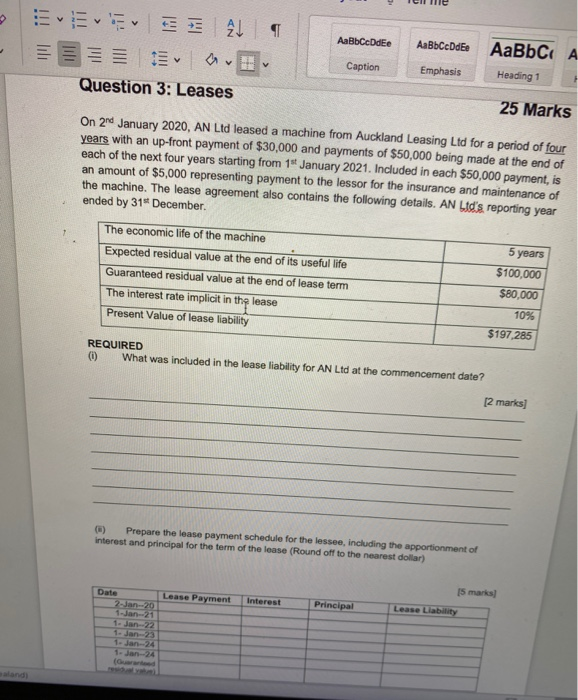

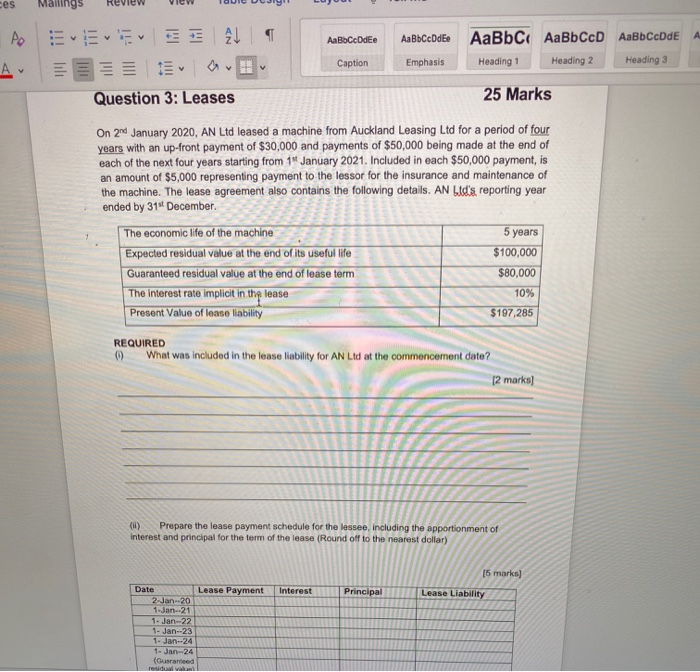

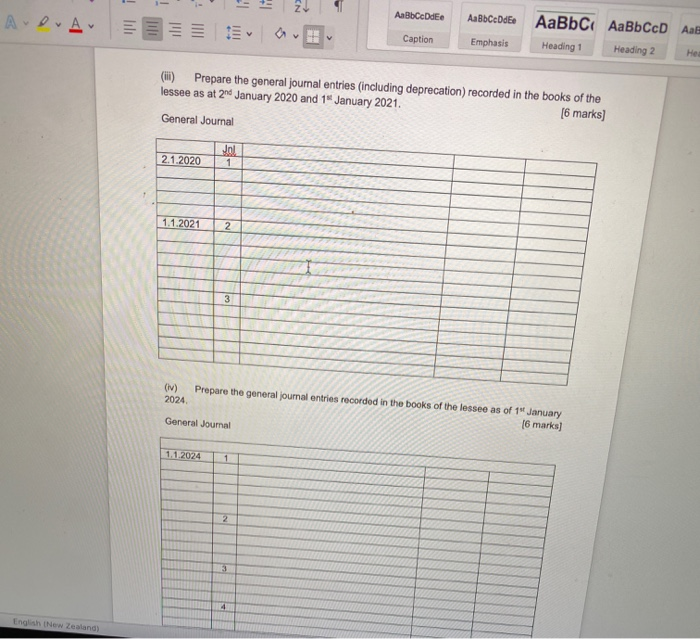

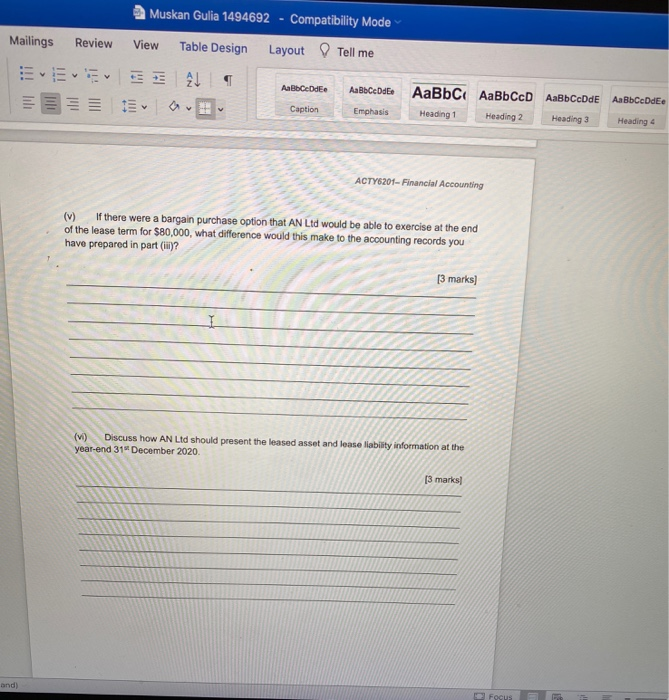

AaBbCcDdEe AaBbCcDdEe AaBbCr A av Question 3: Leases Caption Emphasis Heading 1 25 Marks On 2nd January 2020, AN Ltd leased a machine from Auckland Leasing Ltd for a period of four years with an up-front payment of $30,000 and payments of $50,000 being made at the end of each of the next four years starting from 15 January 2021. Included in each $50,000 payment, is an amount of $5,000 representing payment to the lessor for the insurance and maintenance of the machine. The lease agreement also contains the following details. AN Lid's reporting year ended by 319 December. The economic life of the machine Expected residual value at the end of its useful life Guaranteed residual value at the end of lease term The interest rate implicit in the lease Present Value of lease liability 5 years $100,000 $80,000 10% $197.285 REQUIRED (0) What was included in the lease liability for AN Ltd at the commencement date? [2 marks] Prepare the lease payment schedule for the lessee, including the apportionment of Interest and principal for the term of the lease (Round off to the nearest dollar) Interest Principal 15 marks Lease Liability Date Lease Payment 2-Jan-20 1-Jan-21 1. Jan 22 1-Jan-23 1-Jan-24 ces Mailings po AL AaBbCcDdEe AaBbCcDdEe . AaBb C AaBb CD AaBbCcDdE Heading 1 Heading 2 Heading 3 Caption Emphasis A Question 3: Leases 25 Marks On 2nd January 2020, AN Ltd leased a machine from Auckland Leasing Ltd for a period of four years with an up-front payment of $30,000 and payments of $50,000 being made at the end of each of the next four years starting from 14 January 2021. Included in each $50,000 payment, is an amount of $5,000 representing payment to the lessor for the