Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Brokers has today written a new European option on stock issued by Dannevirke & Eketahuna Finance ( DEF ) . The option expires in

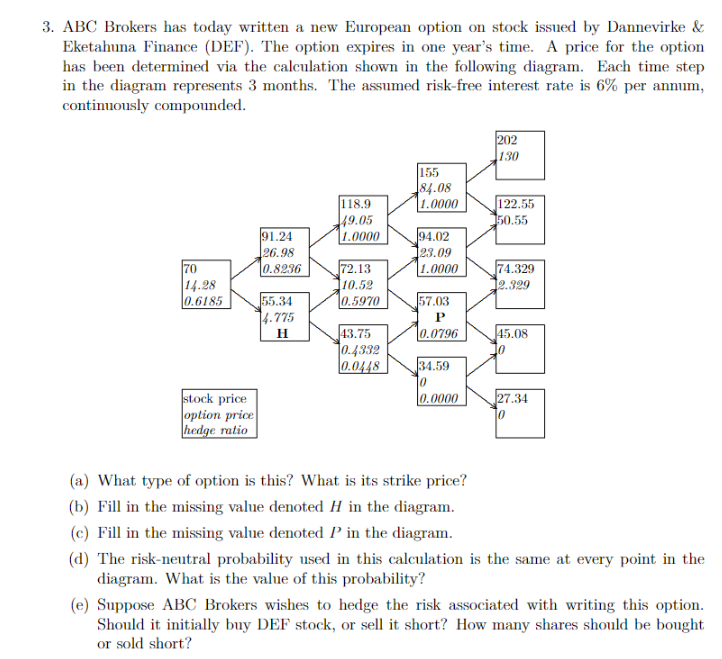

ABC Brokers has today written a new European option on stock issued by Dannevirke & Eketahuna Finance DEF The option expires in one year's time. A price for the option has been determined via the calculation shown in the following diagram. Each time step in the diagram represents months. The assumed riskfree interest rate is per annum, continuously compounded.

a What type of option is this? What is its strike price?

b Fill in the missing value denoted in the diagram.

c Fill in the missing value denoted in the diagram.

d The riskneutral probability used in this calculation is the same at every point in the diagram. What is the value of this probability?

e Suppose ABC Brokers wishes to hedge the risk associated with writing this option. Should it initially buy DEF stock, or sell it short? How many shares should be bought or sold short?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started