Question

ABC Company, as of December 31, 2021 provided the following balances: Cash, net of a P7,000 overdraft Receivable, net of customer credit balances totaling

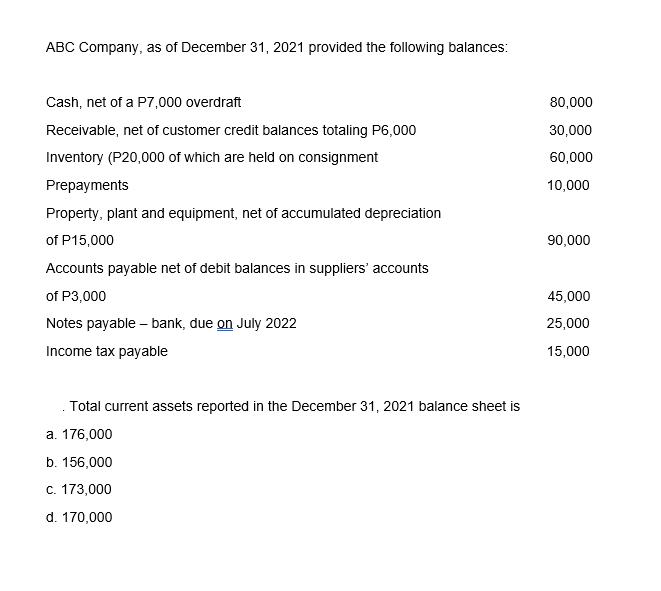

ABC Company, as of December 31, 2021 provided the following balances: Cash, net of a P7,000 overdraft Receivable, net of customer credit balances totaling P6,000 Inventory (P20,000 of which are held on consignment Prepayments Property, plant and equipment, net of accumulated depreciation of P15,000 Accounts payable net of debit balances in suppliers' accounts of P3,000 Notes payable - bank, due on July 2022 Income tax payable Total current assets reported in the December 31, 2021 balance sheet is a. 176,000 b. 156,000 c. 173,000 d. 170,000 80,000 30,000 60,000 10,000 90,000 45,000 25,000 15,000

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

c 173000 Total current ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume 1

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

15th Canadian Edition

1259259803, 978-1259259807

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App