Answered step by step

Verified Expert Solution

Question

1 Approved Answer

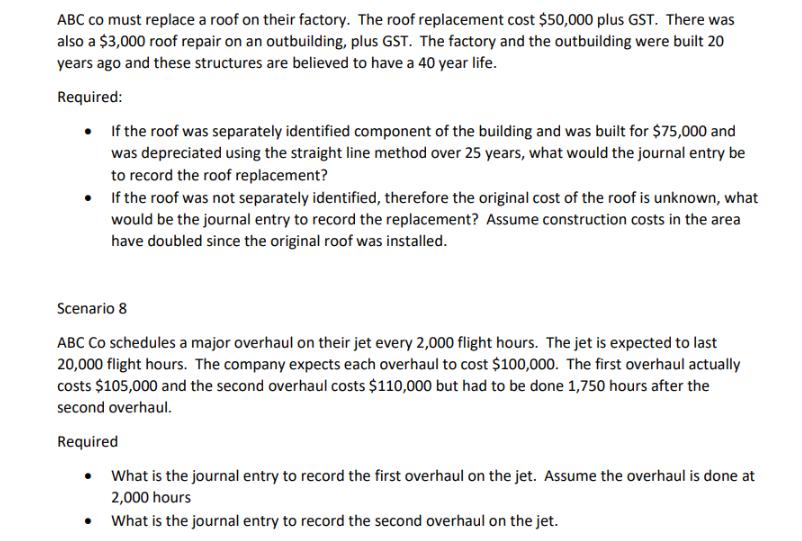

ABC co must replace a roof on their factory. The roof replacement cost $50,000 plus GST. There was also a $3,000 roof repair on

ABC co must replace a roof on their factory. The roof replacement cost $50,000 plus GST. There was also a $3,000 roof repair on an outbuilding, plus GST. The factory and the outbuilding were built 20 years ago and these structures are believed to have a 40 year life. Required: If the roof was separately identified component of the building and was built for $75,000 and was depreciated using the straight line method over 25 years, what would the journal entry be to record the roof replacement? If the roof was not separately identified, therefore the original cost of the roof is unknown, what would be the journal entry to record the replacement? Assume construction costs in the area have doubled since the original roof was installed. Scenario 8 ABC Co schedules a major overhaul on their jet every 2,000 flight hours. The jet is expected to last 20,000 flight hours. The company expects each overhaul to cost $100,000. The first overhaul actually costs $105,000 and the second overhaul costs $110,000 but had to be done 1,750 hours after the second overhaul. Required What is the journal entry to record the first overhaul on the jet. Assume the overhaul is done at 2,000 hours What is the journal entry to record the second overhaul on the jet.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Journal entry to record the roof replacement assuming it was separately identified an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started