Answered step by step

Verified Expert Solution

Question

1 Approved Answer

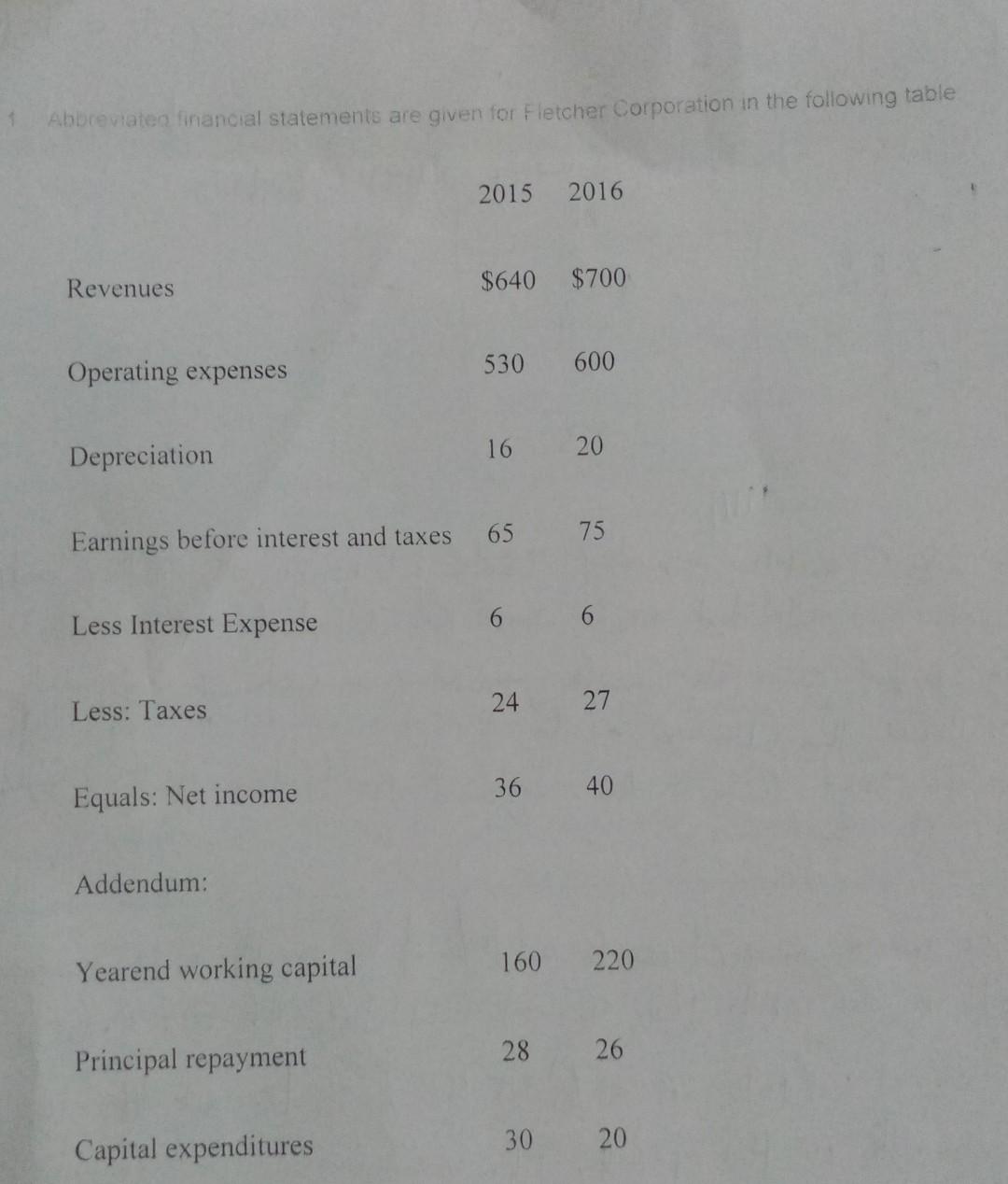

Abbreviatea financial statements are given for Fletcher Corporation in the following table 2015 2016 Revenues $640 $700 530 Operating expenses 600 Depreciation 16 20 65

