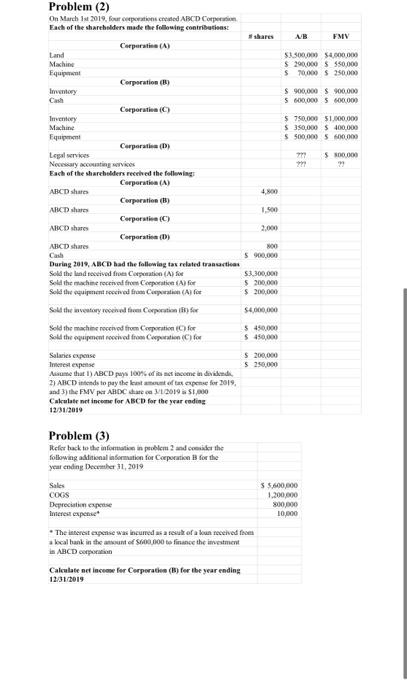

AB FMV $3.500,00) 54.000.000 $ 290,000 $ 550,000 $70,000 $250.000 $ 900,000 $900.000 S 600.000 S 600.000 $750,000 51.000.000 $ 350,000 $400.000 $ 500,000 5 600.000 500.000 Problem (2) On March 12019, four ceperations creed ABCD Corp Each of the shareholders made the following contributions Corporativa (A) Land Machine Fuit Corporation (3) Inwy Corporativa (6) Imety Machine Equip Corporation (D) Legal services Necessary cousing rices Each of the shareholders reched the following Corporation (A) ABCD shares 4,800 Corporation (B) ABCD share 1.500 Corporation (C) ABCD shares Corporation (D) ABCD shares 00 Case $ 900.000 During 2019, ABCD had the following tax related transactions Sold the land toeived from operation (A) $3.300.000 Sold the machine received from Cooperativa A) for $ 200.000 Sold the equipment socived from Cap (Al for $ 200,000 Soll the inventory roceed the Corporation for $4.000.000 Sold the machine reserved from Corporation for $ 450,000 Sold the open received from Corporation (C) for $450,000 Salaries expense $ 200,000 Imeres experts 5 250.000 Assume that 1) ABCD paya 100% din met income in devandi 2) ABCD intends to pay the best amount of tax expense for 2019, and 3) the FNV PARDC 12019 1,000 Calculate net income for ABCD for the year eading 12/31/2019 Problem (3) Refer back to the information problem and consider the following additional information for Corporation for the your ending December 31, 2019 Sales COS Depreciation expense Interest expense The interest expense was incurred as a result of a loun received from local bank in the amount of S600,000 to finance the investment in ABCD corporation Calculate net income for Corporation ( for the year ending 13/01/2018 55,600,000 1.200.000 800,000 10,000 AB FMV $3.500,00) 54.000.000 $ 290,000 $ 550,000 $70,000 $250.000 $ 900,000 $900.000 S 600.000 S 600.000 $750,000 51.000.000 $ 350,000 $400.000 $ 500,000 5 600.000 500.000 Problem (2) On March 12019, four ceperations creed ABCD Corp Each of the shareholders made the following contributions Corporativa (A) Land Machine Fuit Corporation (3) Inwy Corporativa (6) Imety Machine Equip Corporation (D) Legal services Necessary cousing rices Each of the shareholders reched the following Corporation (A) ABCD shares 4,800 Corporation (B) ABCD share 1.500 Corporation (C) ABCD shares Corporation (D) ABCD shares 00 Case $ 900.000 During 2019, ABCD had the following tax related transactions Sold the land toeived from operation (A) $3.300.000 Sold the machine received from Cooperativa A) for $ 200.000 Sold the equipment socived from Cap (Al for $ 200,000 Soll the inventory roceed the Corporation for $4.000.000 Sold the machine reserved from Corporation for $ 450,000 Sold the open received from Corporation (C) for $450,000 Salaries expense $ 200,000 Imeres experts 5 250.000 Assume that 1) ABCD paya 100% din met income in devandi 2) ABCD intends to pay the best amount of tax expense for 2019, and 3) the FNV PARDC 12019 1,000 Calculate net income for ABCD for the year eading 12/31/2019 Problem (3) Refer back to the information problem and consider the following additional information for Corporation for the your ending December 31, 2019 Sales COS Depreciation expense Interest expense The interest expense was incurred as a result of a loun received from local bank in the amount of S600,000 to finance the investment in ABCD corporation Calculate net income for Corporation ( for the year ending 13/01/2018 55,600,000 1.200.000 800,000 10,000