Question

ABC & Company are manufacturers of furniture. They are contemplating the introduction of a new line which will require investment of Rs. 20 million in

ABC & Company are manufacturers of furniture.

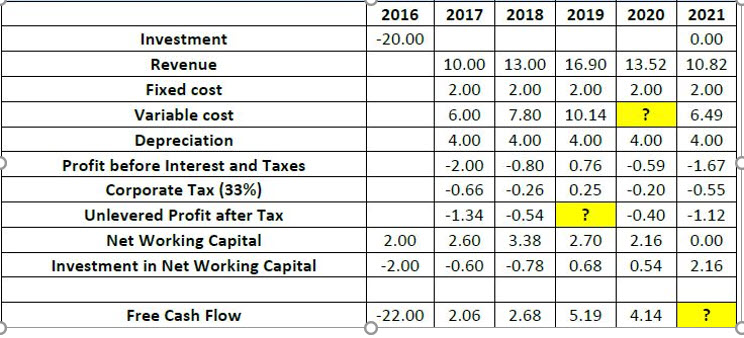

They are contemplating the introduction of a new line which will require investment of Rs. 20 million in plant and machinery, which would have to be incurred by the end of December 2016. Production, and the resultant revenue and costs will start immediately.

In the first year, revenue is expected to be Rs. 10 million followed by an increase of 30% each year for the next 2 years, and then decline by 20% each year for the next 2 years, after which the line will be discontinued.

There is a fixed cost of Rs. 2 million each year and the variable cost of production comes to 60% of sales revenue.

Depreciation is straight line over the 5 year period.

The value of plant and machinery at the end of 5 years can be assumed to be zero.

ABC will have to invest in working capital equal to 20% of sales revenue at the beginning of each year.

You may assume that the entire working capital investment is recovered at the end of the project.

The applicable tax rate for ABC is 33%.

ABC has a Weighted Average Cost of Capital of 10%.

(Assume that all cash flows occur at the end of each year for convenience.)

The table given shows the different components associated with the calculation of Free Cash Flow for this company.

QUESTIONS: find out the solution of the yellow boxes. Show the detailed steps.

NOTE: CHOICES ARE 'VARIABLE COST' in the year 2020, Should be one of these choices (8.11 million 9.70 million 10.80 million or 14.90 million ) the value of 'FREE CASH FLOW' in the year 2021 should be one of these choices (1.23 million 2.95 million 3.95 million or 5.04 million)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started