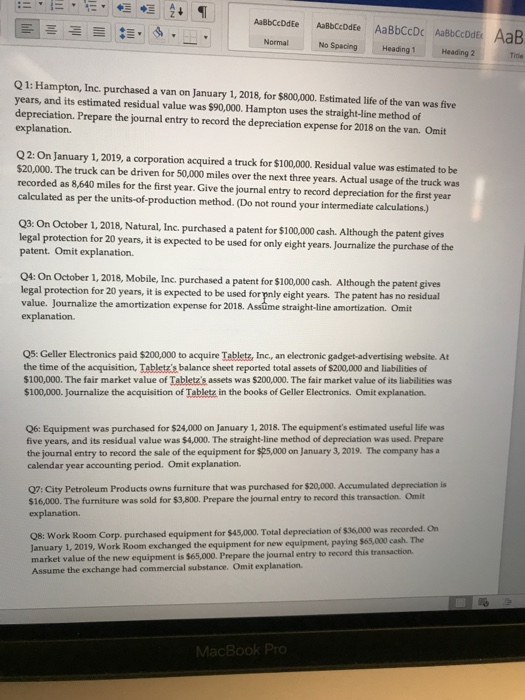

AasbcDdte AaBbcDdte AaBbCcDc AaBbCDdE AaB Heading 1 NormalN No Spacing Heading 2 Tine Q1: Hampton, Inc. purchased a van on January 1, 2018, for $800,000. Estimated life of the van was five years, and its estimated residual value was $90,000. Hampton uses the straight-line method of depreciation. Prepare the journal entry to record the depreciation expense for 2018 on the van. Omit explanation. Q2:On January 1, 2019, a corporation acquired a truck for $100,000. Residual value was estimated to be $20,000. The truck can be driven for 50,000 miles over the next three years. Actual usage of the truck was recorded as 8,640 miles for the first year. Give the journal entry to record depreciation for the first year calculated as per the units-of-production method.(Do not round your intermediate calculations.) Q3:On October 1, 2018, Natural, Inc. purchased a patent for $100,000 cash. Although the patent gives legal protection for 20 years, it is expected to be used for only eight years. Journalize the purchase of the patent. Omit explanation. Mobile, Inc. purchased a patent for $100,000 cash. Although the patent gives legal protection for 20 years, it is expected to be used for pmly eight years. The patent has no residual value. Journalize the amortization expense for 2018. Assume straight-line amortization. Omit explanation Q5: Geller Electronics paid $200,000 to acquire Tabletz, Inc, an electronic gadget-advertising website. At the time of the acquisition, Tabletz's balance sheet reported total assets of $200,000 and liabilities of $100,000. The fair market value of Tabletz's assets was $200,000. The fair market value of its liabilities was $100,000. Journalize the acquisition of Tabletz in the books of Geller Electronics. Omit explanation. 06: Equipment was purchased for $24,000 on January 1, 2018. The equipment's estimated useful life was five years, and its residual value was $4,000. The straight-line method of depreciation was used. Prepare the journal entry to record the sale of the equipment for $25,000 on January 3, 2019. The company has a calendar year accounting period. Omit explanation 07: City Petroleum Products owns furniture that was purchased for $20,000. Accumulated depreciation is $16,000. The furniture was sold for $3,800. Prepare the journal entry to record this transaction. Omit explanation Q8: Work Room Corp. purchased equipment for $45,000. Total depreciation of $36.000 was January 1, 2019, Work Room exchanged the equipment for new equipment, paying $65,000 cash market value of the new equipment is $65,000. Prepare the journal entry to record this transaction Assume the exchange had commercial substance. Omit explanation. recorded. On