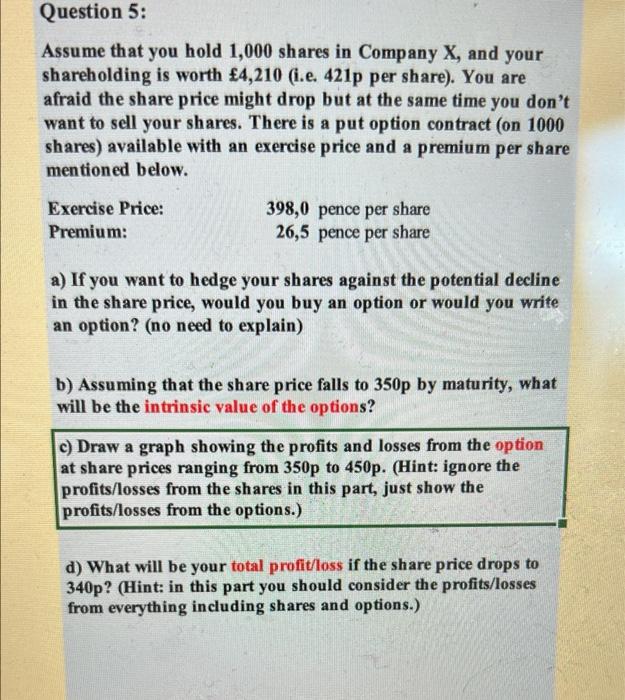

AA Question : Assume that you hold 1,000 shares in Company X, and your shareholding is worth (4,210 0.421p per share). You are afraid the share price might drop but at the same time you don't want to sell your share. There is a put option contract on 1000 shares) available with an exercise price and a premium per share mentioned below Exercise Price 398,6 pece persone Premium: 26,5 pence per she 2) If you want to hedge your shares against the potential dedine in the share pries, would you buy an open or would you write an option to send to explain) b) Amming that the share price fails to 35p by maturity, what will be the intrinse value of the post Dwa praph showing the prodand losses from the option share price ranging from 35 to 456p. Het are the profits/s from the share in this part, just show the pralaara than thrapaark) d) What will be your total profilom the share price drop 347 it in this part you should consider the proses frymerything induding shar and option) MacBook Pro 7 ily be Question 5: Assume that you hold 1,000 shares in Company X, and your shareholding is worth 4,210 (.e. 421p per share). You are afraid the share price might drop but at the same time you don't want to sell your shares. There is a put option contract (on 1000 shares) available with an exercise price and a premium per share mentioned below. Exercise Price: Premium: 398,0 pence per share 26,5 pence per share a) If you want to hedge your shares against the potential decline in the share price, would you buy an option or would you write an option? (no need to explain) b) Assuming that the share price falls to 350p by maturity, what will be the intrinsic value of the options? c) Draw a graph showing the profits and losses from the option at share prices ranging from 350p to 450p. (Hint: ignore the profits/losses from the shares in this part, just show the profits/losses from the options.) d) What will be your total profit/loss if the share price drops to 340p? (Hint: in this part you should consider the profits/losses from everything including shares and options.)