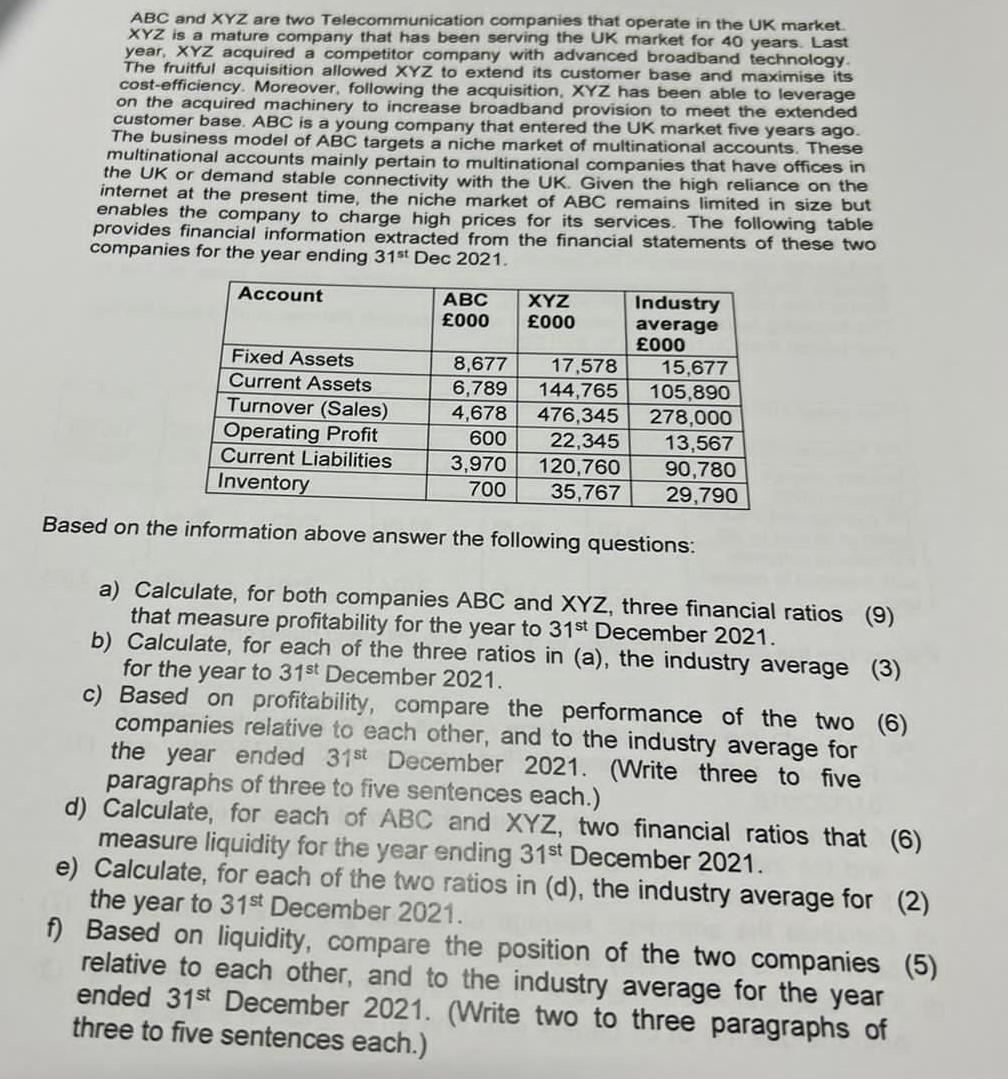

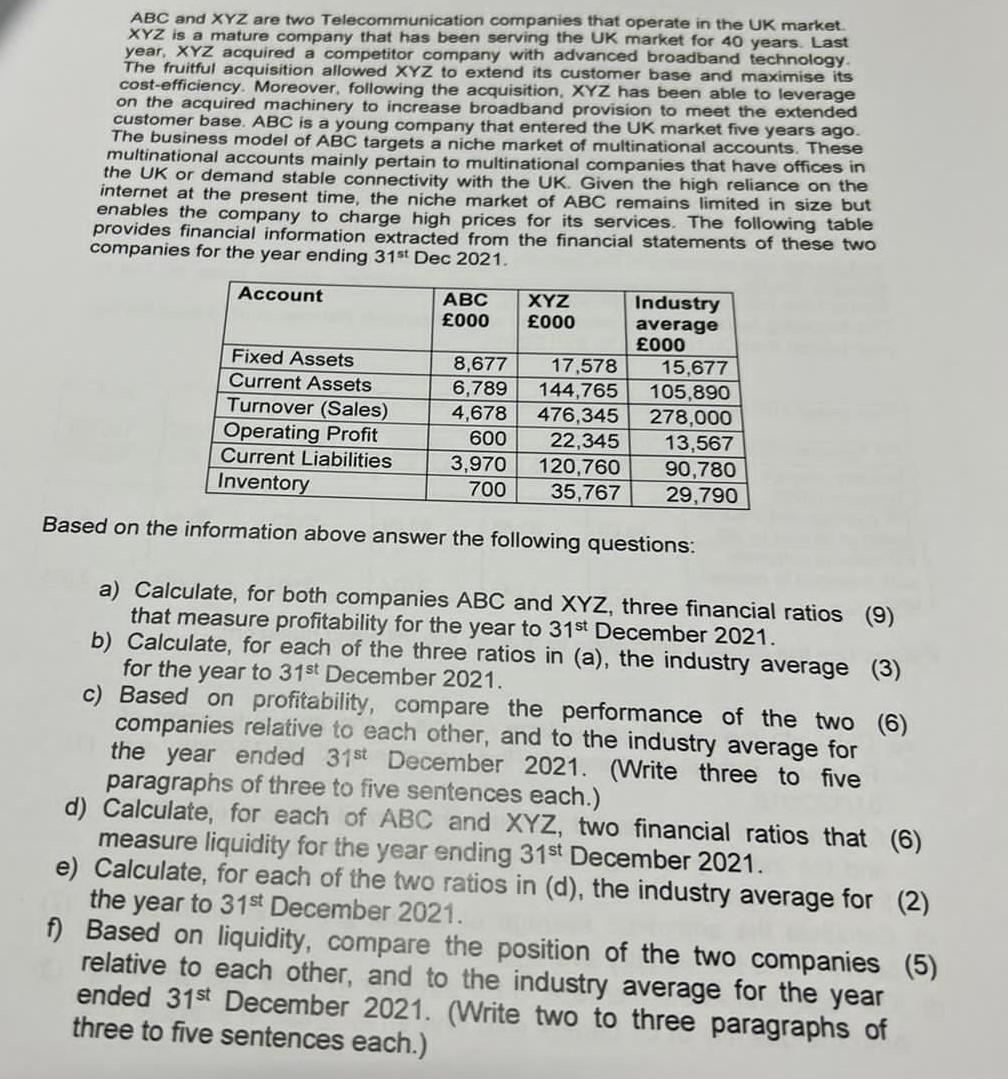

ABC and XYZ are two Telecommunication companies that operate in the UK market XYZ is a mature company that has been serving the UK market for 40 years. Last year, XYZ acquired a competitor company with advanced broadband technology The fruitful acquisition allowed XYZ to extend its customer base and maximise its cost-efficiency. Moreover, following the acquisition, XYZ has been able to leverage on the acquired machinery to increase broadband provision to meet the extended customer base. ABC is a young company that entered the UK market five years ago The business model of ABC targets a niche market of multinational accounts. These multinational accounts mainly pertain to multinational companies that have offices in the UK or demand stable connectivity with the UK. Given the high reliance on the internet at the present time, the niche market of ABC remains limited in size but enables the company to charge high prices for its services. The following table provides financial information extracted from the financial statements of these two companies for the year ending 31st Dec 2021. Account ABC 000 Fixed Assets Current Assets Turnover (Sales) Operating Profit Current Liabilities Inventory 8,677 6,789 4,678 600 3,970 700 XYZ Industry 000 average 000 17,578 15,677 144,765 105,890 476,345 278,000 22,345 13,567 120,760 90,780 35,767 29,790 Based on the information above answer the following questions: a) Calculate, for both companies ABC and XYZ, three financial ratios (9) that measure profitability for the year to 31st December 2021. b) Calculate, for each of the three ratios in (a), the industry average (3) for the year to 31st December 2021. c) Based on profitability, compare the performance of the two (6) companies relative to each other, and to the industry average for the year ended 31st December 2021. (Write three to five paragraphs of three to five sentences each.) d) Calculate, for each of ABC and XYZ, two financial ratios that (6) measure liquidity for the year ending 31st December 2021. e) Calculate, for each of the two ratios in (d), the industry average for (2) the year to 31st December 2021. f) Based on liquidity, compare the position of the two companies (5) relative to each other, and to the industry average for the year ended 31st December 2021. (Write two to three