Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A25 fx A B C begin{tabular}{l|l|l|} D & E end{tabular} G H M Your clients Mr. and Mrs. Smith have just had their first grandchild

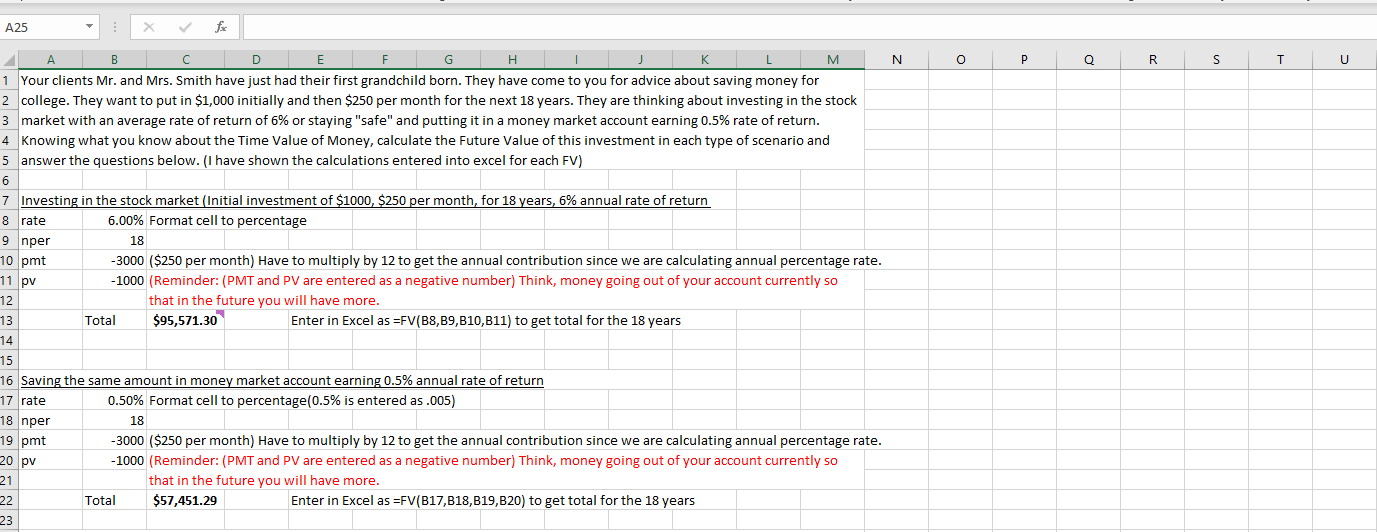

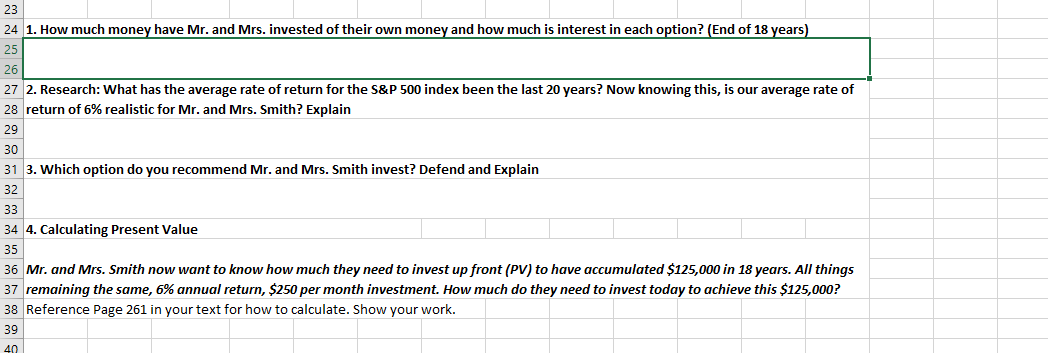

A25 fx A B C \begin{tabular}{l|l|l|} D & E \end{tabular} G H M Your clients Mr. and Mrs. Smith have just had their first grandchild born. They have come to you for advice about saving money for college. They want to put in $1,000 initially and then $250 per month for the next 18 years. They are thinking about investing in the stock market with an average rate of return of 6% or staying "safe" and putting it in a money market account earning 0.5% rate of return. Knowing what you know about the Time Value of Money, calculate the Future Value of this investment in each type of scenario and answer the questions below. (I have shown the calculations entered into excel for each FV) Investing in the stock market (Initial investment of $1000,$250 per month, for 18 years, 6% annual rate of return rate 6.00% Format cell to percentage nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. pv -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so that in the future you will have more. Total $95,571.30 Enter in Excel as =FV(B8,B9,B10,B11) to get total for the 18 years Saving the same amount in money market account earning 0.5% annual rate of return nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so pv that in the future you will have more. Total Enter in Excel as =FV(B17,B18,B19,B20) to get total for the 18 years 23 24 1. How much money have Mr. and Mrs. invested of their own money and how much is interest in each option? (End of 18 years) 25 7 2. Research: What has the average rate of return for the S\&P 500 index been the last 20 years? Now knowing this, is our average rate of return of 6% realistic for Mr. and Mrs. Smith? Explain 3. Which option do you recommend Mr. and Mrs. Smith invest? Defend and Explain 32 33 34 4. Calculating Present Value 35 36 Mr. and Mrs. Smith now want to know how much they need to invest up front (PV) to have accumulated \$125,000 in 18 years. All things 37 remaining the same, 6% annual return, $250 per month investment. How much do they need to invest today to achieve this $125,000 ? 38 Reference Page 261 in your text for how to calculate. Show your work. 39 40 A25 fx A B C \begin{tabular}{l|l|l|} D & E \end{tabular} G H M Your clients Mr. and Mrs. Smith have just had their first grandchild born. They have come to you for advice about saving money for college. They want to put in $1,000 initially and then $250 per month for the next 18 years. They are thinking about investing in the stock market with an average rate of return of 6% or staying "safe" and putting it in a money market account earning 0.5% rate of return. Knowing what you know about the Time Value of Money, calculate the Future Value of this investment in each type of scenario and answer the questions below. (I have shown the calculations entered into excel for each FV) Investing in the stock market (Initial investment of $1000,$250 per month, for 18 years, 6% annual rate of return rate 6.00% Format cell to percentage nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. pv -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so that in the future you will have more. Total $95,571.30 Enter in Excel as =FV(B8,B9,B10,B11) to get total for the 18 years Saving the same amount in money market account earning 0.5% annual rate of return nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so pv that in the future you will have more. Total Enter in Excel as =FV(B17,B18,B19,B20) to get total for the 18 years 23 24 1. How much money have Mr. and Mrs. invested of their own money and how much is interest in each option? (End of 18 years) 25 7 2. Research: What has the average rate of return for the S\&P 500 index been the last 20 years? Now knowing this, is our average rate of return of 6% realistic for Mr. and Mrs. Smith? Explain 3. Which option do you recommend Mr. and Mrs. Smith invest? Defend and Explain 32 33 34 4. Calculating Present Value 35 36 Mr. and Mrs. Smith now want to know how much they need to invest up front (PV) to have accumulated \$125,000 in 18 years. All things 37 remaining the same, 6% annual return, $250 per month investment. How much do they need to invest today to achieve this $125,000 ? 38 Reference Page 261 in your text for how to calculate. Show your work. 39 40

