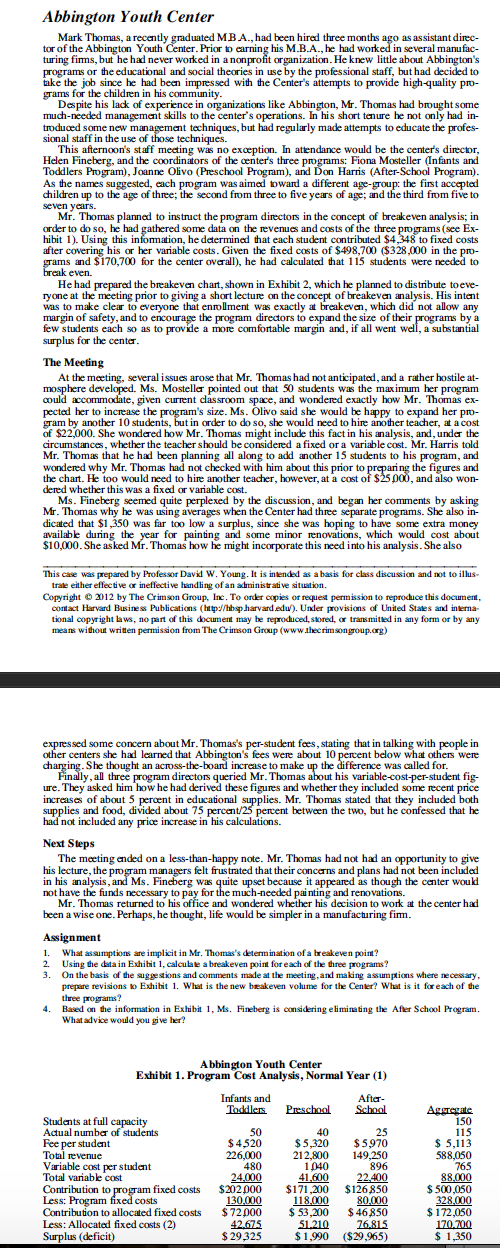

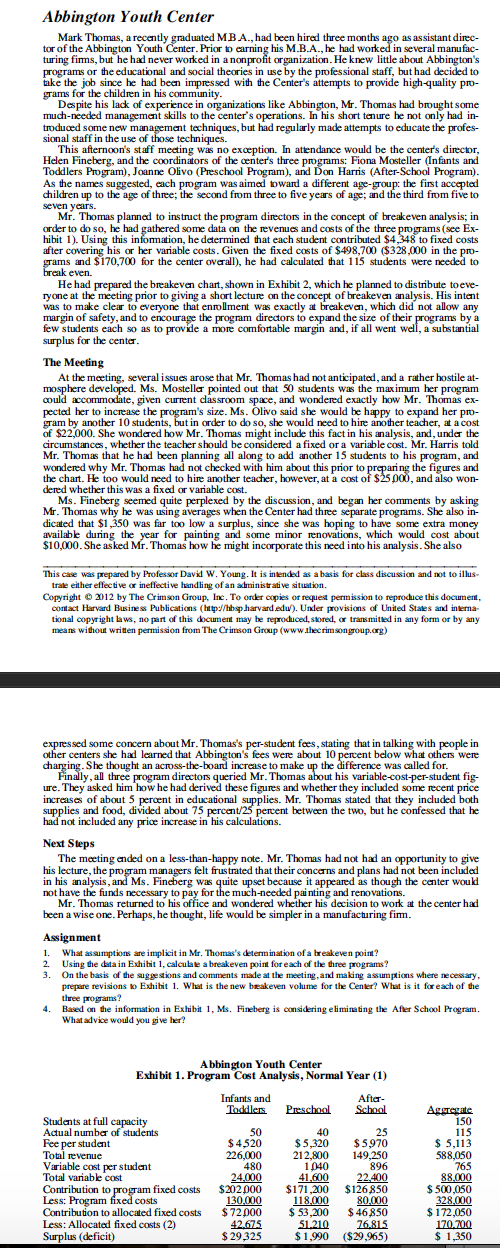

Abbington Youth Center Mark Thomas, a recently graduated MBA., had been hired three months ago as assistant direc- tor of the Abbington Youth Center. Prior to earning his M.B.A., he had worked in several manufac- turing fims, but he had never worked in a nonprofit organization. He knew little about Abbington's programs or the educational and social theories in use by the professional staff, but had decided to take the job since he had been impressed with the Center's attempts to provide high-quality pro- grams for the children in his community. Despite his lack of experience in organizations like Abbington, Mr. Thomas had brought some much-needed management skills to the center's operations. In his short tenure he not only had in- troduced some new management techniques, but had regularly made attempts to educate the profes- sional staff in the use of those techniques. This afternoon's staff meeting was no exception. In attendance would be the center's director, Helen Fineberg, and the coordinators of the center's three programs: Fiona Mosteller (Infants and Toddlers Program), Joanne Olivo (Preschool Program), and Don Harris (After-School Program). As the ne names suggested, each program was aimed toward a different age-group: the first accepted children up to the age of three; the second from three to five years of age; and the third from five to seven years. Mr. Thomas planned to instruct the program directors in the concept of breakeven analysis; in order to do so, he had gathered some data on the revenues and costs of the three programs (see Ex- hibit 1). Using this information, he determined that each student contributed $4,348 to fixed costs after covering his or her variable costs. Given the fixed costs of $498,700 ($328,000 in the pro- grams and $170,700 for the center overall), he had calculated that 115 students were needed to break even. He had prepared the breakeven chart, shown in Exhibit 2, which he planned to distribute toeve- ryone at the meeting prior to giving a short lecture on the concept of breakeven analysis. His intent was to make clear to everyone that enrolment was exactly at breakeven, which did not allow any margin of safety, and to encourage the program directors to expand the size of their programs by a few students each so as to provide a more comfortable margin and, if all went well, a substantial surplus for the center The Meeting At the meeting, several issues arose that Mr. Thomas had not anticipated, and a rather hostile at- mosphere developed. Ms. Mosteller pointed out that 50 students was the maximum her program could accommodate, given current classroom space, and wondered exactly how Mr. Thomas ex- pected her to increase the program's size. Ms. Olivo said she would be happy to expand h yam by another 10 students, but in order to do so, she would need to hire another teacher, at a cost of $22,000. She wondered how Mr. Thomas might include this fact in his analysis, and, under the circumstances, whether the teacher should be considered a fixed or a variable cost. Mr. Harris told Mr. Thomas that he had been planning all along to add another 15 students to his program, and wondered why Mr. Thomas had not checked with him about this prior to preparing the figures and the chart. He too would need to hire another teacher, however, at a cost of $25.000, and also won- dered whether this was a fixed or variable cost. Ms. Fineberg seemed quite perplexed by the