a,b,c, and d

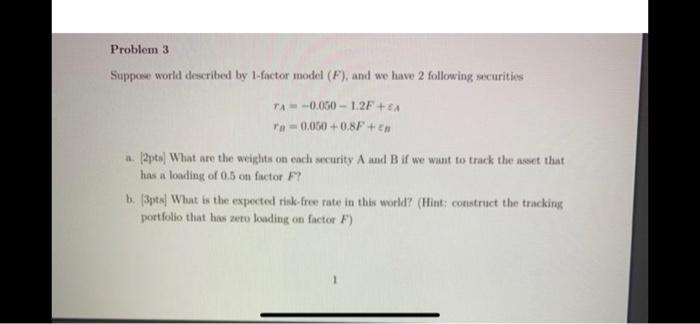

Problem 3 Suppose world described by 1-factor model (F), and we have 2 following securities TA= -0.050 - 1.2F + EA re=0.050 +0.8F + ER a. [2pts) What are the weights on each security A and B if we want to track the asset that has a loading of 0.5 on factor F? b. [3pts] What is the expected risk-free rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) 1 c. 3pts) What is the expected return of factor F? (Hint: construct the tracking portfolio that has a loading of 1 on factor F) d. [1pt) Is there any arbitrage opportunity if expected return on asset, that has a loading of 0.5 on factor F, is 4.50%? Problem 3 Suppose world described by 1-factor model (F), and we have 2 following securities TA = -0.050 - 12F+ ra -0.050 +0.8F+en 2pts) What are the weights on each security A and B if we want to track the set that has a loading of 0.5 on factor F? b. (3ptal What is the expected risk-free rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) b. [3pts) What is the expected risk-free rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) 1 c. pts What is the expected return of factor F (Hint construct the tracking portfolio that a loating of ion factor F) d. pells there any arbitrage opportunity if expected retum on wet, that has a loading of 0.5 on factor is? Problem 3 Suppose world described by 1-factor model (F), and we have 2 following securities TA= -0.050 - 1.2F + EA re=0.050 +0.8F + ER a. [2pts) What are the weights on each security A and B if we want to track the asset that has a loading of 0.5 on factor F? b. [3pts] What is the expected risk-free rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) 1 c. 3pts) What is the expected return of factor F? (Hint: construct the tracking portfolio that has a loading of 1 on factor F) d. [1pt) Is there any arbitrage opportunity if expected return on asset, that has a loading of 0.5 on factor F, is 4.50%? Problem 3 Suppose world described by 1-factor model (F), and we have 2 following securities TA = -0.050 - 12F+ ra -0.050 +0.8F+en 2pts) What are the weights on each security A and B if we want to track the set that has a loading of 0.5 on factor F? b. (3ptal What is the expected risk-free rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) b. [3pts) What is the expected risk-free rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) 1 c. pts What is the expected return of factor F (Hint construct the tracking portfolio that a loating of ion factor F) d. pells there any arbitrage opportunity if expected retum on wet, that has a loading of 0.5 on factor is