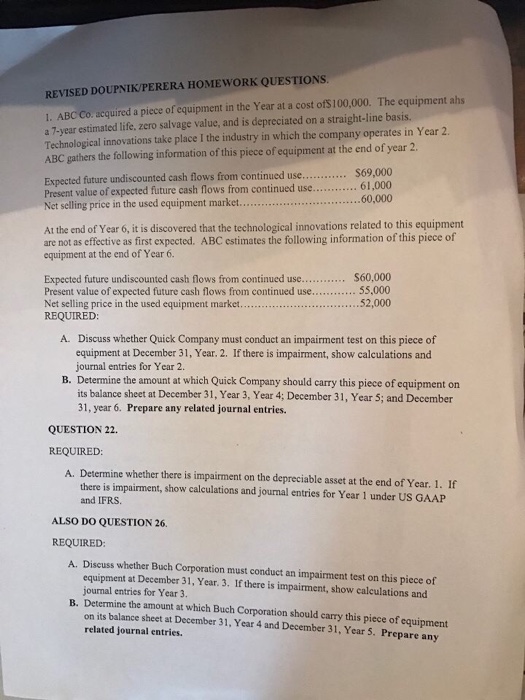

ABC Co acquired a piece of equipment in the year at a cost of^$ 10, 000. The equipment 7-year estimated life, zero salvage value and is depreciated on a straight basis Technological innovations take place 1 the industry in which the company operates in year 2. ABC gather the following information of this piece of equipment at the end of year 2. At the end of Year 6, it is discovered that the technological innovations related to this equipment are not as effective as first expected. ABC estimates the following information of this piece of equipment at the end of Year 6. Discuss whether Quick Company must conduct an impairment test on this piece of equipment at December 31, Year. 2. If there is impairment, show calculations and journal entries for Year 2. Determine the amount at which Quick Company should carry this piece of equipment on its balance sheet at December 31. Year 3, Year 4: December 31, Year 5; and December 31. year 6. Prepare any related journal entries. Determine whether there is impairment on the depreciable asset at the end of Year 1 If there impairment, show calculations and journal entries for Year 1 under US GAAP discuss whether Quick Company must conduct an impairment test on this piece of equipment at December 31, Year. 3. If there is impairment, show calculations and journal entries for Year 3. Determine the amount at which Quick Company should carry this piece of equipment on its balance sheet at December 31, Year 4, and December 31. year 5. Prepare any related journal entries. ABC Co acquired a piece of equipment in the year at a cost of^$ 10, 000. The equipment 7-year estimated life, zero salvage value and is depreciated on a straight basis Technological innovations take place 1 the industry in which the company operates in year 2. ABC gather the following information of this piece of equipment at the end of year 2. At the end of Year 6, it is discovered that the technological innovations related to this equipment are not as effective as first expected. ABC estimates the following information of this piece of equipment at the end of Year 6. Discuss whether Quick Company must conduct an impairment test on this piece of equipment at December 31, Year. 2. If there is impairment, show calculations and journal entries for Year 2. Determine the amount at which Quick Company should carry this piece of equipment on its balance sheet at December 31. Year 3, Year 4: December 31, Year 5; and December 31. year 6. Prepare any related journal entries. Determine whether there is impairment on the depreciable asset at the end of Year 1 If there impairment, show calculations and journal entries for Year 1 under US GAAP discuss whether Quick Company must conduct an impairment test on this piece of equipment at December 31, Year. 3. If there is impairment, show calculations and journal entries for Year 3. Determine the amount at which Quick Company should carry this piece of equipment on its balance sheet at December 31, Year 4, and December 31. year 5. Prepare any related journal entries