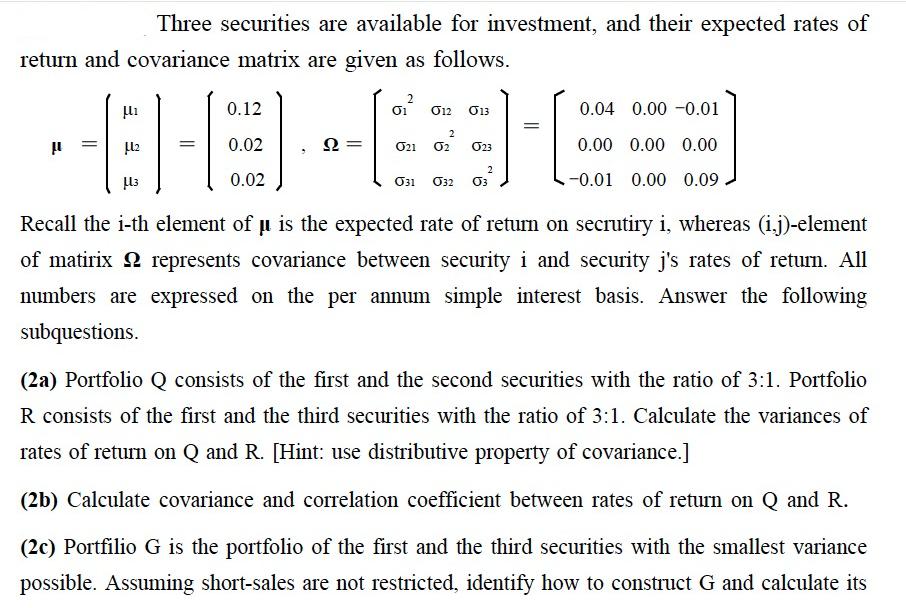

Question: return and covariance matrix are given as follows. L2 Three securities are available for investment, and their expected rates of 3 = 0.12 0.02

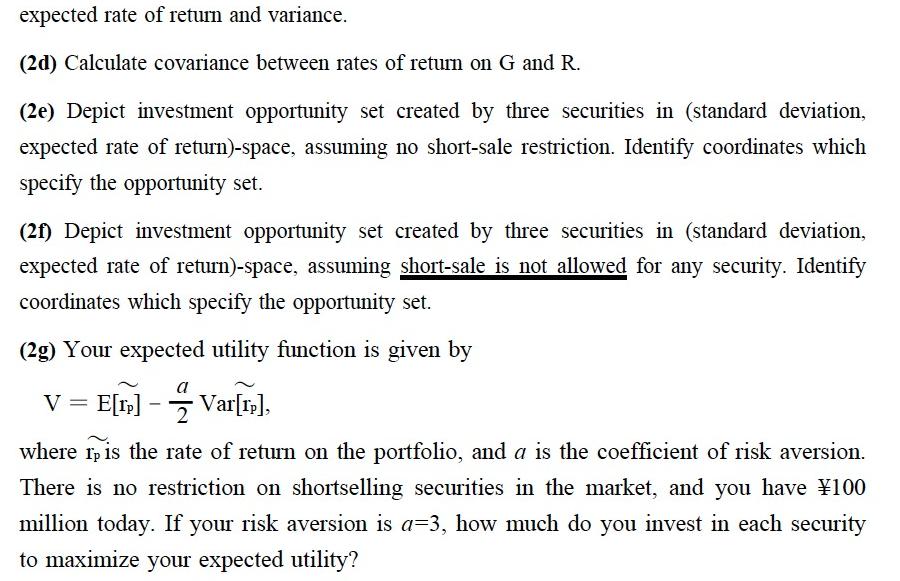

return and covariance matrix are given as follows. L2 Three securities are available for investment, and their expected rates of 3 = 0.12 0.02 0.02 2 01 012 2 021 02 013 023 2 031 032 03 = 0.04 0.00 -0.01 0.00 0.00 0.00 -0.01 0.00 0.09 Recall the i-th element of is the expected rate of return on secrutiry i, whereas (i.j)-element of matirix represents covariance between security i and security j's rates of return. All numbers are expressed on the per annum simple interest basis. Answer the following subquestions. (2a) Portfolio Q consists of the first and the second securities with the ratio of 3:1. Portfolio R consists of the first and the third securities with the ratio of 3:1. Calculate the variances of rates of return on Q and R. [Hint: use distributive property of covariance.] (2b) Calculate covariance and correlation coefficient between rates of return on Q and R. (2c) Portfilio G is the portfolio of the first and the third securities with the smallest variance possible. Assuming short-sales are not restricted, identify how to construct G and calculate its expected rate of return and variance. (2d) Calculate covariance between rates of return on G and R. (2e) Depict investment opportunity set created by three securities in (standard deviation, expected rate of return)-space, assuming no short-sale restriction. Identify coordinates which specify the opportunity set. (2f) Depict investment opportunity set created by three securities in (standard deviation, expected rate of return)-space, assuming short-sale is not allowed for any security. Identify coordinates which specify the opportunity set. (2g) Your expected utility function is given by a 2 Var[rp], V = E[1] where rp is the rate of return on the portfolio, and a is the coefficient of risk aversion. There is no restriction on shortselling securities in the market, and you have 100 million today. If your risk aversion is a=3, how much do you invest in each security to maximize your expected utility? -

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

2a Variance of ... View full answer

Get step-by-step solutions from verified subject matter experts