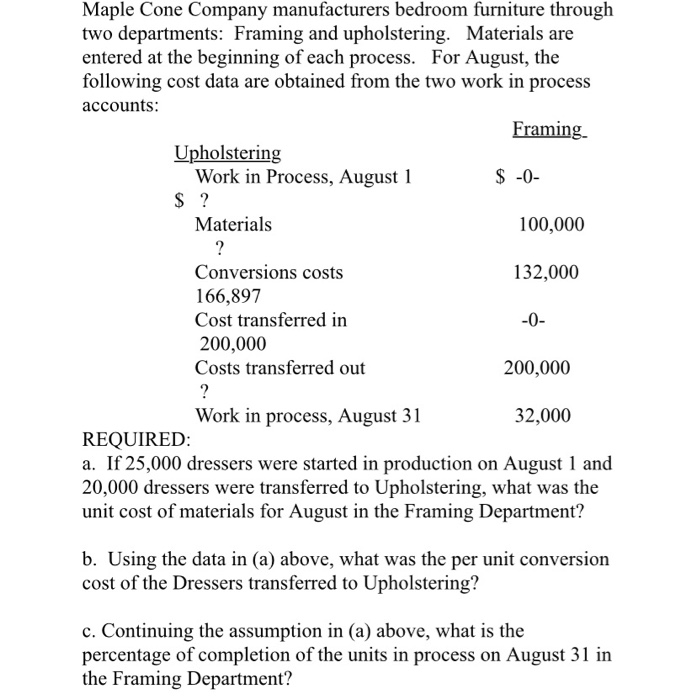

A2: During routine checking of all journal entries prior to preparing year-end reports, Stephanie Holder discovered several strange entries. She recalled that the president's daughter, Princess, had come in to help during an especially busy time and that she had recorded some journal entries. Stephanie was relieved that there was only a few of Princess entries She is also relieved that Princess had included rather lengthy explanations. Princess recorded the entries below, along with explanations: a. Raw Materials used in Production 25,000 Cash 25,000 (This transaction is for the purchase of materials, on account, to be added to the item being produced.) b. Work-in-Process 12,000 Payroll Payable 12,000 (This entry is for salaries paid to the maintenance workers in the factory. There was no account called Payroll Expense. Therefore, since they workers work in the factory, I debited "WIP.") c. Manufacturing Overhead 120,000 Accrued Payroll 120,000 (This is the payroll related to the sales force and the factory general manager. One-third of the total relates to the factory general manager.) d. Depreciation Expense 36,000 Accumulated Depreciation 36,000 (This entry is for depreciation expense on ALL equipment for the company. About 25% of the equipment is used in the administrative offices. The remainder of the equipment is in the factory) REQUIRED: a. Indicate how Princess SHOULD have recorded each of above transactions. b. For each transaction, indicate what accounts, financial statement(s), etc., were affected by the erroneous entry. BE SPECIFIC. Maple Cone Company manufacturers bedroom furniture through two departments: Framing and upholstering. Materials are entered at the beginning of each process. For August, the following cost data are obtained from the two work in process accounts: Framing. Upholstering Work in Process, August 1 $ -0- $ ? Materials 100,000 ? Conversions costs 132,000 166,897 Cost transferred in -0- 200,000 Costs transferred out 200,000 ? Work in process, August 31 32,000 REQUIRED: a. If 25,000 dressers were started in production on August 1 and 20,000 dressers were transferred to Upholstering, what was the unit cost of materials for August in the Framing Department? b. Using the data in (a) above, what was the per unit conversion cost of the Dressers transferred to Upholstering? c. Continuing the assumption in (a) above, what is the percentage of completion of the units in process on August 31 in the Framing Department? process, August REQUIRED: a. If 25,000 dressers were started in production on August 1 and 20,000 dressers were transferred to Upholstering, what was the unit cost of materials for August in the Framing Department? b. Using the data in (a) above, what was the per unit conversion cost of the Dressers transferred to Upholstering