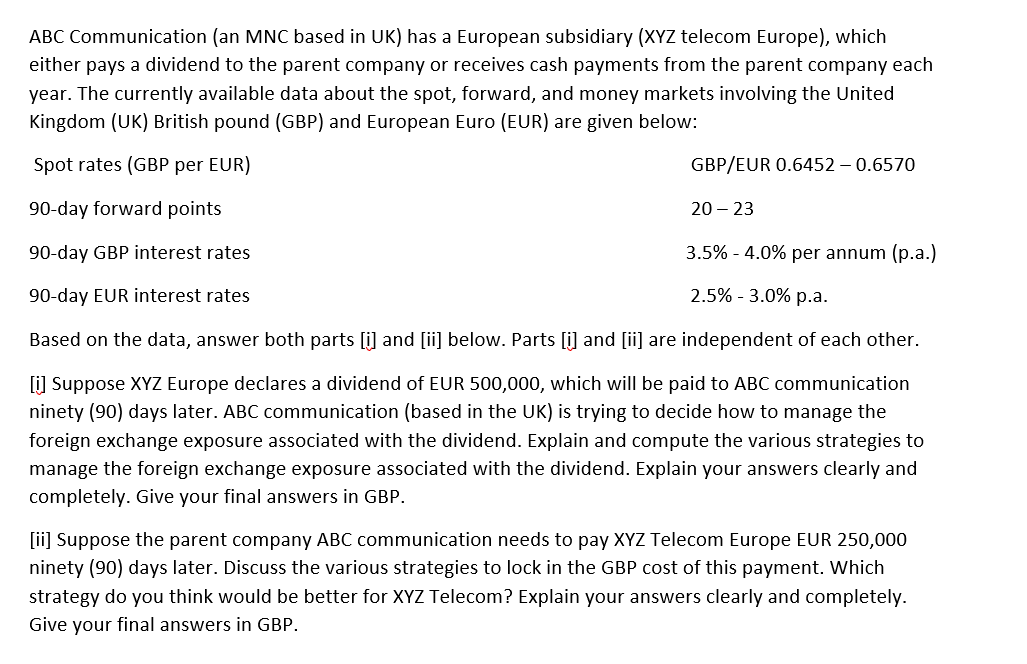

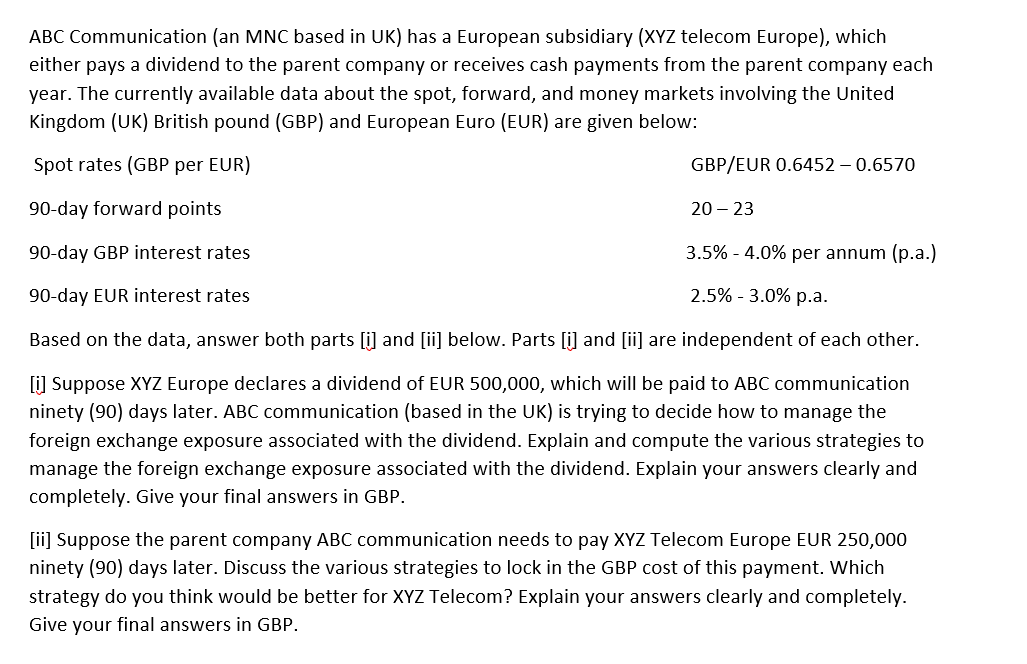

ABC Communication (an MNC based in UK) has a European subsidiary (XYZ telecom Europe), which either pays a dividend to the parent company or receives cash payments from the parent company each year. The currently available data about the spot, forward, and money markets involving the United Kingdom (UK) British pound (GBP) and European Euro (EUR) are given below: Spotrates(GBPperEUR)90-dayforwardpoints90-dayGBPinterestrates90-dayEURinterestratesGBP/EUR0.64520.657020233.5%4.0%perannum(p.a.)2.5%3.0%p.a. Based on the data, answer both parts [i] and [ii] below. Parts [i] and [ii] are independent of each other. [i] Suppose XYZ Europe declares a dividend of EUR 500,000, which will be paid to ABC communication ninety (90) days later. ABC communication (based in the UK) is trying to decide how to manage the foreign exchange exposure associated with the dividend. Explain and compute the various strategies to manage the foreign exchange exposure associated with the dividend. Explain your answers clearly and completely. Give your final answers in GBP. [ii] Suppose the parent company ABC communication needs to pay XYZ Telecom Europe EUR 250,000 ninety (90) days later. Discuss the various strategies to lock in the GBP cost of this payment. Which strategy do you think would be better for XYZ Telecom? Explain your answers clearly and completely. Give your final answers in GBP. ABC Communication (an MNC based in UK) has a European subsidiary (XYZ telecom Europe), which either pays a dividend to the parent company or receives cash payments from the parent company each year. The currently available data about the spot, forward, and money markets involving the United Kingdom (UK) British pound (GBP) and European Euro (EUR) are given below: Spotrates(GBPperEUR)90-dayforwardpoints90-dayGBPinterestrates90-dayEURinterestratesGBP/EUR0.64520.657020233.5%4.0%perannum(p.a.)2.5%3.0%p.a. Based on the data, answer both parts [i] and [ii] below. Parts [i] and [ii] are independent of each other. [i] Suppose XYZ Europe declares a dividend of EUR 500,000, which will be paid to ABC communication ninety (90) days later. ABC communication (based in the UK) is trying to decide how to manage the foreign exchange exposure associated with the dividend. Explain and compute the various strategies to manage the foreign exchange exposure associated with the dividend. Explain your answers clearly and completely. Give your final answers in GBP. [ii] Suppose the parent company ABC communication needs to pay XYZ Telecom Europe EUR 250,000 ninety (90) days later. Discuss the various strategies to lock in the GBP cost of this payment. Which strategy do you think would be better for XYZ Telecom? Explain your answers clearly and completely. Give your final answers in GBP