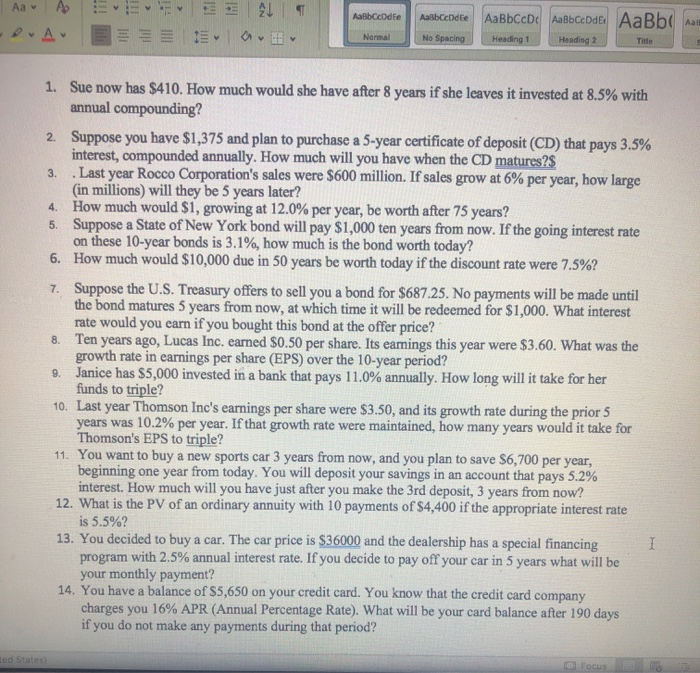

Aa A E 21 AaBbcode Abdte AaBbCcDc ABCD Heading 1 Heading 2 AaBb Normal No Spacing 1. Sue now has $410. How much would she have after 8 years if she leaves it invested at 8.5% with annual compounding? 2. Suppose you have $1,375 and plan to purchase a 5-year certificate of deposit (CD) that pays 3.5% interest, compounded annually. How much will you have when the CD matures? 3. . Last year Rocco Corporation's sales were $600 million. If sales grow at 6% per year, how large (in millions) will they be 5 years later? 4. How much would $1, growing at 12.0% per year, be worth after 75 years? 5. Suppose a State of New York bond will pay $1,000 ten years from now. If the going interest rate on these 10-year bonds is 3.1%, how much is the bond worth today? 6. How much would $10,000 due in 50 years be worth today if the discount rate were 7.5%? 7. Suppose the U.S. Treasury offers to sell you a bond for $687.25. No payments will be made until the bond matures 5 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond at the offer price? 8. Ten years ago, Lucas Inc. earned $0.50 per share. Its earnings this year were $3.60. What was the growth rate in earnings per share (EPS) over the 10-year period? 9. Janice has $5,000 invested in a bank that pays 11.0% annually. How long will it take for her funds to triple? 10. Last year Thomson Inc's earnings per share were $3.50, and its growth rate during the prior 5 years was 10.2% per year. If that growth rate were maintained, how many years would it take for Thomson's EPS to triple? 11. You want to buy a new sports car 3 years from now, and you plan to save $6,700 per year, beginning one year from today. You will deposit your savings in an account that pays 5.2% interest. How much will you have just after you make the 3rd deposit, 3 years from now? 12. What is the PV of an ordinary annuity with 10 payments of $4,400 if the appropriate interest rate is 5.5%? 13. You decided to buy a car. The car price is $36000 and the dealership has a special financing program with 2.5% annual interest rate. If you decide to pay off your car in 5 years what will be your monthly payment? 14. You have a balance of $5,650 on your credit card. You know that the credit card company charges you 16% APR (Annual Percentage Rate). What will be your card balance after 190 days if you do not make any payments during that period