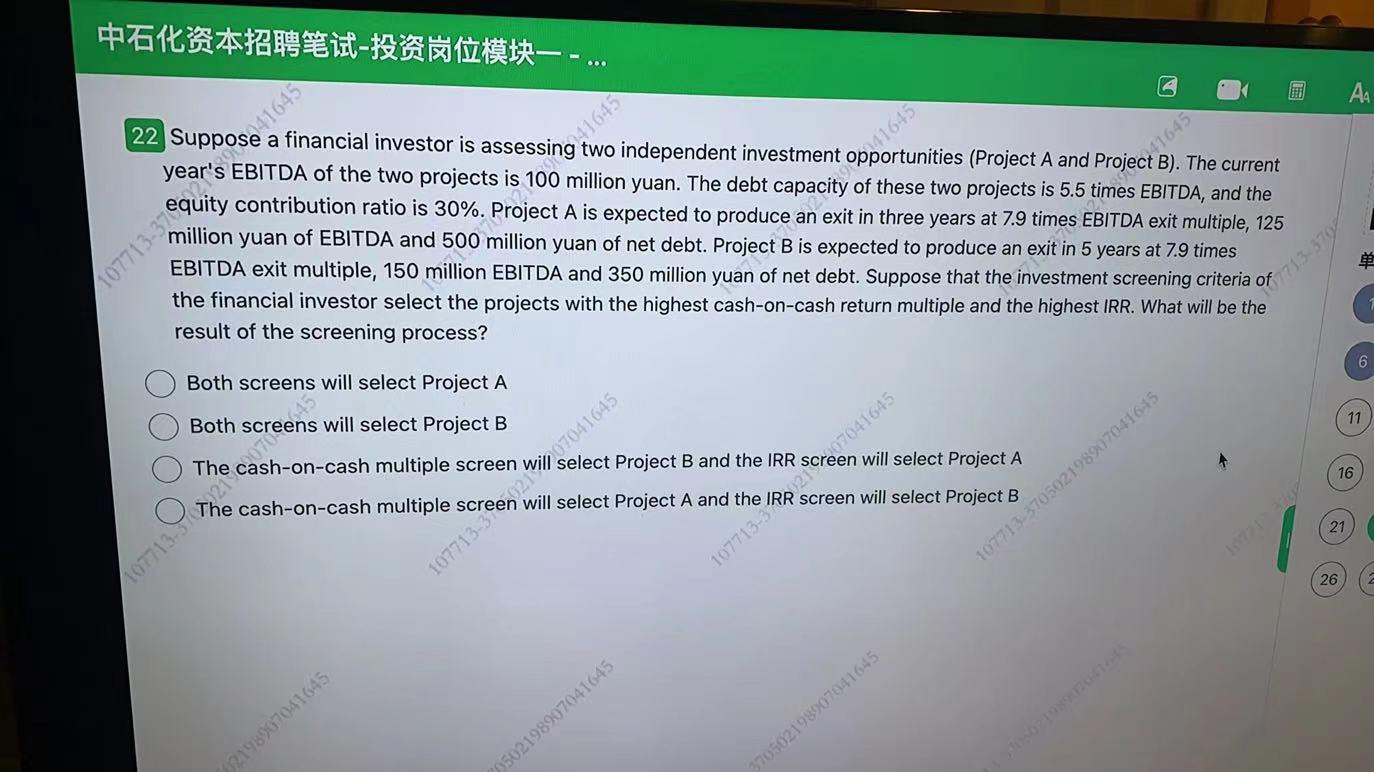

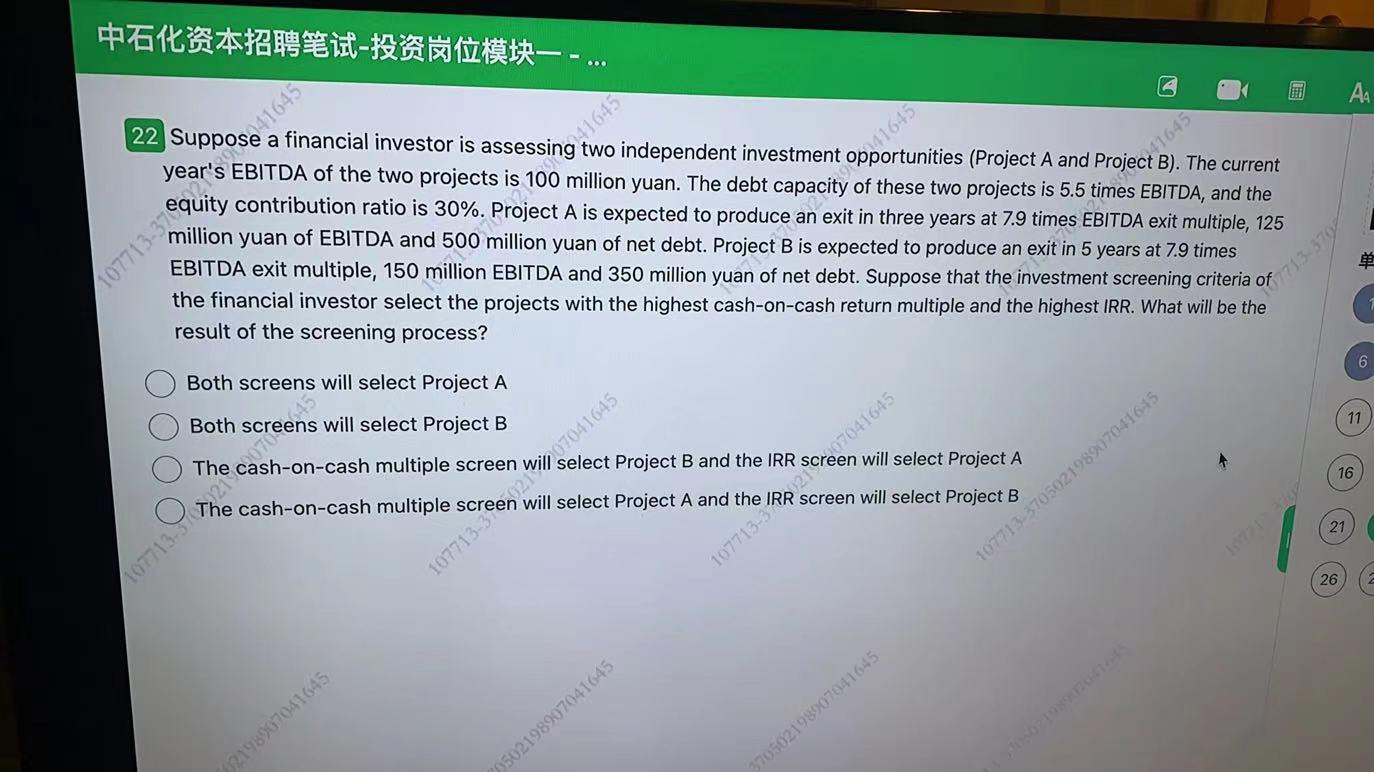

Aa 241645 -... a financial investor is ass 201645 22 two independent investment EBITDA of the two projects is million yuan. The debt capacitu %1 anities (Project A and Project B). The current of these two projects is 5.5 times EBITDA, and the contribution ratio is 30%. Project A is expected to produce an exit in three years at 7.9 times EBITDA exit multiple, 125 million yuan of EBITDA and 500 million yuan of net debt. Project B is expected to produce an exit in 5 years at 7.9 times EBITDA exit multiple, 150 million EBITDA and 350 million yuan of net debt. Suppose that the investment screening criteria of 213-37 the financial investor select the projects with the highest cash-on-cash return multiple and the highest IRR. What will be the result of the screening process? 107713.30 1645 6 11 The select Project B and the IRR: will select Project A 16 Both screens will select Project A Both will select Project B 107713-57 cash multiple screen cash-on-cash multiple will select Project A and the screen will select Project B 21 107713-Po 2.7041645 107713-370502198907041645 107713 7041645 26 32198907041645 20502198907041645 370502198907041645 Aa 241645 -... a financial investor is ass 201645 22 two independent investment EBITDA of the two projects is million yuan. The debt capacitu %1 anities (Project A and Project B). The current of these two projects is 5.5 times EBITDA, and the contribution ratio is 30%. Project A is expected to produce an exit in three years at 7.9 times EBITDA exit multiple, 125 million yuan of EBITDA and 500 million yuan of net debt. Project B is expected to produce an exit in 5 years at 7.9 times EBITDA exit multiple, 150 million EBITDA and 350 million yuan of net debt. Suppose that the investment screening criteria of 213-37 the financial investor select the projects with the highest cash-on-cash return multiple and the highest IRR. What will be the result of the screening process? 107713.30 1645 6 11 The select Project B and the IRR: will select Project A 16 Both screens will select Project A Both will select Project B 107713-57 cash multiple screen cash-on-cash multiple will select Project A and the screen will select Project B 21 107713-Po 2.7041645 107713-370502198907041645 107713 7041645 26 32198907041645 20502198907041645 370502198907041645