A25 fx A B C \begin{tabular}{l|l|l|} D & E \end{tabular} G H M Your clients Mr. and Mrs. Smith have just had their first grandchild born. They have come to you for advice about saving money for college. They want to put in $1,000 initially and then $250 per month for the next 18 years. They are thinking about investing in the stock market with an average rate of return of 6% or staying "safe" and putting it in a money market account earning 0.5% rate of return. Knowing what you know about the Time Value of Money, calculate the Future Value of this investment in each type of scenario and answer the questions below. (I have shown the calculations entered into excel for each FV) Investing in the stock market (Initial investment of $1000,$250 per month, for 18 years, 6% annual rate of return rate 6.00% Format cell to percentage nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. pv -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so that in the future you will have more. Total $95,571.30 Enter in Excel as =FV(B8,B9,B10,B11) to get total for the 18 years Saving the same amount in money market account earning 0.5% annual rate of return nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so pv that in the future you will have more. Total Enter in Excel as =FV(B17,B18,B19,B20) to get total for the 18 years 23 24 1. How much money have Mr. and Mrs. invested of their own money and how much is interest in each option? (End of 18 years) 25 7 2. Research: What has the average rate of return for the S\&P 500 index been the last 20 years? Now knowing this, is our average rate of return of 6% realistic for Mr. and Mrs. Smith? Explain 3. Which option do you recommend Mr. and Mrs. Smith invest? Defend and Explain 32 33 34 4. Calculating Present Value 35 36 Mr. and Mrs. Smith now want to know how much they need to invest up front (PV) to have accumulated \$125,000 in 18 years. All things 37 remaining the same, 6% annual return, $250 per month investment. How much do they need to invest today to achieve this $125,000 ? 38 Reference Page 261 in your text for how to calculate. Show your work. 39 40 A25 fx A B C \begin{tabular}{l|l|l|} D & E \end{tabular} G H M Your clients Mr. and Mrs. Smith have just had their first grandchild born. They have come to you for advice about saving money for college. They want to put in $1,000 initially and then $250 per month for the next 18 years. They are thinking about investing in the stock market with an average rate of return of 6% or staying "safe" and putting it in a money market account earning 0.5% rate of return. Knowing what you know about the Time Value of Money, calculate the Future Value of this investment in each type of scenario and answer the questions below. (I have shown the calculations entered into excel for each FV) Investing in the stock market (Initial investment of $1000,$250 per month, for 18 years, 6% annual rate of return rate 6.00% Format cell to percentage nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. pv -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so that in the future you will have more. Total $95,571.30 Enter in Excel as =FV(B8,B9,B10,B11) to get total for the 18 years Saving the same amount in money market account earning 0.5% annual rate of return nper 18 pmt -3000 (\$250 per month) Have to multiply by 12 to get the annual contribution since we are calculating annual percentage rate. -1000 (Reminder: (PMT and PV are entered as a negative number) Think, money going out of your account currently so pv that in the future you will have more. Total Enter in Excel as =FV(B17,B18,B19,B20) to get total for the 18 years 23 24 1. How much money have Mr. and Mrs. invested of their own money and how much is interest in each option? (End of 18 years) 25 7 2. Research: What has the average rate of return for the S\&P 500 index been the last 20 years? Now knowing this, is our average rate of return of 6% realistic for Mr. and Mrs. Smith? Explain 3. Which option do you recommend Mr. and Mrs. Smith invest? Defend and Explain 32 33 34 4. Calculating Present Value 35 36 Mr. and Mrs. Smith now want to know how much they need to invest up front (PV) to have accumulated \$125,000 in 18 years. All things 37 remaining the same, 6% annual return, $250 per month investment. How much do they need to invest today to achieve this $125,000 ? 38 Reference Page 261 in your text for how to calculate. Show your work. 39 40 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started