Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company acquired a machine for $50,000 on January 1, 20X1. The machine has an estimated useful life of 5 years and an estimated

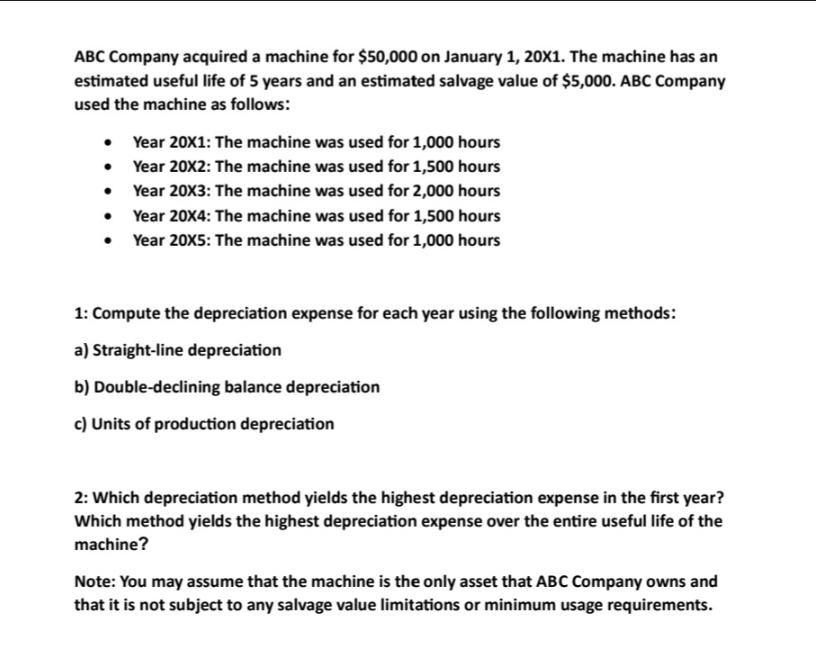

ABC Company acquired a machine for $50,000 on January 1, 20X1. The machine has an estimated useful life of 5 years and an estimated salvage value of $5,000. ABC Company used the machine as follows: Year 20X1: The machine was used for 1,000 hours Year 20X2: The machine was used for 1,500 hours Year 20X3: The machine was used for 2,000 hours Year 20X4: The machine was used for 1,500 hours Year 20X5: The machine was used for 1,000 hours 1: Compute the depreciation expense for each year using the following methods: a) Straight-line depreciation b) Double-declining balance depreciation c) Units of production depreciation 2: Which depreciation method yields the highest depreciation expense in the first year? Which method yields the highest depreciation expense over the entire useful life of the machine? Note: You may assume that the machine is the only asset that ABC Company owns and that it is not subject to any salvage value limitations or minimum usage requirements.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense for each year using different methods lets consider the following Cost of the machine 50000 Estimated useful lif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started