Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aaron's Rentals has 58,000 shares of common stock outstanding at a market price of $36 a share. The common stock just paid a $1.64 annual

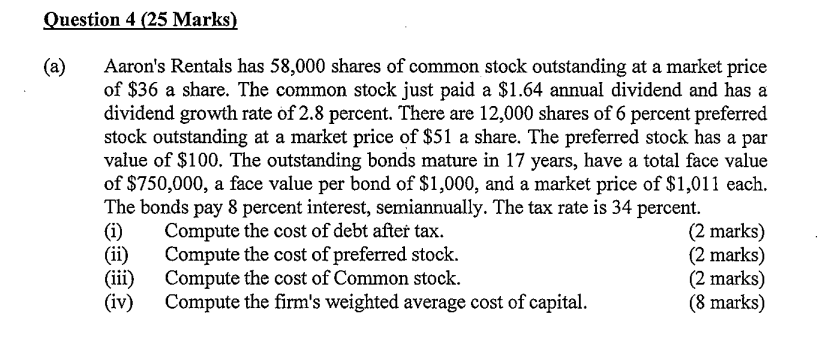

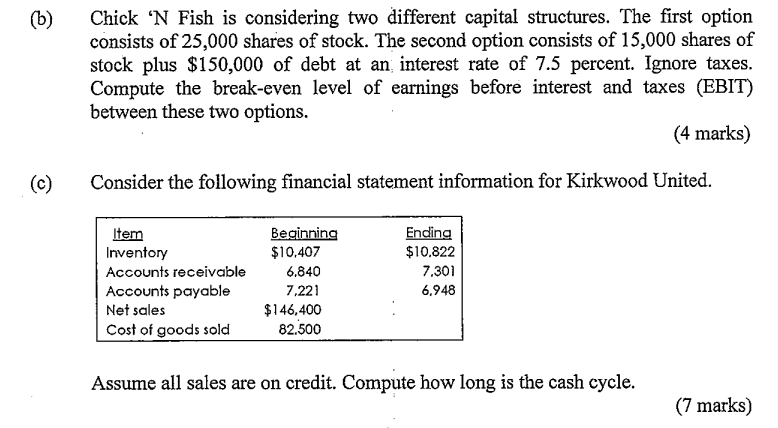

Aaron's Rentals has 58,000 shares of common stock outstanding at a market price of $36 a share. The common stock just paid a $1.64 annual dividend and has a dividend growth rate of 2.8 percent. There are 12,000 shares of 6 percent preferred stock outstanding at a market price of $51 a share. The preferred stock has a par value of $100. The outstanding bonds mature in 17 years, have a total face value of $750,000, a face value per bond of $1,000, and a market price of $1,011 each. The bonds pay 8 percent interest, semiannually. The tax rate is 34 percent. (i) Compute the cost of debt after tax. (2 marks) (ii) Compute the cost of preferred stock. (2 marks) (iii) Compute the cost of Common stock. (2 marks) (iv) Compute the firm's weighted average cost of capital. (8 marks) Chick ' N Fish is considering two different capital structures. The first option consists of 25,000 shares of stock. The second option consists of 15,000 shares of stock plus $150,000 of debt at an interest rate of 7.5 percent. Ignore taxes. Compute the break-even level of earnings before interest and taxes (EBIT) between these two options. (4 marks) Consider the following financial statement information for Kirkwood United. Assume all sales are on credit. Compute how long is the cash cycle

Aaron's Rentals has 58,000 shares of common stock outstanding at a market price of $36 a share. The common stock just paid a $1.64 annual dividend and has a dividend growth rate of 2.8 percent. There are 12,000 shares of 6 percent preferred stock outstanding at a market price of $51 a share. The preferred stock has a par value of $100. The outstanding bonds mature in 17 years, have a total face value of $750,000, a face value per bond of $1,000, and a market price of $1,011 each. The bonds pay 8 percent interest, semiannually. The tax rate is 34 percent. (i) Compute the cost of debt after tax. (2 marks) (ii) Compute the cost of preferred stock. (2 marks) (iii) Compute the cost of Common stock. (2 marks) (iv) Compute the firm's weighted average cost of capital. (8 marks) Chick ' N Fish is considering two different capital structures. The first option consists of 25,000 shares of stock. The second option consists of 15,000 shares of stock plus $150,000 of debt at an interest rate of 7.5 percent. Ignore taxes. Compute the break-even level of earnings before interest and taxes (EBIT) between these two options. (4 marks) Consider the following financial statement information for Kirkwood United. Assume all sales are on credit. Compute how long is the cash cycle Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started