Answered step by step

Verified Expert Solution

Question

1 Approved Answer

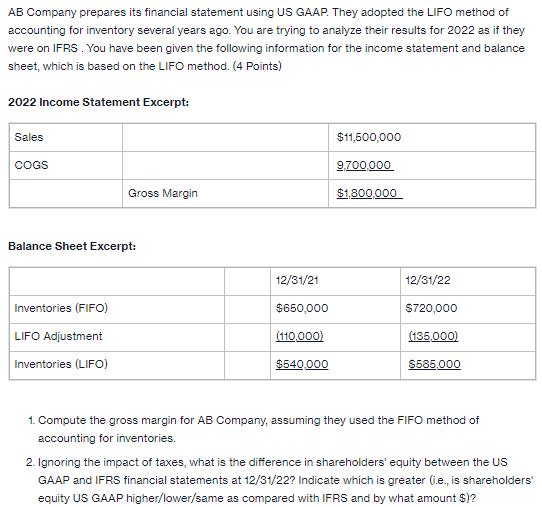

AB Company prepares its financial statement using US GAAP. They adopted the LIFO method of accounting for inventory several years ago. You are trying

AB Company prepares its financial statement using US GAAP. They adopted the LIFO method of accounting for inventory several years ago. You are trying to analyze their results for 2022 as if they were on IFRS. You have been given the following information for the income statement and balance sheet, which is based on the LIFO method. (4 Points) 2022 Income Statement Excerpt: Sales COGS Balance Sheet Excerpt: Inventories (FIFO) LIFO Adjustment Gross Margin Inventories (LIFO) 12/31/21 $650,000 (110,000) $540,000 $11,500,000 9,700,000 $1,800,000 12/31/22 $720,000 (135,000) $585,000 1. Compute the gross margin for AB Company, assuming they used the FIFO method of accounting for inventories. 2. Ignoring the impact of taxes, what is the difference in shareholders' equity between the US GAAP and IFRS financial statements at 12/31/22? Indicate which is greater (i.e., is shareholders' equity US GAAP higher/lower/same as compared with IFRS and by what amount $)?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the Gross Margin using FIFO method To calculate the gross margin using the FIFO method we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started