Question

ABC Company and XYZ Company need to raise funds to pay for capital improvements at their manufacturing plants. ABC Company is a well-established firm with

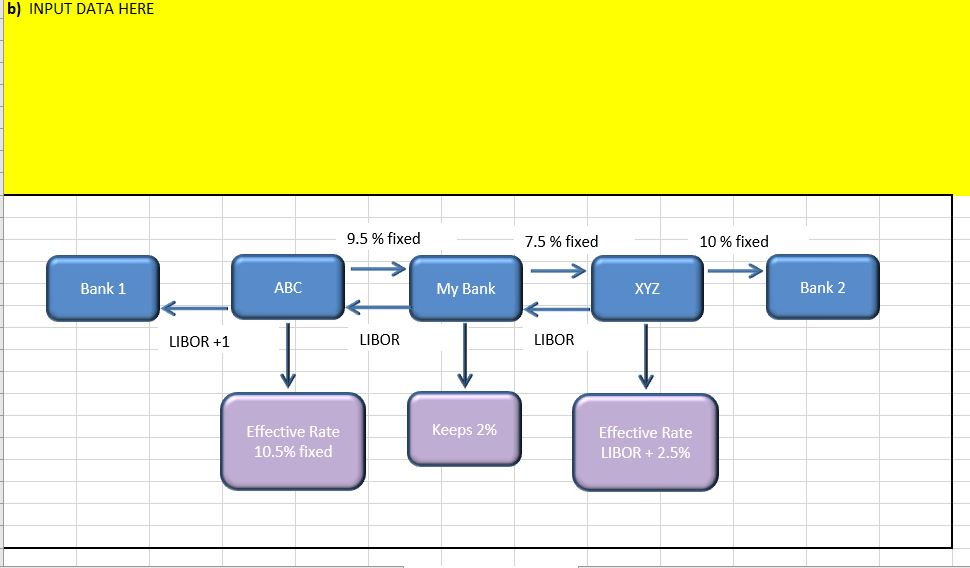

ABC Company and XYZ Company need to raise funds to pay for capital improvements at their manufacturing plants. ABC Company is a well-established firm with an excellent credit rating in the debt market; it can borrow funds either at 11 percent fixed rate or at LIBOR + 1 percent floating rate. XYZ Company is a fledgling start-up firm without a strong credit history. It can borrow funds either at 10 percent fixed rate or at LIBOR + 3 percent floating rate.

A. Suppose you've just been hired at a bank that acts as a dealer in the swaps market, and your boss has shown you the borrowing rate information for your clients, ABC and XYZ. Describe how you could bring these two companies together in an interest rate swap that could make both firms better off while netting your bank a 2 percent profit

**Please provide detailed Work**

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started