Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company, a flourishing business specializing in product storage and distribution, operates from three distinct warehouse locations. This case study will explore the company's

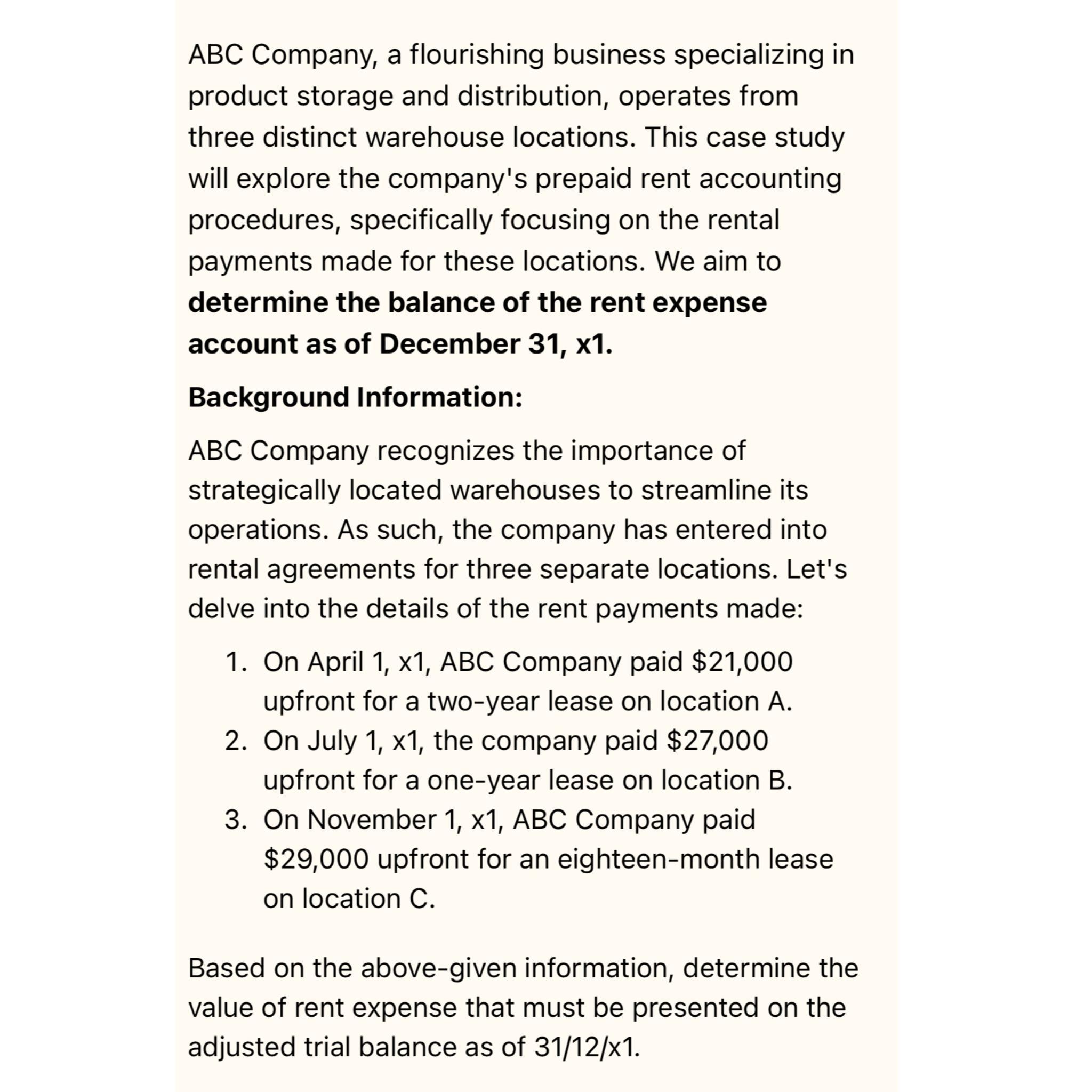

ABC Company, a flourishing business specializing in product storage and distribution, operates from three distinct warehouse locations. This case study will explore the company's prepaid rent accounting procedures, specifically focusing on the rental payments made for these locations. We aim to determine the balance of the rent expense account as of December 31, x1. Background Information: ABC Company recognizes the importance of strategically located warehouses to streamline its operations. As such, the company has entered into rental agreements for three separate locations. Let's delve into the details of the rent payments made: 1. On April 1, x1, ABC Company paid $21,000 upfront for a two-year lease on location A. 2. On July 1, x1, the company paid $27,000 upfront for a one-year lease on location B. 3. On November 1, x1, ABC Company paid $29,000 upfront for an eighteen-month lease on location C. Based on the above-given information, determine the value of rent expense that must be presented on the adjusted trial balance as of 31/12/x1.

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

To determine the rent expense as of December 31 x1 you need to allocate the prepaid rent over the re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started