Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abandonment options Alpha Co. is considering... How does one find the PV factor with the WACC being at 10%? I keep getting stuck there. Please

Abandonment options Alpha Co. is considering...

How does one find the PV factor with the WACC being at 10%? I keep getting stuck there. Please help by showing the work in excel.

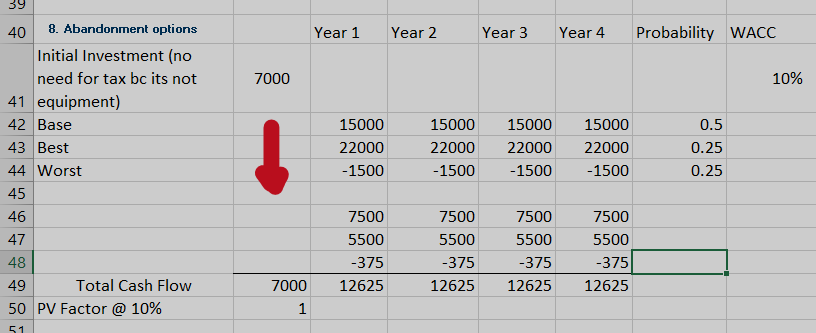

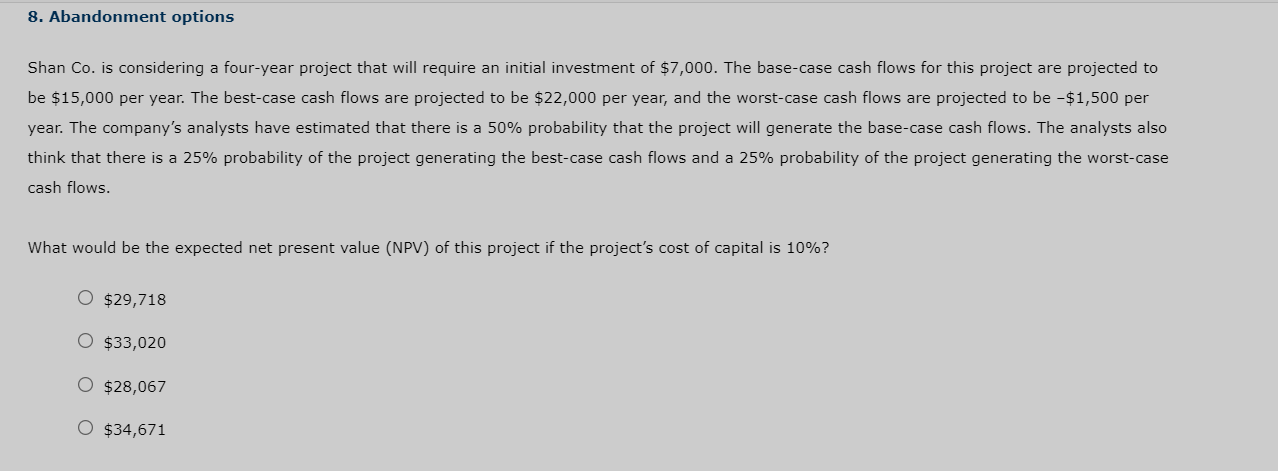

39 Year 1 Year 2 Year 3 Year 4 Probability WACC 7000 10% 40 8. Abandonment options Initial Investment (no need for tax bc its not 41 equipment) 42 Base 43 Best 44. Worst 45 ! 15000 22000 -1500 15000 22000 -1500 15000 22000 -1500 15000 22000 -1500 0.5 0.25 0.25 46 47 7500 5500 -375 12625 7500 5500 -375 12625 7500 5500 -375 12625 7500 5500 -375 12625 48 49 Total Cash Flow 50 PV Factor @ 10% 7000 1 51 8. Abandonment options Shan Co. is considering a four-year project that will require an initial investment of $7,000. The base-case cash flows for this project are projected to be $15,000 per year. The best-case cash flows are projected to be $22,000 per year, and the worst-case cash flows are projected to be -$1,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project's cost of capital is 10%? O $29,718 O $33,020 $28,067 $34,671

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started