Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AA Limited purchased advertising supplies on 1 January 2020 for $25,000. On 30 June 2020, an inventory count revealed that $11,000 of supplies were

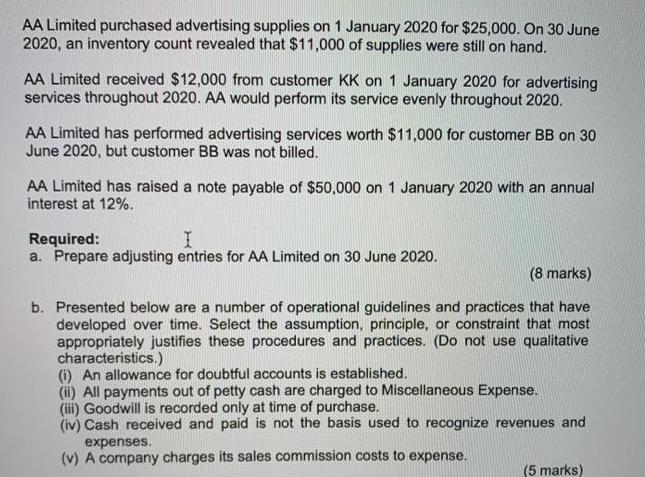

AA Limited purchased advertising supplies on 1 January 2020 for $25,000. On 30 June 2020, an inventory count revealed that $11,000 of supplies were still on hand. AA Limited received $12,000 from customer KK on 1 January 2020 for advertising services throughout 2020. AA would perform its service evenly throughout 2020. AA Limited has performed advertising services worth $11,000 for customer BB on 30 June 2020, but customer BB was not billed. AA Limited has raised a note payable of $50,000 on 1 January 2020 with an annual interest at 12%. Required: a. Prepare adjusting entries for AA Limited on 30 June 2020. (8 marks) b. Presented below are a number of operational guidelines and practices that have developed over time. Select the assumption, principle, or constraint that most appropriately justifies these procedures and practices. (Do not use qualitative characteristics.) (i) An allowance for doubtful accounts is established. (ii) All payments out of petty cash are charged to Miscellaneous Expense. (iii) Goodwill is recorded only at time of purchase. (iv) Cash received and paid is not the basis used to recognize revenues and expenses. (v) A company charges its sales commission costs to expense. (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

b 1 expenses recognition pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started