Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Co. has an expected EBIT (eamings before interest and taxes) of $63,000 in perpetuity and a tax rate of 21 percent. Its unlevered

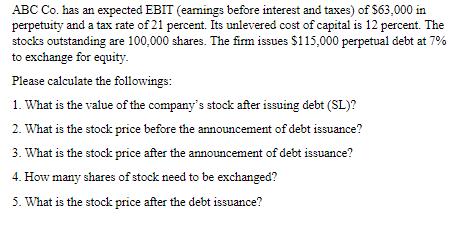

ABC Co. has an expected EBIT (eamings before interest and taxes) of $63,000 in perpetuity and a tax rate of 21 percent. Its unlevered cost of capital is 12 percent. The stocks outstanding are 100,000 shares. The firm issues $115,000 perpetual debt at 7% to exchange for equity. Please calculate the followings: 1. What is the value of the company's stock after issuing debt (SL)? 2. What is the stock price before the announcement of debt issuance? 3. What is the stock price after the announcement of debt issuance? 4. How many shares of stock need to be exchanged? 5. What is the stock price after the debt issuance?

Step by Step Solution

★★★★★

3.55 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ABC Co Stock Valuation and Debt Issuance 1 Value of the companys stock after issuing debt SL First calculate the value of the company before issuing d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started