Answered step by step

Verified Expert Solution

Question

1 Approved Answer

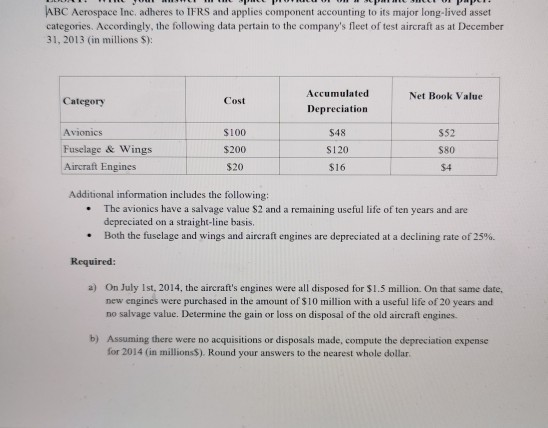

ABC Aerospace Inc. adheres to IFRS and applies component accounting to its major long-lived asset categories. Accordingly, the following data pertain to the company's fleet

ABC Aerospace Inc. adheres to IFRS and applies component accounting to its major long-lived asset categories. Accordingly, the following data pertain to the company's fleet of test aircraft as at December 31, 2013 in millions $): Category Cost Net Book Value Accumulated Depreciation Avionics Fuselage & Wings Aircraft Engines $100 $200 $20 $48 SI 20 $16 S52 80 $4 Additional information includes the following: The avionics have a salvage value $2 and a remaining useful life of ten years and are depreciated on a straight-line basis. Both the fuselage and wings and aircraft engines are depreciated at a declining rate of 25%. Required: a) On July Ist, 2014, the aircraft's engines were all disposed for $1.5 million. On that same date, new engines were purchased in the amount of $10 million with a useful life of 20 years and no salvage value. Determine the gain or loss on disposal of the old aircraft engines. b) Assuming there were no acquisitions or disposals made, compute the depreciation expense for 2014 (in millions). Round your answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started