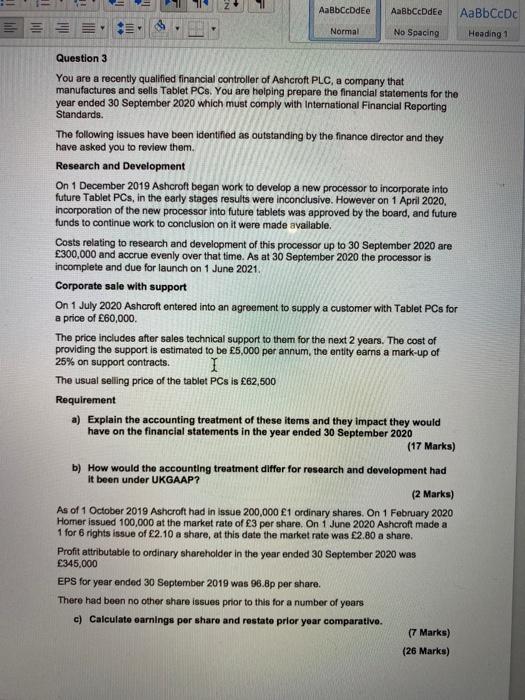

AaRbCcDdEe AaBbCcDdEe AaBbCcDc Normal No Spacing Heading 1 Question 3 You are a recently qualified financial controller of Ashcroft PLC, a company that manufactures and sells Tablet PCs. You are helping prepare the financial statements for the year ended 30 September 2020 which must comply with International Financial Reporting Standards. The following issues have been identified as outstanding by the finance director and they have asked you to review them. Research and Development On 1 December 2019 Ashcroft began work to develop a new processor to incorporate into future Tablet PCs, in the early stages results were inconclusive. However on 1 April 2020, incorporation of the new processor into future tablets was approved by the board, and future funds to continue work to conclusion on it were made available. Costs relating to research and development of this processor up to 30 September 2020 are 300,000 and accrue evenly over that time. As at 30 September 2020 the processor is incomplete and due for launch on 1 June 2021. Corporate sale with support On 1 July 2020 Ashcroft entered into an agreement to supply a customer with Tablet PCs for a price of 60,000 The price includes after sales technical support to them for the next 2 years. The cost of providing the support is estimated to be 5,000 per annum, the entity earns a mark-up of 25% on support contracts. I The usual selling price of the tablet PCs is 62,500 Requirement a) Explain the accounting treatment of these items and they impact they would have on the financial statements in the year ended 30 September 2020 (17 Marks) b) How would the accounting treatment differ for research and development had it been under UKGAAP? (2 Marks) As of 1 October 2019 Ashcroft had in issue 200,000 1 ordinary shares. On 1 February 2020 Homer issued 100,000 at the market rate of 3 per share. On 1 June 2020 Ashcroft made a 1 for 6 rights issue of 2.10 a share, at this date the market rate was 2.80 a share. Profit attributable to ordinary shareholder in the year ended 30 September 2020 was 345,000 EPS for year ended 30 September 2019 was 96.8p per share. There had been no other share issues prior to this for a number of years c) Calculate earnings por share and restate prior year comparativo. (7 Marks) (26 Marks)