Answered step by step

Verified Expert Solution

Question

1 Approved Answer

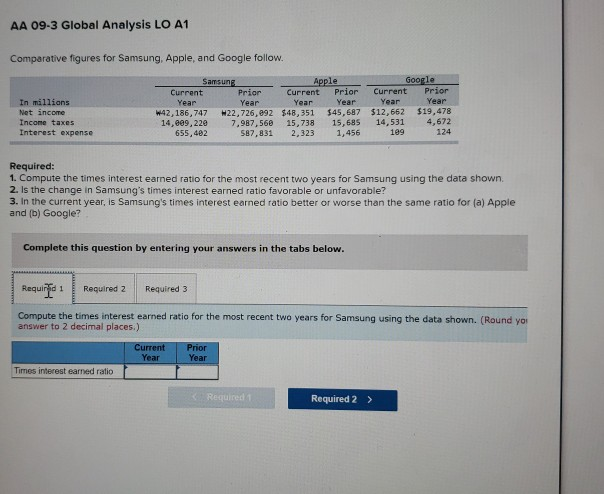

AA 09-3 Global Analysis LO A1 Comparative figures for Samsung, Apple, and Google follow. In millions Net income Income taxes Interest expense Samsung Apple Current

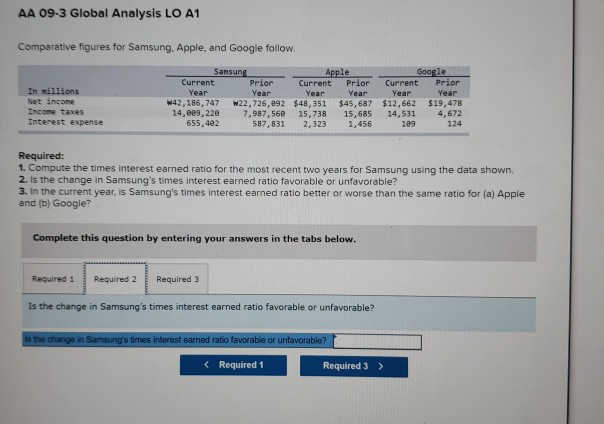

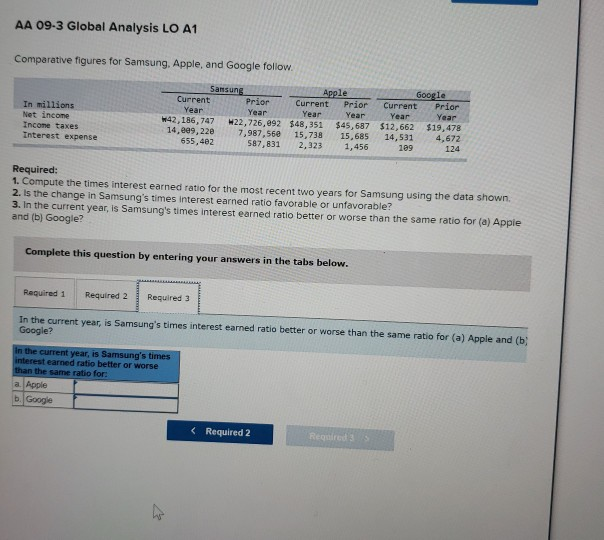

AA 09-3 Global Analysis LO A1 Comparative figures for Samsung, Apple, and Google follow. In millions Net income Income taxes Interest expense Samsung Apple Current Prior Current Prior Year Year Year Year W42,186,747 W22.726,092 $48,351 $45,687 14, 209, 220 7.987,560 15,738 15,685 655,402 S87,8312 .323 1.456 Google Current Prior Year Year $12.662 $19,478 14,531 4,672 109 124 Required: 1. Compute the times interest earned ratio for the most recent two years for Samsung using the data shown 2. Is the change in Samsung's times interest earned ratio favorable or unfavorable? 3. In the current year, is Samsung's times interest earned ratio better or worse than the same ratio for (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the times interest earned ratio for the most recent two years for Samsung using the data shown. (Round you answer to 2 decimal places.) Current Year Prior Year Times interest earned ratio Required 1 Required 2 > AA 09-3 Global Analysis LO A1 Comparative figures for Samsung, Apple, and Google follow. Apple In millions Year Current Year 42,186, 747 14,609, 22e 655,402 Prior Current Year W22,726, e92 $48,351 7.957.56 15,738 587,831 2,323 Prior Year $45,687 15,685 1.456 Google Current Prior Year Year $12,662 $19,478 14.531 4,672 124 Income taxes Interest expense 109 Required: 1. Compute the times interest earned ratio for the most recent two years for Samsung using the data shown, 2. Is the change in Samsung's times interest earned ratio favorable or unfavorable? 3. In the current year, is Samsung's times interest earned ratio better or worse than the same ratio for (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Is the change in Samsung's times interest earned ratio favorable or unfavorable? is the change in Samsung's times interest oamed ratio favorable or unfavorable?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started