Answered step by step

Verified Expert Solution

Question

1 Approved Answer

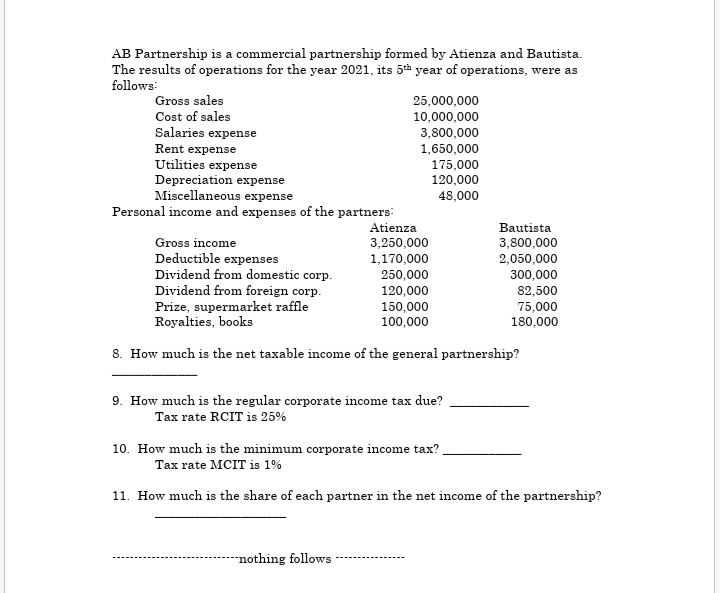

AB Partnership is a commercial partnership formed by Atienza and Bautista. The results of operations for the year 2021, its 5h year of operations,

AB Partnership is a commercial partnership formed by Atienza and Bautista. The results of operations for the year 2021, its 5h year of operations, were as follows: Gross sales 25,000,000 Cost of sales 10,000,000 Salaries expense Rent expense Utilities expense Depreciation expense Miscellaneous expense Personal income and expenses of the partners: 3,800,000 1,650,000 175,000 120,000 48,000 Atienza Bautista 3,250,000 1,170,000 250,000 Gross income 3,800,000 Deductible expenses Dividend from domestic corp. Dividend from foreign corp. Prize, supermarket raffle Royalties, books 2,050,000 300,000 120,000 82,500 150,000 75,000 180,000 100,000 8. How much is the net taxable income of the general partnership? 9. How much is the regular corporate income tax due? Tax rate RCIT is 25% 10. How much is the minimum corporate income tax? Tax rate MCIT is 1% 11. How much is the share of each partner in the net income of the partnership? "nothing follows

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 In the given question we are provided with the information of AB Partnership We are provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started