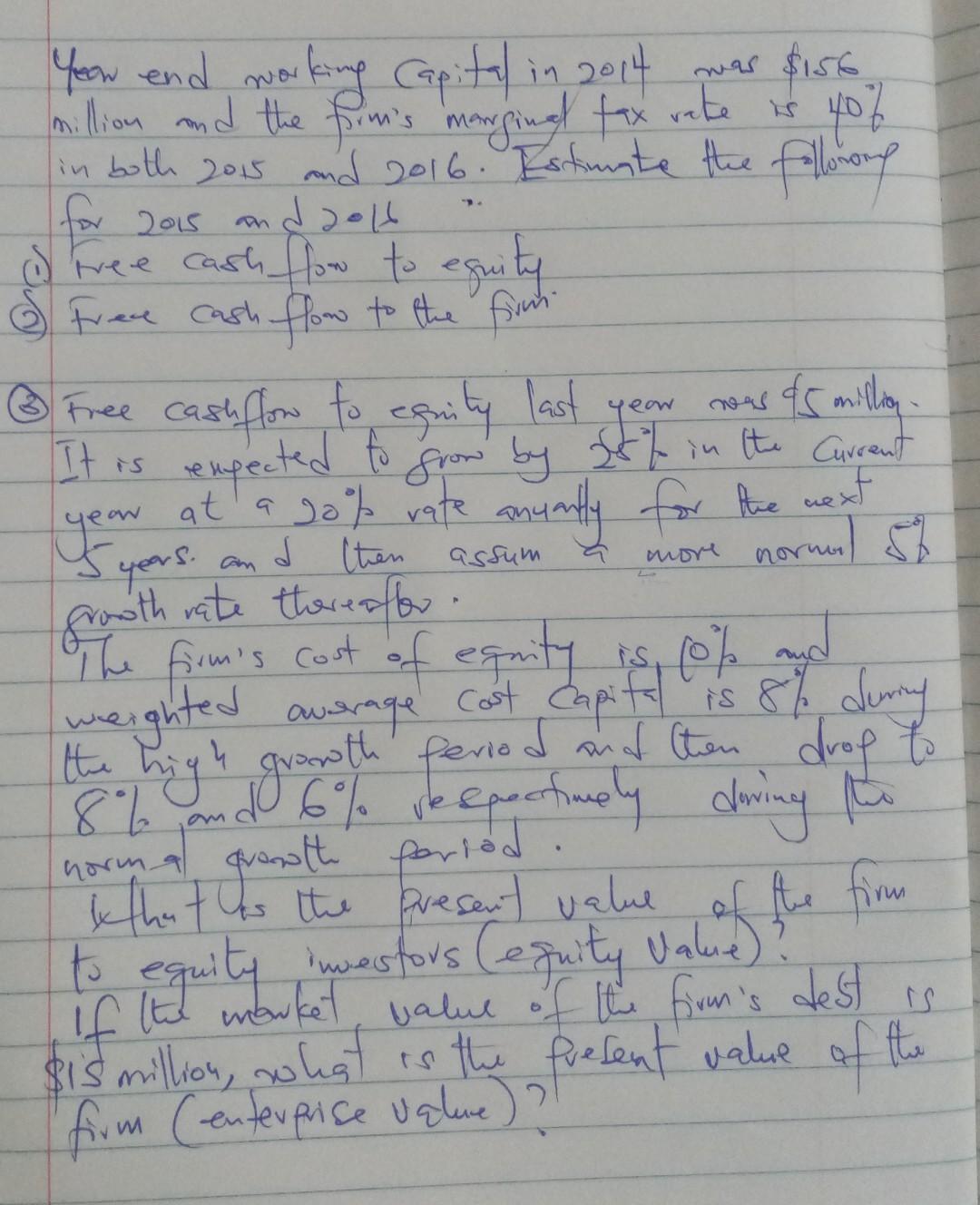

Abbreviatea financial statements are given for Fletcher Corporation in the following table 2015 2016 Revenues $640 $700 530 Operating expenses 600 Depreciation 16 20 65 75 Earnings before interest and taxes 6 Less Interest Expense Less: Taxes 24 27 36 40 Equals: Net income Addendum: 160 220 Yearend working capital Principal repayment 28 26 30 20 Capital expenditures It is reupected to d then assum the high growth period working capital in 2014 was $156 million and the firm's marginal tax rate is 40% in both 2015 and 2016. Estante the follorong for 20s and doll o free cash flow to equity I free cash flow to the fine Free cashflow to efnity last year news was &5 million frow by off in the Current yoon at a goot rate anually for the next more normal s 1 growth rate thereafter. The firm's cost of equity is o% and weighted average Cost capital is 8% during 8% and 6% respectively during the normal growth period. that has the present value to equity investors (equity Valure)? if the market value of the firm's dest is $is million, what is the present value of the from Centerprise valove)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started