Answered step by step

Verified Expert Solution

Question

1 Approved Answer

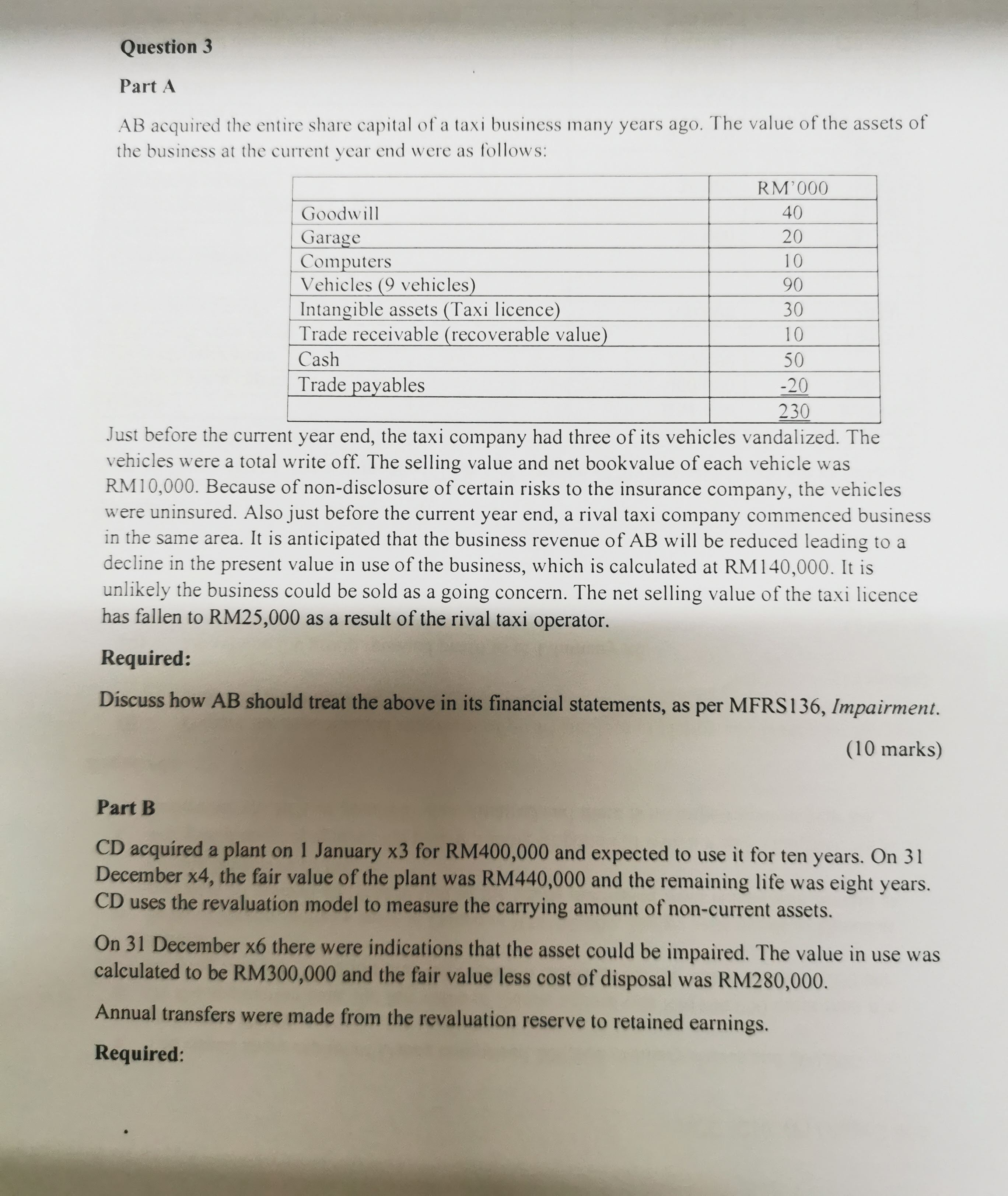

AB acquired the entire share capital of a taxi business many years ago. The value of the assets of the business at the current year

AB acquired the entire share capital of a taxi business many years ago. The value of the assets of the business at the current year end were as follows: Just before the current year end, the taxi company had three of its vehicles vandalized. The vehicles were a total write off. The selling value and net bookvalue of each vehicle was RM10,000. Because of non-disclosure of certain risks to the insurance company, the vehicles were uninsured. Also just before the current year end, a rival taxi company commenced business in the same area. It is anticipated that the business revenue of AB will be reduced leading to a decline in the present value in use of the business, which is calculated at RM140,000. It is unlikely the business could be sold as a going concern. The net selling value of the taxi licence has fallen to RM25,000 as a result of the rival taxi operator. Required: Discuss how AB should treat the above in its financial statements, as per MFRS136, Impairment. (10 marks) Part B CD acquired a plant on 1 January 3 for RM400,000 and expected to use it for ten years. On 31 December 4, the fair value of the plant was RM440,000 and the remaining life was eight years. CD uses the revaluation model to measure the carrying amount of non-current assets. On 31 December 6 there were indications that the asset could be impaired. The value in use was calculated to be RM300,000 and the fair value less cost of disposal was RM280,000. Annual transfers were made from the revaluation reserve to retained earnings. Required: ACC 3210(F)/ Page 5 of 6 Discuss the accounting treatment, as per MFRS136, Impairment, in year 3 to year 7. You may discuss in words or using ledger. (15 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started