paragraphs of three to five sentences each.) ABC and XYZ are two Telecommunication companies that operate in the UK market XYZ is a mature company that has been serving the UK market for 40 years. Last year, XYZ acquired a competitor company with advanced broadband technology The fruitful acquisition allowed XYZ to extend its customer base and maximise its cost-efficiency. Moreover, following the acquisition, XYZ has been able to leverage on the acquired machinery to increase broadband provision to meet the extended customer base. ABC is a young company that entered the UK market five years ago The business model of ABC targets a niche market of multinational accounts. These multinational accounts mainly pertain to multinational companies that have offices in the UK or demand stable connectivity with the UK. Given the high reliance on the internet at the present time, the niche market of ABC remains limited in size but enables the company to charge high prices for its services. The following table provides financial information extracted from the financial statements of these two companies for the year ending 31st Dec 2021. Account ABC 000 Fixed Assets Current Assets Turnover (Sales) Operating Profit Current Liabilities Inventory 8,677 6,789 4,678 600 3,970 700 XYZ Industry 000 average 000 17,578 15,677 144,765 105,890 476,345 278,000 22,345 13,567 120,760 90,780 35,767 29,790 Based on the information above answer the following questions: a) Calculate, for both companies ABC and XYZ, three financial ratios (9) that measure profitability for the year to 31st December 2021. b) Calculate, for each of the three ratios in (a), the industry average (3) for the year to 31st December 2021. c) Based on profitability, compare the performance of the two (6) companies relative to each other, and to the industry average for the year ended 31st December 2021. (Write three to five paragraphs of three to five sentences each.) d) Calculate, for each of ABC and XYZ, two financial ratios that (6) measure liquidity for the year ending 31st December 2021. e) Calculate, for each of the two ratios in (d), the industry average for (2) the year to 31st December 2021. f) Based on liquidity, compare the position of the two companies (5) relative to each other, and to the industry average for the year ended 31st December 2021. (Write two to three paragraphs of three to five sentences each.)