Question

Abbas and Sabrina, aged 32 and 33 respectively, are living in a house that they bought last year. They have only one child, Vincent, aged

Abbas and Sabrina, aged 32 and 33 respectively, are living in a house that they bought last year. They have only one child, Vincent, aged 2. They plan to have another child in two or three years. Lately, the Agarwal's have become concerned about their finances.

Abbas is an architect for Gensler, which is a global design and architecture firm. His annual gross salary is $65,000, after deductions his net monthly pay is $3,700. Sabrina is a medical office assistant with a gross salary of $31,000, and after deductions, her net monthly pay is $1,950.

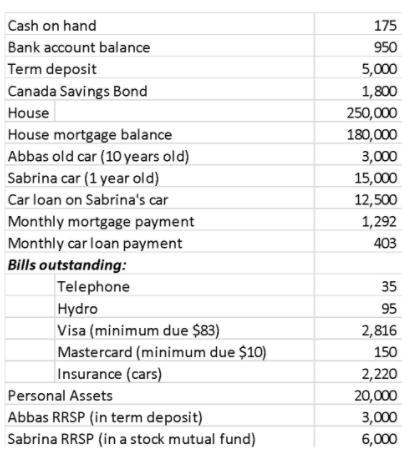

Abbas is planning to buy a new car and has approach the bank for a car loan. Agarwal also approaches the bank for a personal line of credit since they are experiencing cash-flow problems. They have been asked by the bank to provide a Statement of New Worth and monthly Cash Flow statement.

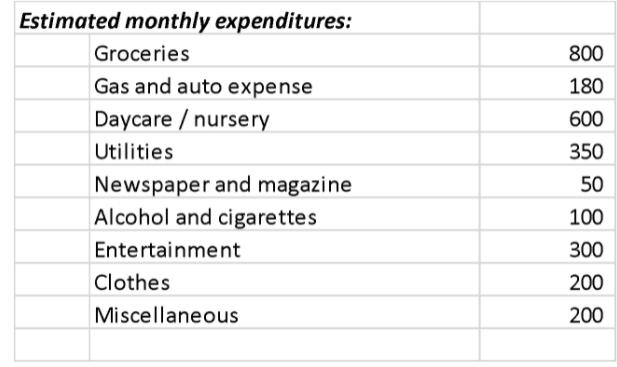

The information is provided.

The next day Abbas phone with additional information. He mentioned the property taxes are about $1,800, and the home insurance premium is $450. Last year he spent over $700 on landscaping. He also borrowed an interest-free loan of $25,000 from his father to make the down payment for the house. Abbas wants to repay his father $7,000 annually until the loan is paid off.

Abbas has good company benefits, which includes medical and drug plan, pension plan, life and disability insurance. However, Sabrina does not have any company benefits. The Agarwal usually take a vacation once a year which costs about $2,000.

The banker needs to create

net worth statement

cashflow statement

List five comments for each statement.

If their income increases by 5%, their total expense by 4%, and their total assets (excluding personal assets and the cars) by 6%.

What will be their net worth one year from now?

Estimated monthly expenditures: Groceries Gas and auto expense Daycare / nursery Utilities Newspaper and magazine Alcohol and cigarettes Entertainment Clothes Miscellaneous 800 180 600 350 50 100 300 200 200

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Net Worth Statement Assets Cash and deposits 1125 House 250000 Abbass car 3000 Sabrinas car 15000 RR...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started