Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AAnswer the following question: Create a pro forma cash flow statement for 2019 using the information provided. Show all work and steps. Who all are

AAnswer the following question:

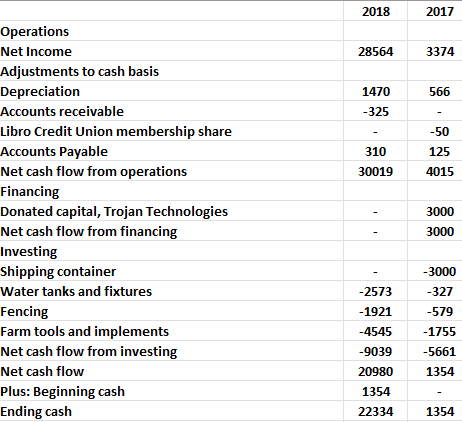

Create a pro forma cash flow statement for 2019 using the information provided. Show all work and steps.

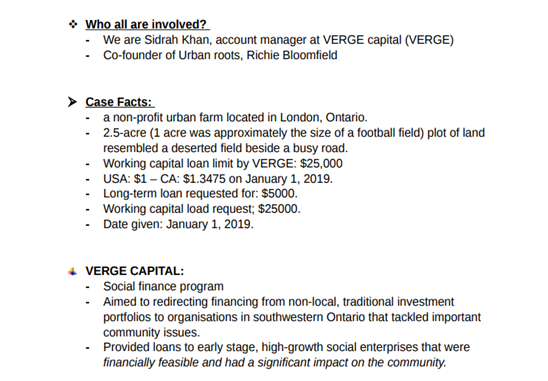

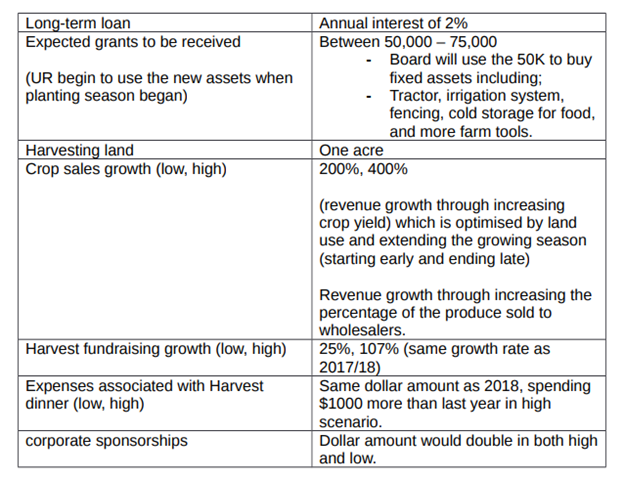

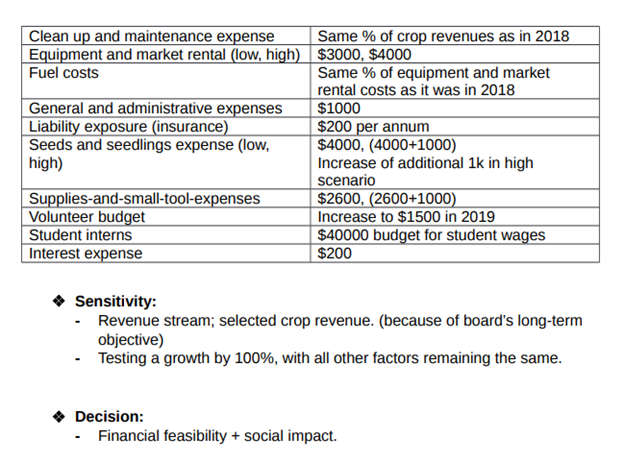

Who all are involved? - We are Sidrah Khan, account manager at VERGE capital (VERGE) - Co-founder of Urban roots, Richie Bloomfield Case Facts: - a non-profit urban farm located in London, Ontario. - 2.5-acre (1 acre was approximately the size of a football field) plot of land resembled a deserted field beside a busy road. - Working capital loan limit by VERGE: $25,000 - USA: $1 - CA: $1.3475 on January 1, 2019. - Long-term loan requested for: $5000. - Working capital load request; $25000. - Date given: January 1, 2019. VERGE CAPITAL: - Social finance program - Aimed to redirecting financing from non-local, traditional investment portfolios to organisations in southwestern Ontario that tackled important community issues. - Provided loans to early stage, high-growth social enterprises that were financially feasible and had a significant impact on the community. * Sensitivity: - Revenue stream; selected crop revenue. (because of board's long-term objective) - Testing a growth by 100%, with all other factors remaining the same. Decision: - Financial feasibility + social impact. Who all are involved? - We are Sidrah Khan, account manager at VERGE capital (VERGE) - Co-founder of Urban roots, Richie Bloomfield Case Facts: - a non-profit urban farm located in London, Ontario. - 2.5-acre (1 acre was approximately the size of a football field) plot of land resembled a deserted field beside a busy road. - Working capital loan limit by VERGE: $25,000 - USA: $1 - CA: $1.3475 on January 1, 2019. - Long-term loan requested for: $5000. - Working capital load request; $25000. - Date given: January 1, 2019. VERGE CAPITAL: - Social finance program - Aimed to redirecting financing from non-local, traditional investment portfolios to organisations in southwestern Ontario that tackled important community issues. - Provided loans to early stage, high-growth social enterprises that were financially feasible and had a significant impact on the community. * Sensitivity: - Revenue stream; selected crop revenue. (because of board's long-term objective) - Testing a growth by 100%, with all other factors remaining the same. Decision: - Financial feasibility + social impact

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started