discussion, and began her comments by asking Mr. Thomas why he was using averages when the Center had three separate programs. She also in- dicated that $1,350 was far too low a surplus, since she was hoping to have some extra money available during the year for painting and some minor renovations, which would cost about $10,000. She asked Mr. Thomas how he might incorporate this need into his analysis. She also pm- This case was prepared by Professor David W. Young. It is intended as a basis for class discussion and not to illus- trale either effective or ineffective handling of an achinistrative situation. Copyright 2012 by The Crimson Group, Inc. To order copies or request permission to reproduce this document, contact Harvard Business Publications (http://sp.harvard.edu/). Under provisions of United States and interna- tional copyright laws, no part of this document may be reproduced, stored, or transmitted in any form or by any means without written permission from The Crimson Group (www.thecrimson group.org) expressed some concern about Mr. Thomas's per-student fees, stating that in talking with people in other centers she had learned that Abbington's fees were about 10 percent below what others were charging. She thought an across-the-board increase to make up the difference was called for. Finally, al three program directors queried Mr. Thomas about his variable-cost-per-student fig- ure. They asked him how he had derived these figures and whether they included some recent price increases of about 5 percent in educational supplies. Mr. Thomas stated that they included both supplies and food, divided about 75 percent/23 percent between the two, but he confessed that he had not included any price increase in his calculations. Next Steps The meeting ended on a less-than-happy note. Mr. Thomas had not had an opportunity to give his lecture, the program managers felt frustrated that their concerns and plans had not been included in his analysis, and Ms. Fineberg was quite upset because it appeared as though the center would not have the funds necessary to pay for the much-needed painting and renovations. Mr. Thomas returned to his office and wondered whether his decision to work at the center had been a wise one. Perhaps, he thought, life would be simpler in a manufacturing fim. Assignment What assumptions are implicit in Mr. Thomas's determination of a breakeven point? 2 Using the data in Exhibit 1, calculate a breakeven point for each of the three programs? 3. On the basis of the suggestions and comments made at the meeting, and making assumptions where necessary, prepare revisions to Exhibit 1. What is the new breakeven volume for the Center? What is it for each of the three programs? 4. Based on the information in Exhibit 1, Ms. Fineberg is considering eliminating the After School Program, What advice would you give her? Abbington Youth Center Exhibit 1. Program Cost Analysis, Normal Year (1) Infants and Toddlers Preschool After- School Students at full capacity Actual number of students Fee per student Total revenue Variable cost per student Total variable cost Contribution to program fixed costs Less: Program fixed costs Contribution to allocated fixed costs Less: Allocated fixed costs (2) Surplus (deficit) 50 $ 4520 226,000 480 24.000 $202 000 130.000 $72.000 42.675 $ 29,325 40 25 $5,320 $5,970 212,800 149,250 1040 896 41.600 22.400 $171,200 $126850 118,000 80.000 $ 53,200 $ 46850 51.210 76.815 $ 1,990 ($29,965) $ Aggregate 150 115 $ 5,113 588,050 765 88,000 $ 