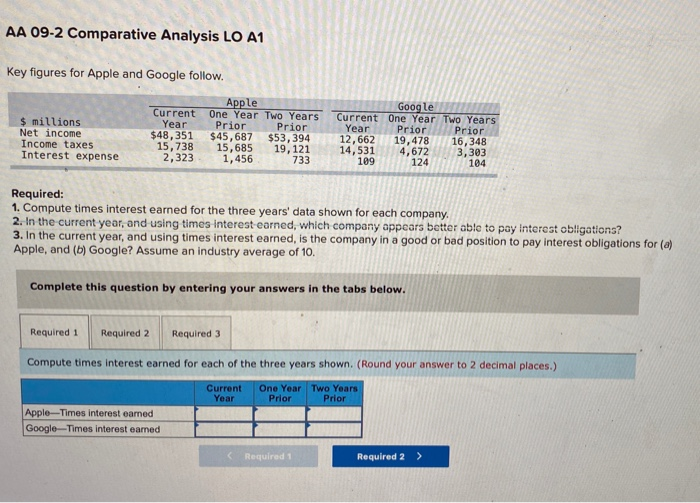

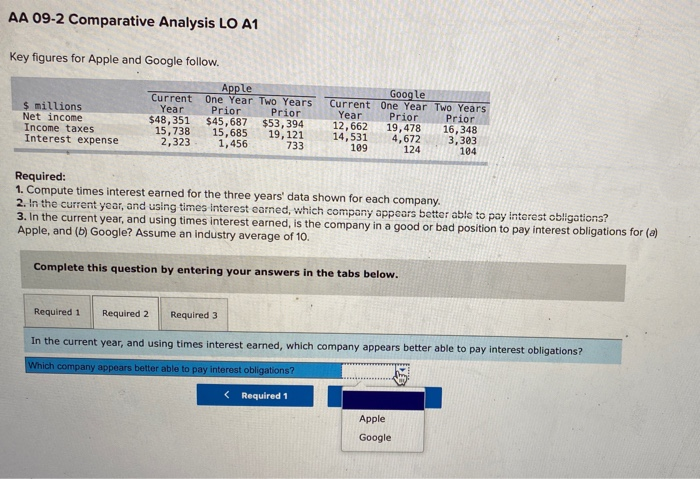

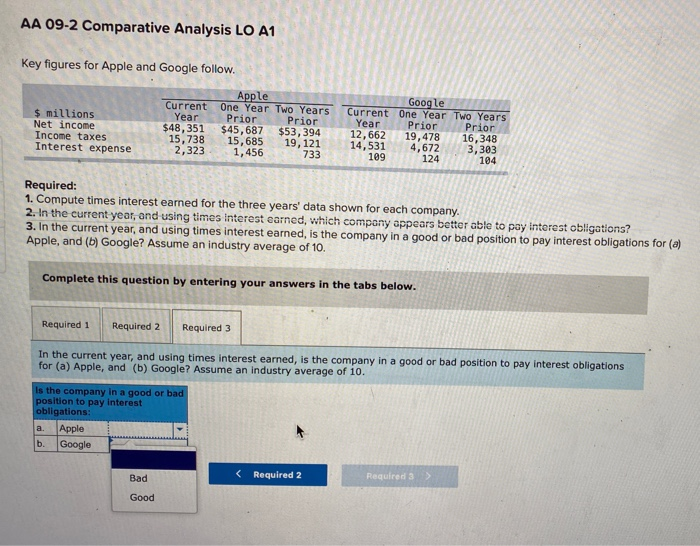

AA 09-2 Comparative Analysis LO A1 Key figures for Apple and Google follow. $ millions Net income Income taxes Interest expense Apple Current One Year Two Years Year Prior Prior $48,351 $45,687 $53,394 15,738 15,685 19, 121 2,323 1,456 733 Google Current One Year Two Years Year Prior Prior 12,662 19,478 16,348 14,531 4,672 3,303 109 124 104 Required: 1. Compute times interest earned for the three years' data shown for each company. 2. In the current year, and using times interest earned, which company appears better able to pay Interest obligations? 3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a) Apple, and (b) Google? Assume an industry average of 10. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute times interest earned for each of the three years shown. (Round your answer to 2 decimal places.) Current Year One Year Two Years Prior Prior Apple-Times interest oamed Google-Times interest eamed (Required 1 Required 2 > AA 09-2 Comparative Analysis LO A1 Key figures for Apple and Google follow. Apple Current One Year Two Years $ millions Year Prior Prior Net income $48,351 $45,687 $53,394 Income taxes 15,738 15,685 19, 121 Interest expense 2,323 1,456 733 Google Current One Year Two Years Year Prior Prior 12,662 19,478 16,348 14,531 4,672 3,303 109 124 104 Required: 1. Compute times interest earned for the three years' data shown for each company. 2. In the current year, and using times interest earned, which company appears better able to pay interest obligations? 3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a) Apple, and (b) Google? Assume an industry average of 10. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 In the current year, and using times interest earned, which company appears better able to pay interest obligations? Which company appears better able to pay interest obligations?