insurance and maintenance of the machine. The lease agreement also contains the following details. AN bid's reporting year ended by 31 December The economic life of the machine Expected residual value at the end of its useful life Guaranteed residual value at the end of lease term The interest rate implicit in the lease Present Value of lease liability 5 years $100,000 $80,000 10% $197,285 REQUIRED 0 What was included in the lease liability for AN Ltd at the commencement date? [2 marks] (11) Prepare the lease payment schedule for the lessee, including the apportionment of interest and principal for the term of the lease (Round off to the nearest dollar) [5 marks) Interest Principal Lease Liability Date Lease Payment 2-Jan-20 1-Jan-21 1-Jan-22 1-Jan-23 1-Jan-24 1- Jan 24 (Gurameed residual AaBbCcDdEe ADA 3 E av Aa BbceDdEe AaBbC AaBbCcD BE Aal Caption Emphasis Heading 1 Heading 2 Her (1) Prepare the general journal entries (including deprecation) recorded in the books of the lessee as at 2nd January 2020 and 15 January 2021. [6 marks) General Journal 2.1.2020 Jol 1 1.1.2021 2 3 (iv) 2024 Prepare the general joumal entries recorded in the books of the lessee as of 1 January [6 marks) General Journal 1.1.2024 1 2 4 English New Zealand) Muskan Gulia 1494692 - Compatibility Mode View Table Design Layout Tell me Mailings Review AL AaBbceDdEe AaBb CeDdE AaBb C AaBb CcD Heading 1 Heading 2 cDd Aa BbCcDdEe v Caption Emphasis Heading 3 Heading 4 ACTY5201- Financial Accounting (v) If there were a bargain purchase option that AN Ltd would be able to exercise at the end of the lease term for $80,000, what difference would this make to the accounting records you have prepared in part ()? [3 marks) (vi) Discuss how AN Ltd should present the leased asset and lease liability information at the year-end 31 December 2020 [3 marks] and) Focus