Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A,B and C only I dyTUI need A. wing is a tax borne by the employer but not the employee? Which of the following is

A,B and C only

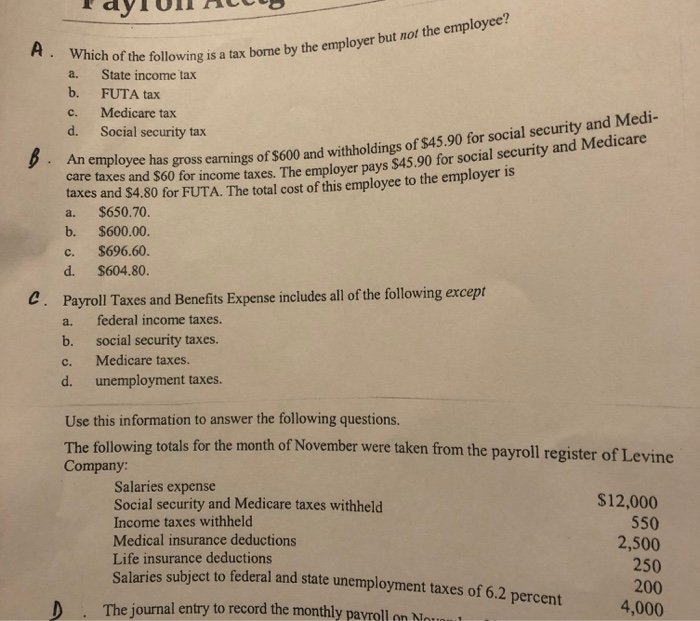

I dyTUI need A. wing is a tax borne by the employer but not the employee? Which of the following is a tax bor a. State income tax b. FUTA tax c. Medicare tax Social security tax d. nas gross earnings of $600 and withholdings of $45.90 for social security and Media for income taxes. The employer pays $45.90 for social security and Medicare An employee has gross earnings o care taxes and $60 for income taxes. The employ taxes and $4.80 for FUTA. The total cost of this employee to the employer is a. $650.70. b. $600.00 c. $696.60. d. $604.80. Payroll Taxes and Benefits Expense includes all of the following except a. federal income taxes. b. social security taxes. c. Medicare taxes. d. unemployment taxes. Use this information to answer the following questions. The following totals for the month of November were taken from the payroll register of Levine Company: Salaries expense Social security and Medicare taxes withheld $12,000 Income taxes withheld 550 Medical insurance deductions 2,500 Life insurance deductions subject to federal and state unemployment taxes of 6.2 percent 250 200 D. The journal entry to record the monthly payroll on No 4,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started