Question

Abbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 17% in 2022 and all assets and

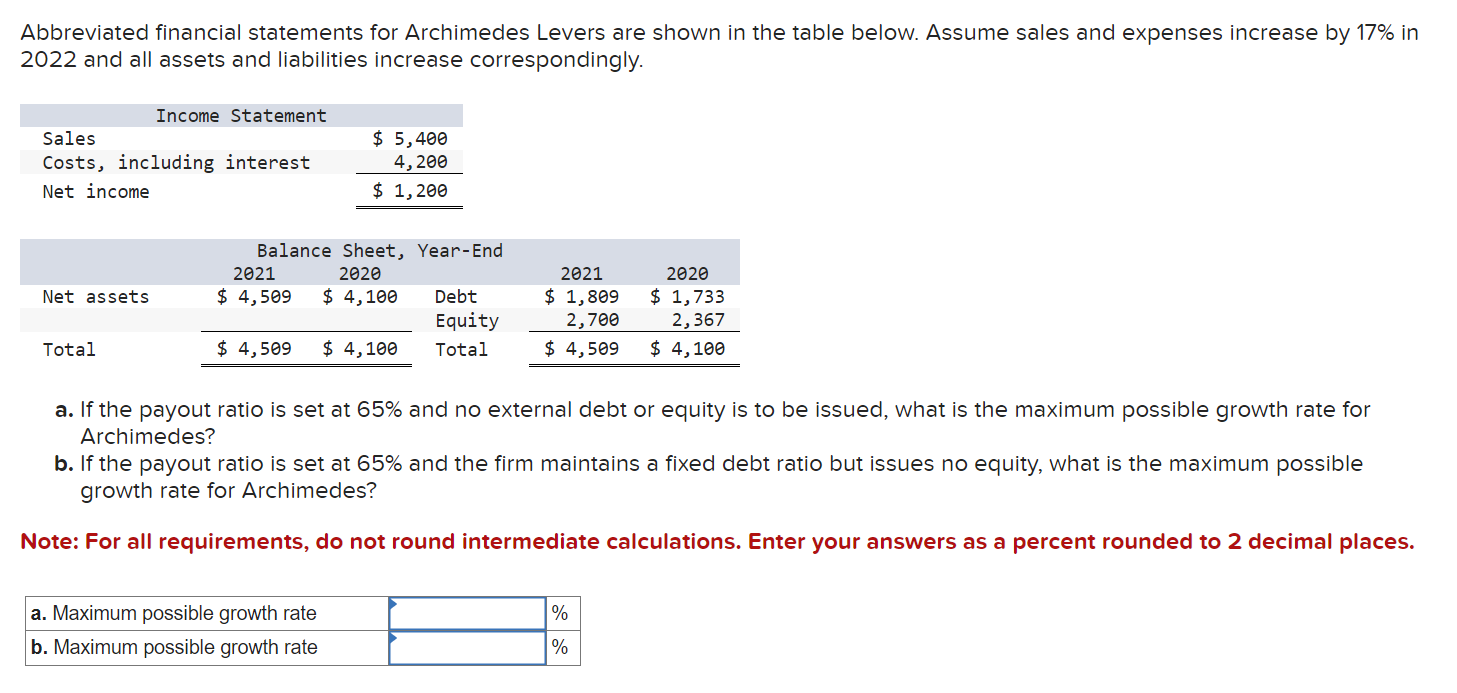

Abbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 17% in 2022 and all assets and liabilities increase correspondingly.

| Income Statement | |

| Sales | $ 5,400 |

|---|---|

| Costs, including interest | 4,200 |

| Net income | $ 1,200 |

| Balance Sheet, Year-End | ||||||

| 2021 | 2020 | 2021 | 2020 | |||

|---|---|---|---|---|---|---|

| Net assets | $ 4,509 | $ 4,100 | Debt | $ 1,809 | $ 1,733 | |

| Equity | 2,700 | 2,367 | ||||

| Total | $ 4,509 | $ 4,100 | Total | $ 4,509 | $ 4,100 | |

If the payout ratio is set at 65% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes?

If the payout ratio is set at 65% and the firm maintains a fixed debt ratio but issues no equity, what is the maximum possible growth rate for Archimedes?

Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started