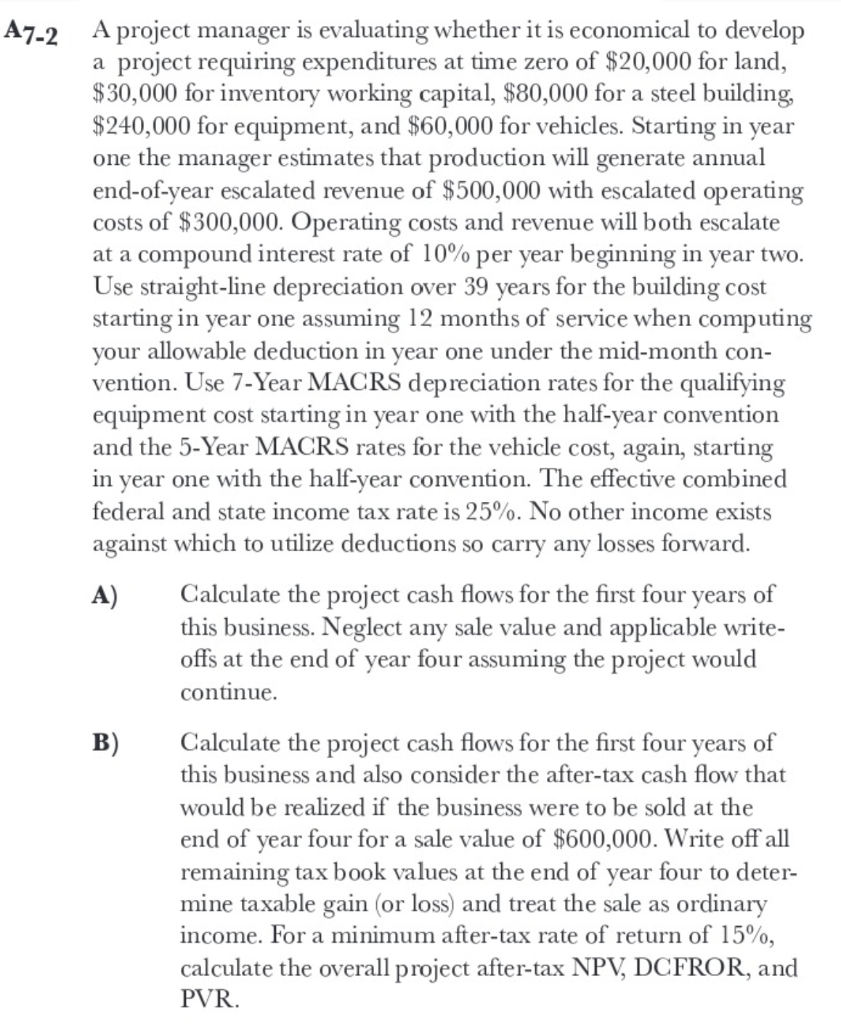

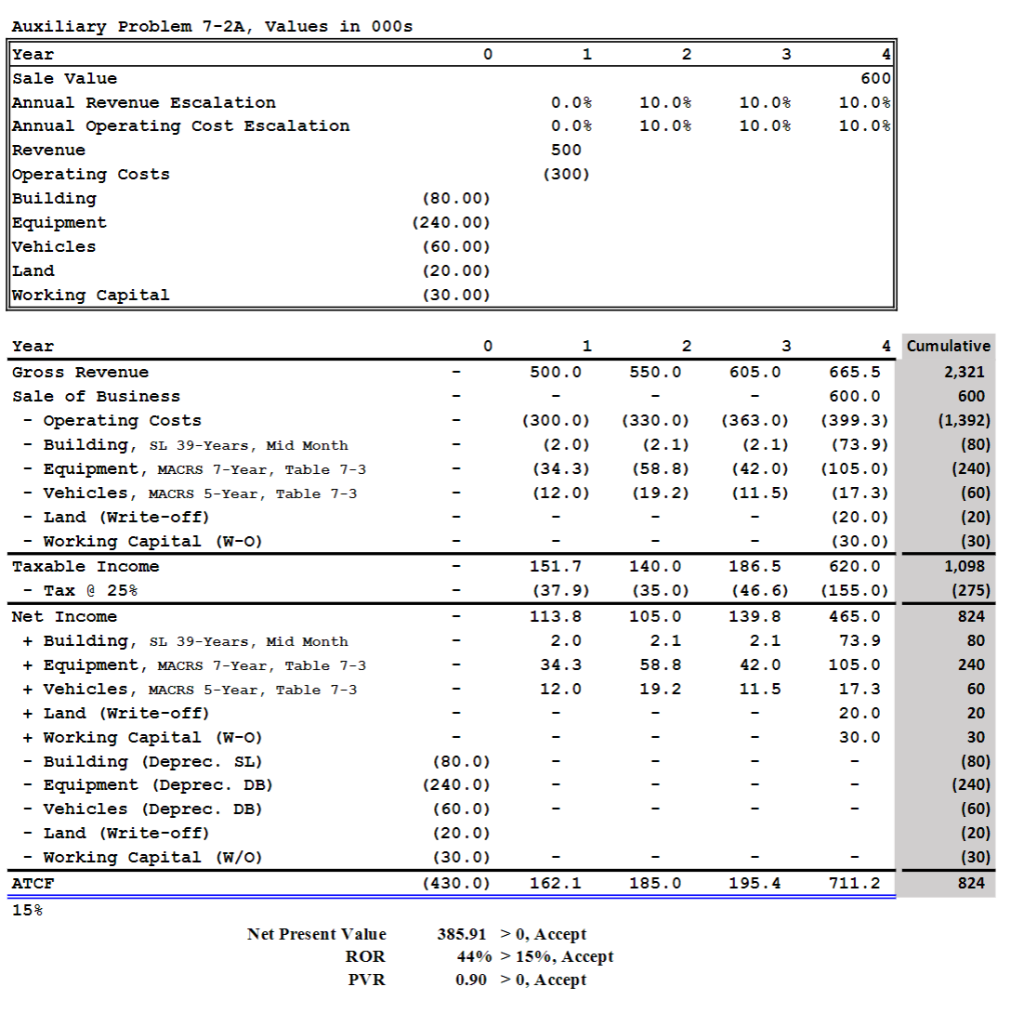

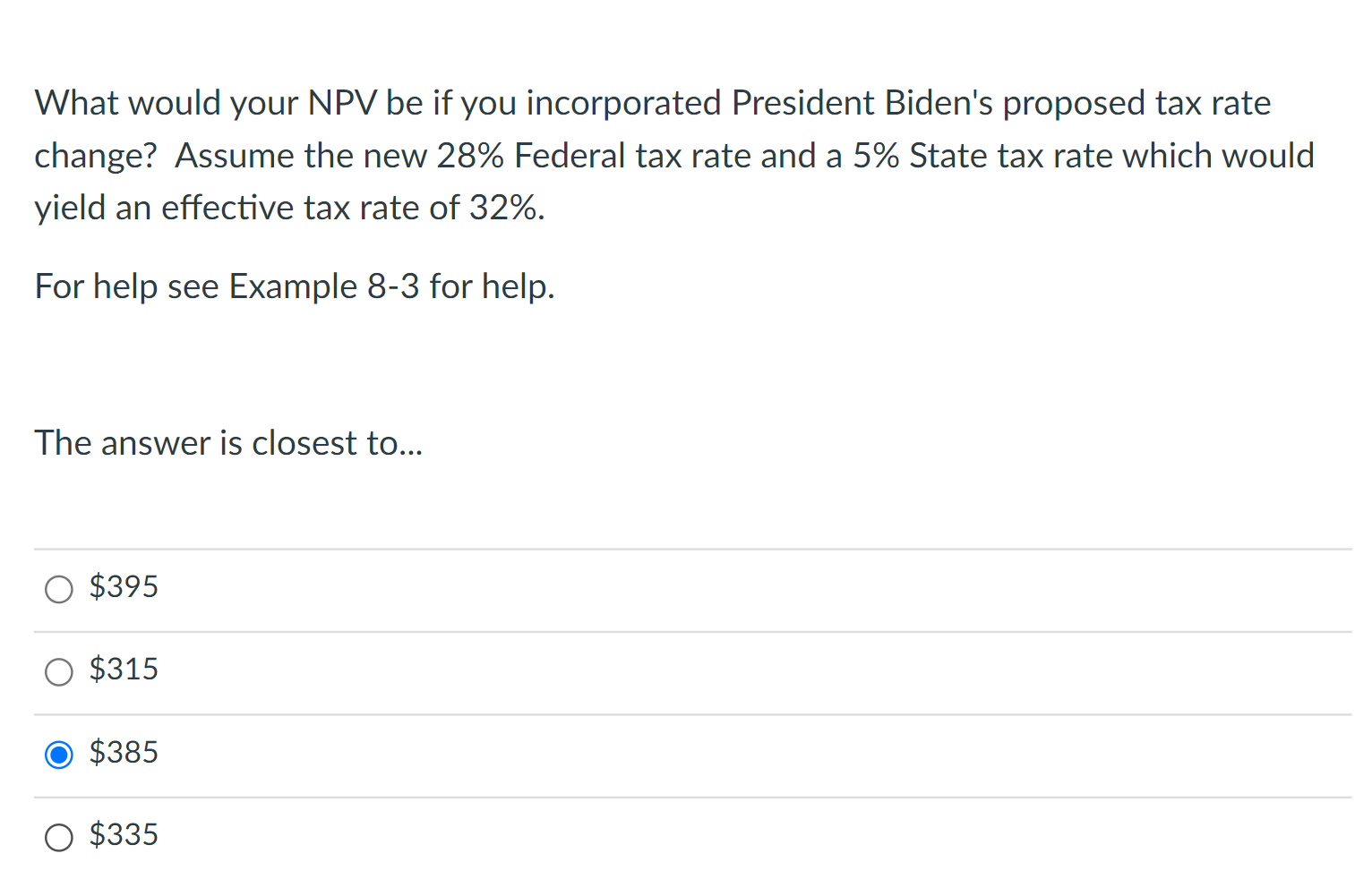

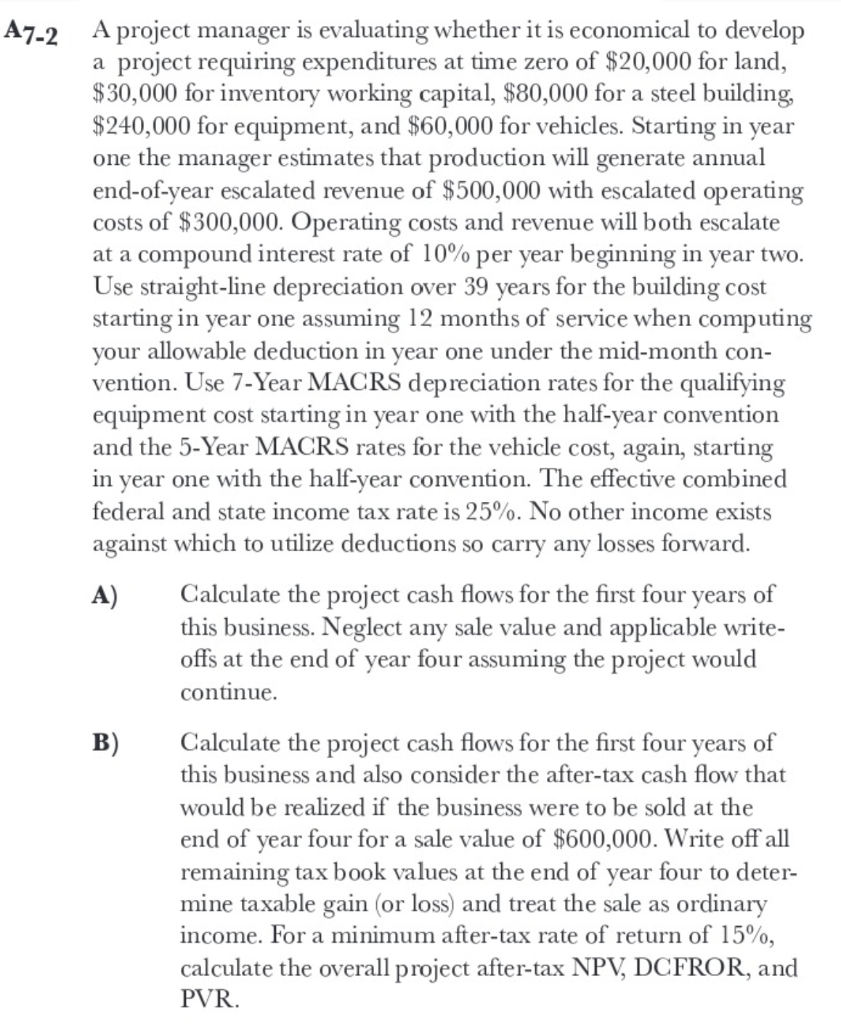

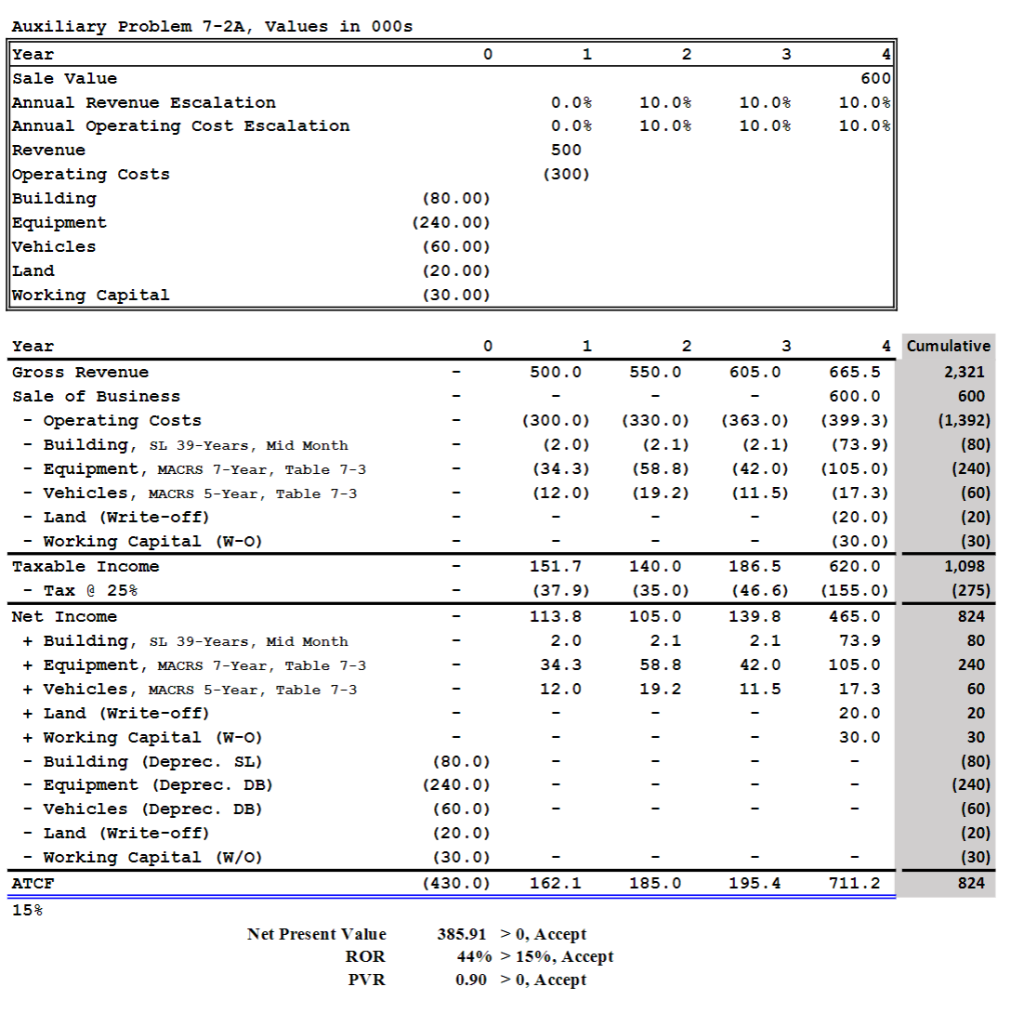

A7-2 A project manager is evaluating whether it is economical to develop a project requiring expenditures at time zero of $20,000 for land, $30,000 for inventory working capital, $80,000 for a steel building, $240,000 for equipment, and $60,000 for vehicles. Starting in year one the manager estimates that production will generate annual end-of-year escalated revenue of $500,000 with escalated operating costs of $300,000. Operating costs and revenue will both escalate at a compound interest rate of 10% per year beginning in year two. Use straight-line depreciation over 39 years for the building cost starting in year one assuming 12 months of service when computing your allowable deduction in year one under the mid-month con- vention. Use 7-Year MACRS depreciation rates for the qualifying equipment cost starting in year one with the half-year convention and the 5-Year MACRS rates for the vehicle cost, again, starting in year one with the half-year convention. The