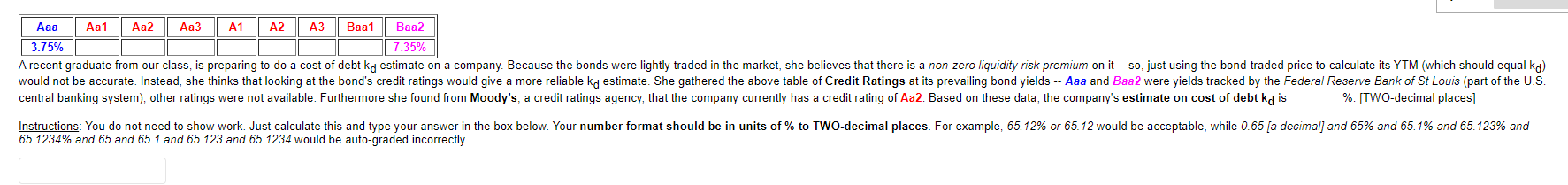

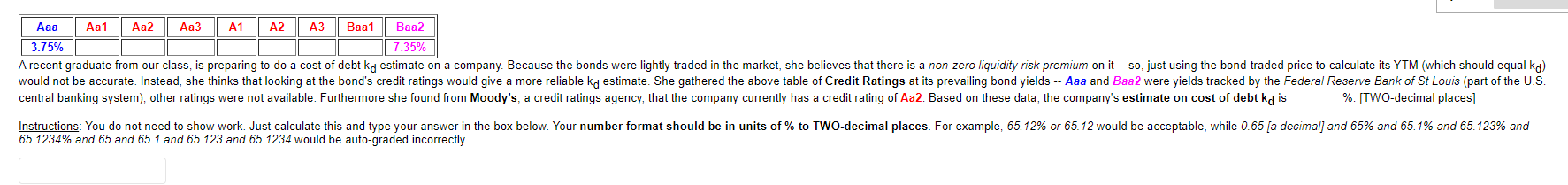

Aa1 Aa2 Aa3 A1 A2 A3 Baa1 Baa2 3.75% 7.35% A recent graduate from our class, is preparing to do a cost of debt kd estimate on a company. Because the bonds were lightly traded in the market, she believes that there is a non-zero liquidity risk premium on it -- So, just using the bond-traded price to calculate its YTM (which should equal kd) would not be accurate. Instead, she thinks that looking at the bond's credit ratings would give a more reliable kd estimate. She gathered the above table of Credit Ratings at its prevailing bond yields -- Aaa and Baa2 were yields tracked by the Federal Reserve Bank of St Louis (part of the U.S. central banking system); other ratings were not available. Furthermore she found from Moody's, a credit ratings agency, that the company currently has a credit rating of Aa2. Based on these data, the company's estimate on cost of debt kd is _%. [TWO-decimal places) Instructions: You do not need to show work. Just calculate this and type your answer in the box below. Your number format should be in units of % to TWO-decimal places. For example, 65.12% or 65.12 would be acceptable, while 0.65 [a decimal) and 65% and 65.1% and 65. 123% and 65. 1234% and 65 and 65.1 and 65.123 and 65. 1234 would be auto-graded incorrectly. Aa1 Aa2 Aa3 A1 A2 A3 Baa1 Baa2 3.75% 7.35% A recent graduate from our class, is preparing to do a cost of debt kd estimate on a company. Because the bonds were lightly traded in the market, she believes that there is a non-zero liquidity risk premium on it -- So, just using the bond-traded price to calculate its YTM (which should equal kd) would not be accurate. Instead, she thinks that looking at the bond's credit ratings would give a more reliable kd estimate. She gathered the above table of Credit Ratings at its prevailing bond yields -- Aaa and Baa2 were yields tracked by the Federal Reserve Bank of St Louis (part of the U.S. central banking system); other ratings were not available. Furthermore she found from Moody's, a credit ratings agency, that the company currently has a credit rating of Aa2. Based on these data, the company's estimate on cost of debt kd is _%. [TWO-decimal places) Instructions: You do not need to show work. Just calculate this and type your answer in the box below. Your number format should be in units of % to TWO-decimal places. For example, 65.12% or 65.12 would be acceptable, while 0.65 [a decimal) and 65% and 65.1% and 65. 123% and 65. 1234% and 65 and 65.1 and 65.123 and 65. 1234 would be auto-graded incorrectly