500,050 328,000 $ 172,050 170.700 $ 1,350 Abbington Youth Center Mark Thomas, a recently graduated MBA., had been hired three months ago as assistant direc- tor of the Abbington Youth Center. Prior to earning his M.B.A., he had worked in several manufac- turing fims, but he had never worked in a nonprofit organization. He knew little about Abbington's programs or the educational and social theories in use by the professional staff, but had decided to take the job since he had been impressed with the Center's attempts to provide high-quality pro- grams for the children in his community. Despite his lack of experience in organizations like Abbington, Mr. Thomas had brought some much-needed management skills to the center's operations. In his short tenure he not only had in- troduced some new management techniques, but had regularly made attempts to educate the profes- sional staff in the use of those techniques. This afternoon's staff meeting was no exception. In attendance would be the center's director, Helen Fineberg, and the coordinators of the center's three programs: Fiona Mosteller (Infants and Toddlers Program), Joanne Olivo (Preschool Program), and Don Harris (After-School Program). As the ne names suggested, each program was aimed toward a different age-group: the first accepted children up to the age of three; the second from three to five years of age; and the third from five to seven years. Mr. Thomas planned to instruct the program directors in the concept of breakeven analysis; in order to do so, he had gathered some data on the revenues and costs of the three programs (see Ex- hibit 1). Using this information, he determined that each student contributed $4,348 to fixed costs after covering his or her variable costs. Given the fixed costs of $498,700 ($328,000 in the pro- grams and $170,700 for the center overall), he had calculated that 115 students were needed to break even. He had prepared the breakeven chart, shown in Exhibit 2, which he planned to distribute toeve- ryone at the meeting prior to giving a short lecture on the concept of breakeven analysis. His intent was to make clear to everyone that enrolment was exactly at breakeven, which did not allow any margin of safety, and to encourage the program directors to expand the size of their programs by a few students each so as to provide a more comfortable margin and, if all went well, a substantial surplus for the center The Meeting At the meeting, several issues arose that Mr. Thomas had not anticipated, and a rather hostile at- mosphere developed. Ms. Mosteller pointed out that 50 students was the maximum her program could accommodate, given current classroom space, and wondered exactly how Mr. Thomas ex- pected her to increase the program's size. Ms. Olivo said she would be happy to expand h yam by another 10 students, but in order to do so, she would need to hire another teacher, at a cost of $22,000. She wondered how Mr. Thomas might include this fact in his analysis, and, under the circumstances, whether the teacher should be considered a fixed or a variable cost. Mr. Harris told Mr. Thomas that he had been planning all along to add another 15 students to his program, and wondered why Mr. Thomas had not checked with him about this prior to preparing the figures and the chart. He too would need to hire another teacher, however, at a cost of $25.000, and also won- dered whether this was a fixed or variable cost. Ms. Fineberg seemed quite perplexed by the discussion, and began her comments by