Answered step by step

Verified Expert Solution

Question

1 Approved Answer

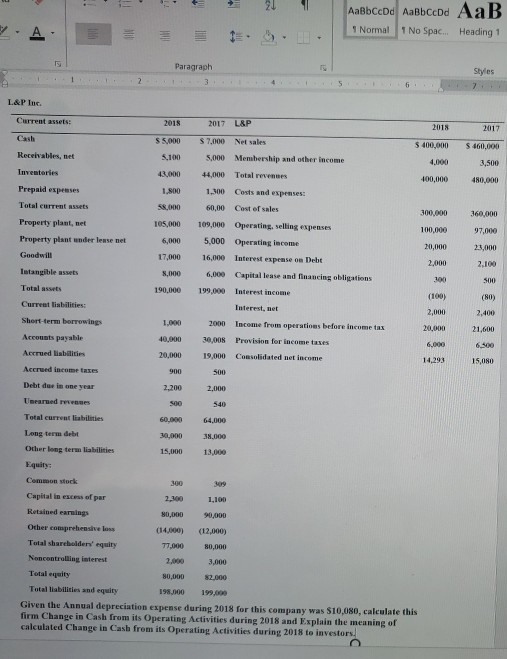

AaBbced Aabbccdd AaB Normal 1 No Spac... Heading 1 HE Paragraph 3 Styles 2 5 7 L&P luc. Current assets: 2018 2017 L&P 2018 2017

AaBbced Aabbccdd AaB Normal 1 No Spac... Heading 1 HE Paragraph 3 Styles 2 5 7 L&P luc. Current assets: 2018 2017 L&P 2018 2017 S 460.000 3,500 480,000 360,000 97,000 23,000 2.100 500 (80) 2,400 21,600 6.300 15,080 Cash $ 5.000 S 7.000 Net sales $400,000 Receivables, net 5.100 5,000 Membership and other income 4.000 Inventaries 43,000 44,000 Total revenues 400,000 Prepaid expenses 1.800 1.300 Costs and expenses Total current is 58.000 60,00 Cost of sales 300,000 Property plant, met 105,000 109,000 Operating, selling expenses 100,000 Property plant under lense net 6,000 5,000 Operating income 20,000 Goodwill 17.000 16,000 Interest expense on Debt 2.000 Intangible assets 8,000 6.000 Capital lease and financing obligations 300 Total assets 190,000 199,000 Interest income (100) Current liabilities: Interest, net 2,000 Short-term borrowings 1.000 2000 Income from operations before income tax 20,000 Accounts payable 40,000 30,008 Provision for income taxes 6.000 Accrued liabilities 20,000 19,000 Consolidated net income 14,293 Accrued income taxes 900 500 Debt dae in one year 2,200 2.000 Uneared ones 500 540 Total current liabilities 60,000 64.000 Long term debt 30,000 38.000 Other long term liabilities 15,000 13,000 Equity Common stock 300 309 Capital in excess of par 2,300 1,100 Retained earnings 80,000 90,000 Other comprehensive less (14,000) (12,000) Total shareholder' equity 77.000 80,000 Noncontrolling interest 2,000 3,000 Total equity 80,000 82.000 Total liabilities and equity 198,000 199,000 Given the Annual depreciation expense during 2018 for this company was $10,080, calculate this firm Change in Cash from its Operating Activities during 2018 and Explain the meaning of calculated Change in Cash from its Operating Activities during 2018 to investors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started