effective combined federal and state income tax rate is 25%. No other income exists against which to utilize deductions so carry any losses forward. A) Calculate the project cash flows for the first four years of this business. Neglect any sale value and applicable write- offs at the end of year four assuming the project would continue. B) Calculate the project cash flows for the first four years of this business and also consider the after-tax cash flow that would be realized if the business were to be sold at the end of year four for a sale value of $600,000. Write off all remaining tax book values at the end of year four to deter- mine taxable gain (or loss) and treat the sale as ordinary income. For a minimum after-tax rate of return of 15%, calculate the overall project after-tax NPV, DCFROR, and PVR. Auxiliary Problem 7-2A, Values in 000s Year 0 1 2 3 4 0.0% 0.0% 10.0% 10.0% 10.0% 10.0% 600 10.0% 10.0% 500 (300) sale Value Annual Revenue Escalation Annual Operating cost Escalation Revenue Operating costs Building Equipment Vehicles Land Working Capital (80.00) (240.00) (60.00) (20.00) (30.00) Year 0 1 2 3 500.0 550.0 605.0 (300.0) (2.0) (34.3) (12.0) (330.0) (2.1) (58.8) (19.2) (363.0) (2.1) (42.0) (11.5) Gross Revenue Sale of Business - Operating costs Building, SL 39-Years, Mid Month - Equipment, MACRS 7-Year, Table 7-3 - Vehicles, MACRS 5-Year, Table 7-3 - Land (Write-off) - Working Capital (W-0) Taxable Income - Tax @ 25% Net Income + Building, SL 39-Years, Mid Month + Equipment, MACRS 7-Year, Table 7-3 + Vehicles, MACRS 5-Year, Table 7-3 + Land (Write-off) + Working Capital (W-0) Building (Deprec. SL) - Equipment (Deprec. DB) Vehicles (Deprec. DB) - Land (Write-off) Working Capital (W/O) ATCF 151.7 (37.9) 113.8 2.0 34.3 12.0 140.0 (35.0) 105.0 2.1 58.8 19.2 186.5 (46.6) 139.8 2.1 42.0 11.5 4 Cumulative 665.5 2,321 600.0 600 (399.3) (1,392) (73.9) (80) (105.0) (240) (17.3) (60) (20.0) (20) (30.0) (30) 620.0 1,098 (155.0) (275) 465.0 824 73.9 80 105.0 240 17.3 60 20.0 20 30.0 30 (80) (240) (60) (20) (30) (80.0) (240.0) (60.0) (20.0) (30.0) (430.0) 162.1 185.0 195.4 711.2 824 15% Net Present Value ROR PVR 385.91 > 0, Accept 44% > 15%, Accept 0.90 > 0, Accept What would your NPV be if you incorporated President Biden's proposed tax rate change? Assume the new 28% Federal tax rate and a 5% State tax rate which would yield an effective