Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abbott Laboratories (ABT) engages in the discovery, development, manufacture, and sale of a line of health care and pharmaceutical products. Below you will find

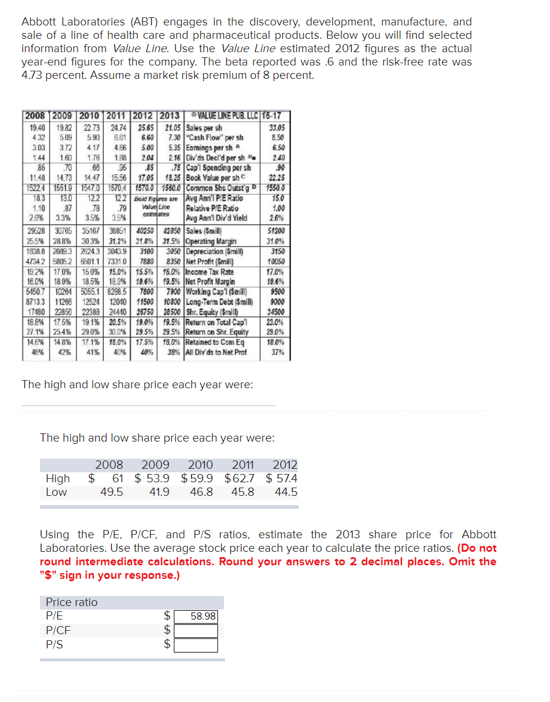

Abbott Laboratories (ABT) engages in the discovery, development, manufacture, and sale of a line of health care and pharmaceutical products. Below you will find selected information from Value Line. Use the Value Line estimated 2012 figures as the actual year-end figures for the company. The beta reported was .6 and the risk-free rate was 4.73 percent. Assume a market risk premium of 8 percent. 2008 2009 2010 2011 2012 2013 VALUE LINE PUB. LLC 16-17 19.40 19.82 22.73 24.74 25.65 21.05 Sales per sh 33.05 432 5.09 5.90 661 6.60 7.30 "Cash Flow" per sh 8.50 303 372 417 456 5.00 5.35 Earnings per sh 6.50 144 160 176 188 204 2.16 Div'ds Deel'd per sh 240 86 70 68 36 85 .75 Cap Spending per sh 90 11.48 14.73 14.47 15.56 17.05 18.25 Book Value per sh 22.25 15224 1551.9 1547.0 183 13.0 122 1.10 87 78 .79 2.6% 33% 3.5% 3.5% 1570.4 1570.0 1560.0 Common Shs Outst1550.0 122 Boid Free are Avg Ann' PE Ratio 15.0 Valine Relative PE Ratio 1.00 Avg Ann Div'd Yield 2.6% 29628 30765 35167 38851 40250 25.5% 28.8% 30.3% 31.2% 31% 18088 20893 2624.3 30439 47342 58052 6501.1 73310 19.2% 170% 15.0% 15.0% 16.0 % 18.9% 18.5% 18.0% 5450.7 10264 5055.1 6296.5 42850 Sales (Smil 31.5% Operating Margin 51200 31.0% 3100 3050 Depreciation (mil) 3150 7880 8350 Net Profit (Smil 10050 15.5% 16.0% Income Tax Rate 17.0% 19.6% 19.5% Net Profit Margin 19.6% 7800 7900 Working Cap1 (mil) 9500 8713.3 11266 12524 17480 22856 22388 24440 12010 11500 10800 Long-Term Debt (mil) 9000 26750 28500 Shr. Equity Smil 34500 18.8% 17.5% 19.1 % 20.5% 27.1% 254% 29 0% 30.0% 29.5% 14.6% 14.8% 17.1% 18.0% 17.5% 48% 42% 41% 40% 40% 19.0% 19.5% Return on Total Cap 23.0% 29.5% Return on Shr. Equity 25.0% 18.0% Retained to Com Eq 18.0% 39% All Div ds to Net Prof 37% The high and low share price each year were: The high and low share price each year were: High Low 2008 2009 2010 2011 2012 $ 61 $ 53.9 $59.9 $62.7 $57.4 49.5 41.9 46.8 45.8 44.5 Using the P/E, P/CF, and P/S ratios, estimate the 2013 share price for Abbott Laboratories. Use the average stock price each year to calculate the price ratios. (Do not round intermediate calculations. Round your answers to 2 decimal places. Omit the "$" sign in your response.) Price ratio P/E P/CF P/S 555 58.98

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started