Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abbcd Abba Abba 3500 AaB Att Font DAR SECTION B.LONG ANSWER QUESTIONS (48 marks) QUESTION 1 (12 marks) Davis is setting an investment plan with

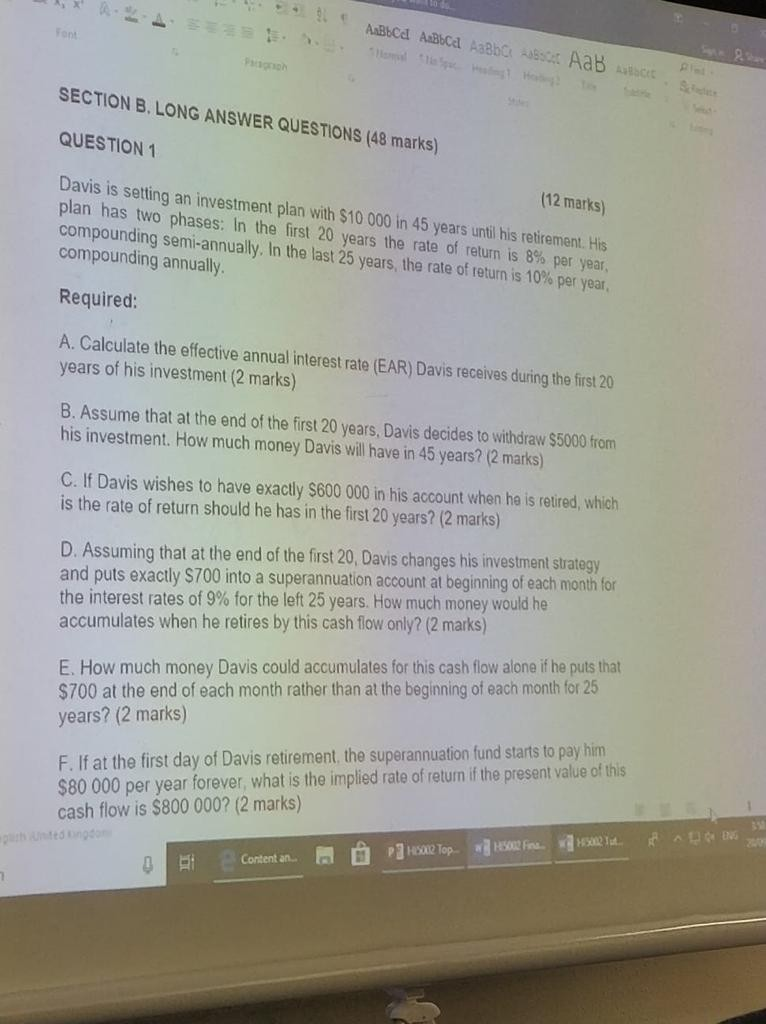

Abbcd Abba Abba 3500 AaB Att Font DAR SECTION B.LONG ANSWER QUESTIONS (48 marks) QUESTION 1 (12 marks) Davis is setting an investment plan with $10 000 in 45 years until his retirement. His plan has two phases: In the first 20 years the rate of return is 8% per year, compounding semi-annually. In the last 25 years, the rate of return is 10% per year, compounding annually. Required: A. Calculate the effective annual interest rate (EAR) Davis receives during the first 20 years of his investment (2 marks) B. Assume that at the end of the first 20 years, Davis decides to withdraw $5000 from his investment. How much money Davis will have in 45 years? (2 marks) C. If Davis wishes to have exactly $600 000 in his account when he is retired, which is the rate of return should he has in the first 20 years? (2 marks) D. Assuming that at the end of the first 20, Davis changes his investment strategy and puts exactly $700 into a superannuation account at beginning of each month for the interest rates of 9% for the left 25 years. How much money would he accumulates when he retires by this cash flow only? (2 marks) E. How much money Davis could accumulates for this cash flow alone if he puts that $700 at the end of each month rather than at the beginning of each month for 25 years? (2 marks) F. If at the first day of Davis retirement, the superannuation fund starts to pay him $80 000 per year forever, what is the implied rate of return if the present value of this cash flow is $800 000? (2 marks) hunting Content an. Hasane Top. w HR Fine. 2. T. R E NG Abbcd Abba Abba 3500 AaB Att Font DAR SECTION B.LONG ANSWER QUESTIONS (48 marks) QUESTION 1 (12 marks) Davis is setting an investment plan with $10 000 in 45 years until his retirement. His plan has two phases: In the first 20 years the rate of return is 8% per year, compounding semi-annually. In the last 25 years, the rate of return is 10% per year, compounding annually. Required: A. Calculate the effective annual interest rate (EAR) Davis receives during the first 20 years of his investment (2 marks) B. Assume that at the end of the first 20 years, Davis decides to withdraw $5000 from his investment. How much money Davis will have in 45 years? (2 marks) C. If Davis wishes to have exactly $600 000 in his account when he is retired, which is the rate of return should he has in the first 20 years? (2 marks) D. Assuming that at the end of the first 20, Davis changes his investment strategy and puts exactly $700 into a superannuation account at beginning of each month for the interest rates of 9% for the left 25 years. How much money would he accumulates when he retires by this cash flow only? (2 marks) E. How much money Davis could accumulates for this cash flow alone if he puts that $700 at the end of each month rather than at the beginning of each month for 25 years? (2 marks) F. If at the first day of Davis retirement, the superannuation fund starts to pay him $80 000 per year forever, what is the implied rate of return if the present value of this cash flow is $800 000? (2 marks) hunting Content an. Hasane Top. w HR Fine. 2. T. R E NG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started