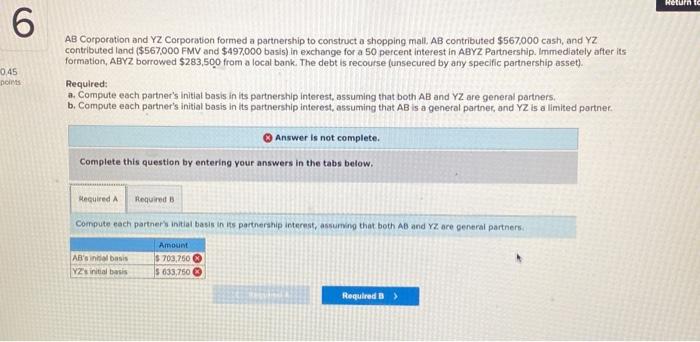

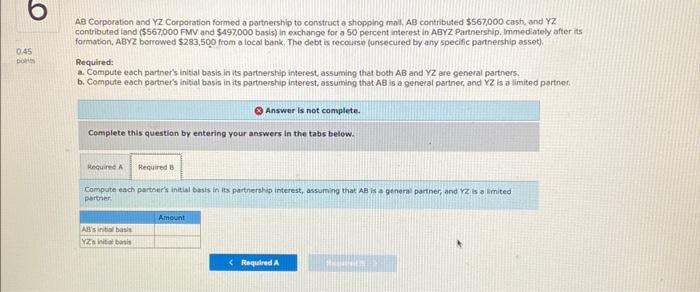

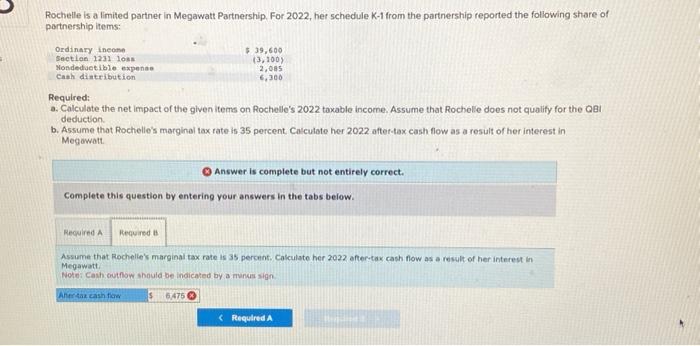

AB Corporation and YZ Corporation formed a partnership to construct a shopping mall. AB contributed $567,000 cash, and YZ contributed land (\$567,000 FMV and $497,000 basis) in exchange for a 50 percent interest in ABYZ Partnership. Immediately after its formation, ABYZ borrowed $283,500 from a local bank. The debt is recourse (unsecured by any specific partnership asset). Required: a. Compute each partner's initial basis in its partnership interest, assuming that both AB and YZ are general parthers. b. Compute each partner's initial basis in its partnership interest, assuming that AB is a general partner, and YZ is a limited partnee. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute each partners initial basis in its parthership interest, assuming that both AB and YZ are general partners. AB Corporation and YZ Corporation formed a parthership to construct a shopping mal. AB contributed $567,000 cash, and YZ contributed land (\$567,000 FMV and $497,000 basis) in exchange for a 50 percent interest in ABYZ Parthership, Immedlately after its formation, ABYZ borrowed $283,500 from a local bank, The debt is recourse (unsecured by any specific parthership asset). Required: a. Compute each parther's initial basis in its partnership interest, assuming that both AB and YZ are general partners. b. Compute each parther's initial bosis in its partnership interest, assuming that AB is a genecal partnec, and YZ is a limited porthec Answer is not complete. Complete this question by entering your answers in the tabs below. Compute each partser's initial bass in its partnerhhio interest, assuming that AB is a genera partner, and Yz is a lmted pertner. Rochelle is a limited partner in Megawatt Partnership. For 2022, her schedule K-1 from the partnership reported the following share of partnership items: Required: a. Calculate the net impact of the given items on Rochelle's 2022 taxable income. Assume that Rochelie does not qualify for the QBi deduction. b. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2022 aftertax cash flow as a result of her interest in Megawott Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs beiow. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2022 affertax cash flow as a result of her interest in Megawatt. Notoi Cash outhow should be indicated by a munus sign