Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AB Corporation and YZ Corporation formed a partnership to construct a shopping mall. AB contributed $510,000cash, and YZ contributed land ($510,000 FMV and $440,000 basis)

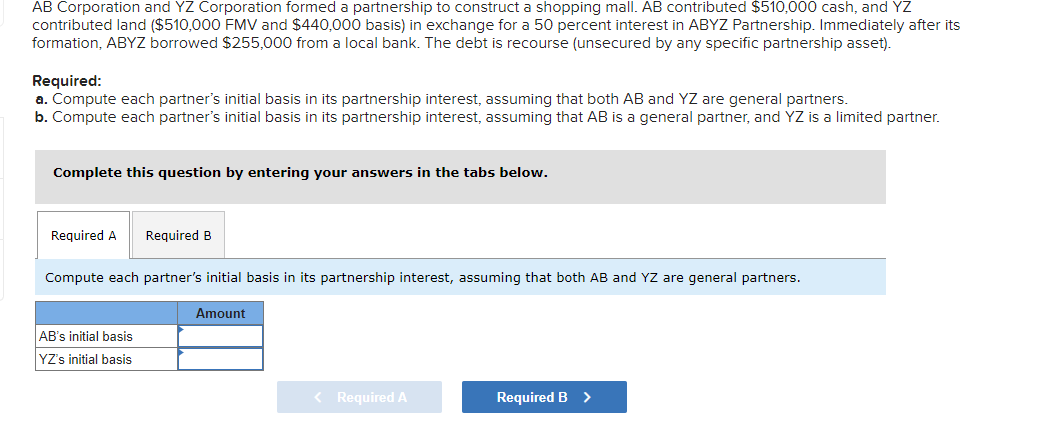

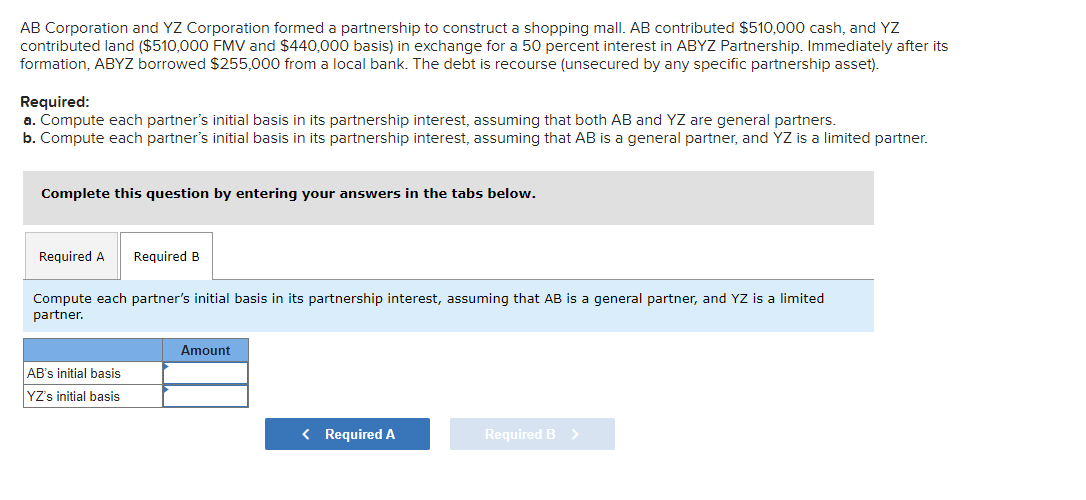

AB Corporation and YZ Corporation formed a partnership to construct a shopping mall. AB contributed $510,000cash, and YZ contributed land ($510,000 FMV and $440,000 basis) in exchange for a 50 percent interest in ABYZ Partnership. Immediately after its formation, ABYZ borrowed $255,000 from a local bank. The debt is recourse (unsecured by any specific partnership asset). Required: a. Compute each partner's initial basis in its partnership interest, assuming that both AB and YZ are general partners. b. Compute each partner's initial basis in its partnership interest, assuming that AB is a general partner, and YZ is a limited partner. Complete this question by entering your answers in the tabs below. Compute each partner's initial basis in its partnership interest, assuming that both AB and YZ are general partners. AB Corporation and YZ Corporation formed a partnership to construct a shopping mall. AB contributed $510,000 cash, and YZ contributed land ( $510,000 FMV and $440,000 basis) in exchange for a 50 percent interest in ABYZ Partnership. Immediately after its formation, ABYZ borrowed $255,000 from a local bank. The debt is recourse (unsecured by any specific partnership asset). Required: a. Compute each partner's initial basis in its partnership interest, assuming that both AB and YZ are general partners. b. Compute each partner's initial basis in its partnership interest, assuming that AB is a general partner, and YZ is a limited partner. Complete this question by entering your answers in the tabs below. Compute each partner's initial basis in its partnership interest, assuming that AB is a general partner, and YZ is a limited partner

AB Corporation and YZ Corporation formed a partnership to construct a shopping mall. AB contributed $510,000cash, and YZ contributed land ($510,000 FMV and $440,000 basis) in exchange for a 50 percent interest in ABYZ Partnership. Immediately after its formation, ABYZ borrowed $255,000 from a local bank. The debt is recourse (unsecured by any specific partnership asset). Required: a. Compute each partner's initial basis in its partnership interest, assuming that both AB and YZ are general partners. b. Compute each partner's initial basis in its partnership interest, assuming that AB is a general partner, and YZ is a limited partner. Complete this question by entering your answers in the tabs below. Compute each partner's initial basis in its partnership interest, assuming that both AB and YZ are general partners. AB Corporation and YZ Corporation formed a partnership to construct a shopping mall. AB contributed $510,000 cash, and YZ contributed land ( $510,000 FMV and $440,000 basis) in exchange for a 50 percent interest in ABYZ Partnership. Immediately after its formation, ABYZ borrowed $255,000 from a local bank. The debt is recourse (unsecured by any specific partnership asset). Required: a. Compute each partner's initial basis in its partnership interest, assuming that both AB and YZ are general partners. b. Compute each partner's initial basis in its partnership interest, assuming that AB is a general partner, and YZ is a limited partner. Complete this question by entering your answers in the tabs below. Compute each partner's initial basis in its partnership interest, assuming that AB is a general partner, and YZ is a limited partner Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started