Answered step by step

Verified Expert Solution

Question

1 Approved Answer

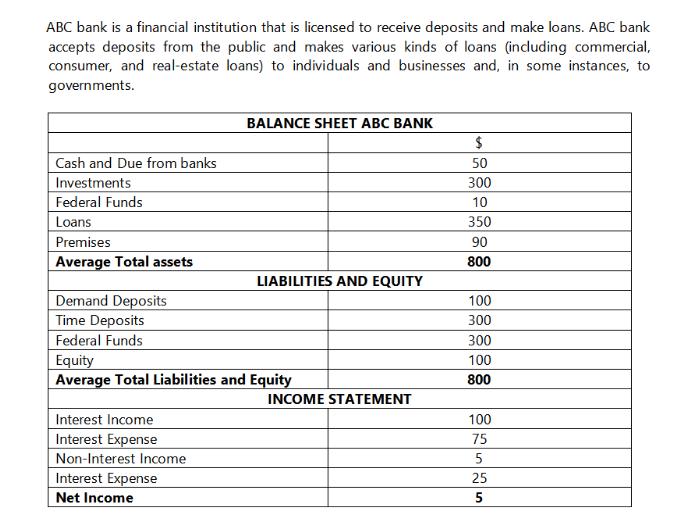

ABC bank is a financial institution that is licensed to receive deposits and make loans. ABC bank accepts deposits from the public and makes

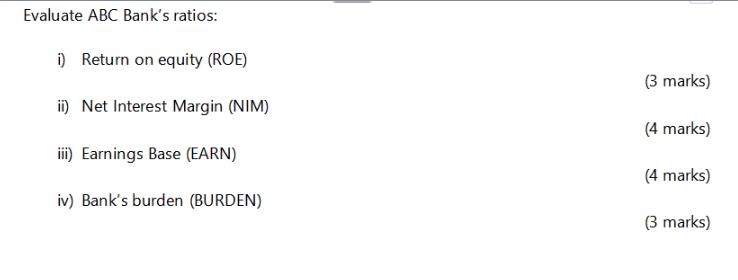

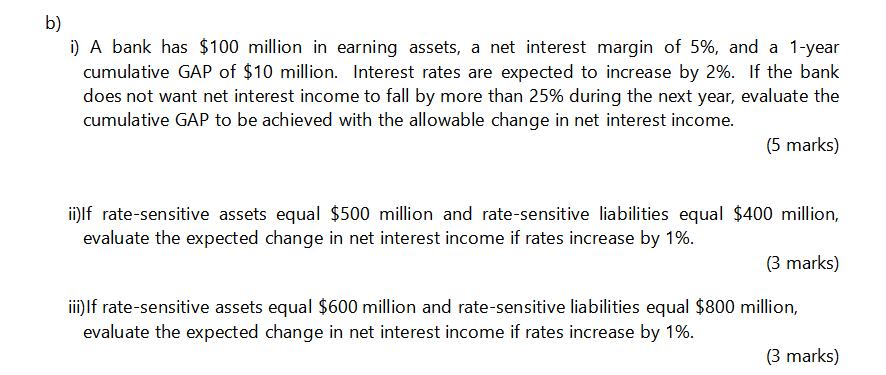

ABC bank is a financial institution that is licensed to receive deposits and make loans. ABC bank accepts deposits from the public and makes various kinds of loans (including commercial, consumer, and real-estate loans) to individuals and businesses and, in some instances, to governments. Cash and Due from banks Investments Federal Funds Loans Premises Average Total assets Demand Deposits Time Deposits Federal Funds Interest Income Interest Expense Non-Interest Income BALANCE SHEET ABC BANK Equity Average Total Liabilities and Equity Interest Expense Net Income LIABILITIES AND EQUITY INCOME STATEMENT $ 50 300 10 350 90 800 100 300 300 100 800 100 75 5 25 5 Evaluate ABC Bank's ratios: i) Return on equity (ROE) ii) Net Interest Margin (NIM) iii) Earnings Base (EARN) iv) Bank's burden (BURDEN) (3 marks) (4 marks) (4 marks) (3 marks) b) i) A bank has $100 million in earning assets, a net interest margin of 5%, and a 1-year cumulative GAP of $10 million. Interest rates are expected to increase by 2%. If the bank does not want net interest income to fall by more than 25% during the next year, evaluate the cumulative GAP to be achieved with the allowable change in net interest income. (5 marks) ii)lf rate-sensitive assets equal $500 million and rate-sensitive liabilities equal $400 million, evaluate the expected change in net interest income if rates increase by 1%. (3 marks) iii) If rate-sensitive assets equal $600 million and rate-sensitive liabilities equal $800 million, evaluate the expected change in net interest income if rates increase by 1%. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets evaluate the ratios for ABC Bank i Return on equity ROE ROE Net Income Average Equity 5 100 5 i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started