tax rate of 32%. For help see Example 8-3 for help. The answer is closest to... $395 $315 $385 O $335 A7-2 A project manager is evaluating whether it is economical to develop a project requiring expenditures at time zero of $20,000 for land, $30,000 for inventory working capital, $80,000 for a steel building, $240,000 for equipment, and $60,000 for vehicles. Starting in year one the manager estimates that production will generate annual end-of-year escalated revenue of $500,000 with escalated operating costs of $300,000. Operating costs and revenue will both escalate at a compound interest rate of 10% per year beginning in year two. Use straight-line depreciation over 39 years for the building cost starting in year one assuming 12 months of service when computing your allowable deduction in year one under the mid-month con- vention. Use 7-Year MACRS depreciation rates for the qualifying equipment cost starting in year one with the half-year convention and the 5-Year MACRS rates for the vehicle cost, again, starting in year one with the half-year convention. The effective combined federal and state income tax rate is 25%. No other income exists against which to utilize deductions so carry any losses forward. A) Calculate the project cash flows for the first four years of this business. Neglect any sale value and applicable write- offs at the end of year four assuming the project would continue. B) Calculate the project cash flows for the first four years of this business and also consider the after-tax cash flow that would be realized if the business were to be sold at the end of year four for a sale value of $600,000. Write off all remaining tax book values at the end of year four to deter- mine taxable gain (or loss) and treat the sale as ordinary income. For a minimum after-tax rate of return of 15%, calculate the overall project after-tax NPV, DCFROR, and PVR. Auxiliary Problem 7-2A, Values in 000s Year 0 1 2 3 4 0.0% 0.0% 10.0% 10.0% 10.0% 10.0% 600 10.0% 10.0% 500 (300) sale Value Annual Revenue Escalation Annual Operating cost Escalation Revenue Operating costs Building Equipment Vehicles Land Working Capital (80.00) (240.00) (60.00) (20.00) (30.00) Year 0 1 2 3 500.0 550.0 605.0 (300.0) (2.0) (34.3) (12.0) (330.0) (2.1) (58.8) (19.2) (363.0) (2.1) (42.0) (11.5) Gross Revenue Sale of Business - Operating costs Building, SL 