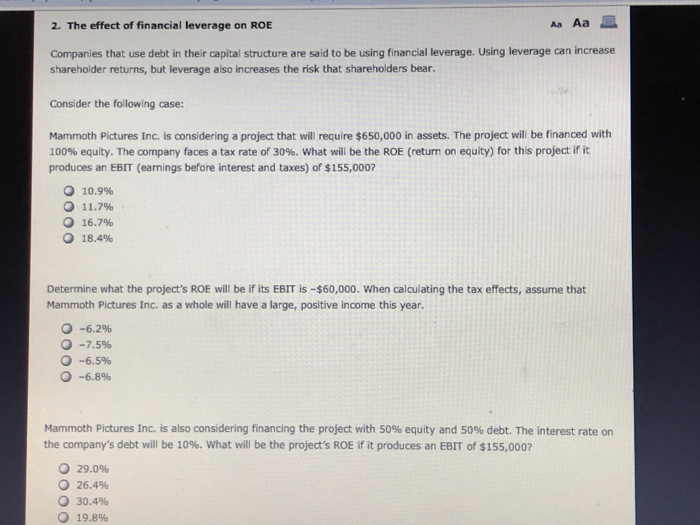

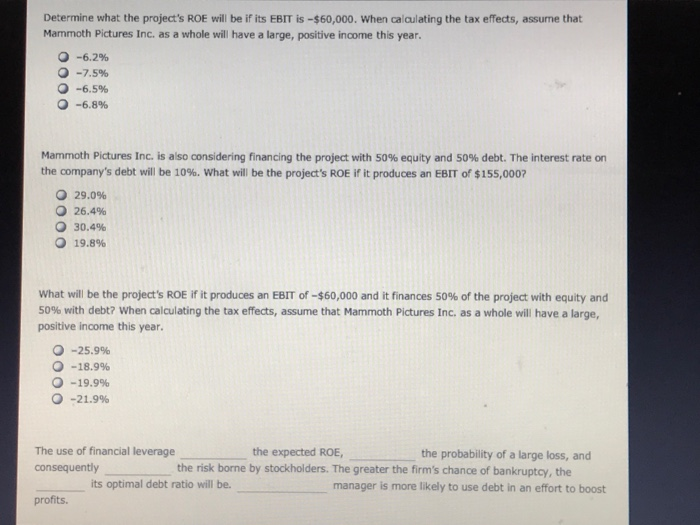

Aa Aa 2. The effect of financial leverage on ROB Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder returns, but leverage also increases the risk that shareholders bear. Consider the following case: Mammoth Pictures Inc. is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 30 %. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? O 10.9% O 11.7% O 16.7% 18.4% Determine what the project's ROE will be if its EBIT is -$60,000. When calculating the tax effects, assume that Mammoth Pictures Inc. as a whole will have a large, positive income this year. -6.2 % O-7.5% O-6.5% O-6.8% Mammoth Pictures Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 10 %. What will be the project's ROE if it produces an EBIT of $155,000? O 29.0% O 26.4% O 30.4 % 19.8% Determine what the project's ROE will be if its EBIT is -$60,000. When calaul ating the tax effects, assume that Mammoth Pictures Inc. as a whole will have a large, positive income this year. O-6.2% O-7.5% O-6.5% O-6.8% Mammoth Pictures Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 10 %. What will be the project's ROE if it produces an EBIT of $155,000? 29.0% 26.4% O30.4% O 19.8% What will be the project's ROE if it produces an EBIT of-$60,000 and it finances 50% of the project with equity and 50% with debt? When calculating the tax effects, assume that Mammoth Pictures Inc. as a whole will have a large positive income this year. O-25.9% -18.9% -19.9% O-21.9% The use of financial leverage the expected ROE, the probability of a large loss, and the risk borne by stockholders. The greater the firm's chance of bankruptcy, the consequently its optimal debt ratio will be. manager is more likely to use debt in an effort to boost profits. OOOO