asking Mr. Thomas why he was using averages when the Center had three separate programs. She also in- dicated that $1,350 was far too low a surplus, since she was hoping to have some extra money available during the year for painting and some minor renovations, which would cost about $10,000. She asked Mr. Thomas how he might incorporate this need into his analysis. She also pm- This case was prepared by Professor David W. Young. It is intended as a basis for class discussion and not to illus- trale either effective or ineffective handling of an achinistrative situation. Copyright 2012 by The Crimson Group, Inc. To order copies or request permission to reproduce this document, contact Harvard Business Publications (http://sp.harvard.edu/). Under provisions of United States and interna- tional copyright laws, no part of this document may be reproduced, stored, or transmitted in any form or by any means without written permission from The Crimson Group (www.thecrimson group.org) expressed some concern about Mr. Thomas's per-student fees, stating that in talking with people in other centers she had learned that Abbington's fees were about 10 percent below what others were charging. She thought an across-the-board increase to make up the difference was called for. Finally, al three program directors queried Mr. Thomas about his variable-cost-per-student fig- ure. They asked him how he had derived these figures and whether they included some recent price increases of about 5 percent in educational supplies. Mr. Thomas stated that they included both supplies and food, divided about 75 percent/23 percent between the two, but he confessed that he had not included any price increase in his calculations. Next Steps The meeting ended on a less-than-happy note. Mr. Thomas had not had an opportunity to give his lecture, the program managers felt frustrated that their concerns and plans had not been included in his analysis, and Ms. Fineberg was quite upset because it appeared as though the center would not have the funds necessary to pay for the much-needed painting and renovations. Mr. Thomas returned to his office and wondered whether his decision to work at the center had been a wise one. Perhaps, he thought, life would be simpler in a manufacturing fim. Assignment What assumptions are implicit in Mr. Thomas's determination of a breakeven point? 2 Using the data in Exhibit 1, calculate a breakeven point for each of the three programs? 3. On the basis of the suggestions and comments made at the meeting, and making assumptions where necessary, prepare revisions to Exhibit 1. What is the new breakeven volume for the Center? What is it for each of the three programs? 4. Based on the information in Exhibit 1, Ms. Fineberg is considering eliminating the After School Program, What advice would you give her? Abbington Youth Center Exhibit 1. Program Cost Analysis, Normal Year (1) Infants and Toddlers Preschool After- School Students at full capacity Actual number of students Fee per student Total revenue Variable cost per student Total variable cost Contribution to program fixed costs Less: Program fixed costs Contribution to allocated fixed costs Less: Allocated fixed costs (2) Surplus (deficit) 50 $ 4520 226,000 480 24.000 $202 000 130.000 $72.000 42.675 $ 29,325 40 25 $5,320 $5,970 212,800 149,250 1040 896 41.600 22.400 $171,200 $126850 118,000 80.000 $ 53,200 $ 46850 51.210 76.815 $ 1,990 ($29,965) $ Aggregate 150 115 $ 5,113 588,050 765 88,000 $ 500,050 328,000 $ 172,050 170.700 $ 1,350