39-Years, Mid Month - Equipment, MACRS 7-Year, Table 7-3 - Vehicles, MACRS 5-Year, Table 7-3 - Land (Write-off) - Working Capital (W-0) Taxable Income - Tax @ 25% Net Income + Building, SL 39-Years, Mid Month + Equipment, MACRS 7-Year, Table 7-3 + Vehicles, MACRS 5-Year, Table 7-3 + Land (Write-off) + Working Capital (W-0) Building (Deprec. SL) - Equipment (Deprec. DB) Vehicles (Deprec. DB) - Land (Write-off) Working Capital (W/O) ATCF 151.7 (37.9) 113.8 2.0 34.3 12.0 140.0 (35.0) 105.0 2.1 58.8 19.2 186.5 (46.6) 139.8 2.1 42.0 11.5 4 Cumulative 665.5 2,321 600.0 600 (399.3) (1,392) (73.9) (80) (105.0) (240) (17.3) (60) (20.0) (20) (30.0) (30) 620.0 1,098 (155.0) (275) 465.0 824 73.9 80 105.0 240 17.3 60 20.0 20 30.0 30 (80) (240) (60) (20) (30) (80.0) (240.0) (60.0) (20.0) (30.0) (430.0) 162.1 185.0 195.4 711.2 824 15% Net Present Value ROR PVR 385.91 > 0, Accept 44% > 15%, Accept 0.90 > 0, Accept What would your NPV be if you incorporated President Biden's proposed tax rate change? Assume the new 28% Federal tax rate and a 5% State tax rate which would yield an effective tax rate of 32%. For help see Example 8-3 for help. The answer is closest to... $395 $315 $385 O $335