Answered step by step

Verified Expert Solution

Question

1 Approved Answer

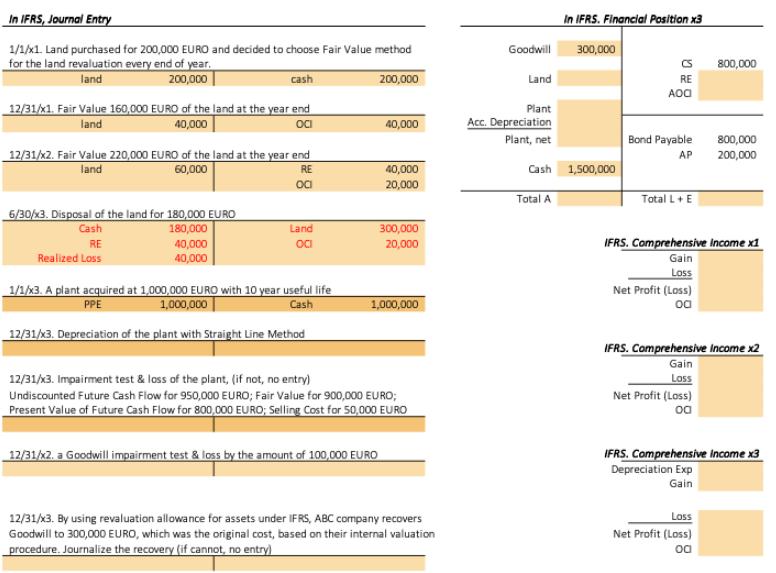

ABC company based in Germany has had the following transactions pertaining to the noncurrent assets since 20x1. Complete the Journal Entries and report Statement of

ABC company based in Germany has had the following transactions pertaining to the noncurrent assets since 20x1.

Complete the Journal Entries and report Statement of Financial Position and Statement of Comprehensive Income under IFRS.

The orange parts of this sheet need to be filled in with the appropriate journal entries for asset revaluation using the fair value method under IFRS rules. I've filled in as much as I could but feel that it's wrong. Each journal entry has the prompt above it.

In IFRS, Journal Entry In IFRS. Financial Position x3 1/1/x1. Land purchased for 200,000 EURO and decided to choose Fair Value method Goodwill 300,000 for the land revaluation every end of year. land CS 800,000 200,000 cash 200,000 Land RE AOa 12/31/x1. Fair Value 160,000 EURO of the land at the year end 40,000 Plant land Acc. Depreciation OCI 40,000 800,000 200,000 Plant, net Bond Payable 12/31/k2. Fair Value 220,000 EURO of the land at the year end 60,000 AP land RE Cash 1,500,000 40,000 20,000 oa Total A Total L+E 6/30/3. Disposal of the land for 180,000 EURO Cash 180,000 Land 300,000 IFRS. Comprehensive income x1 RE 40,000 40,000 OCI 20,000 Realized Loss Gain Loss Net Profit (Loss) 1/1/x3. A plant acquired at 1,000,000 EURO with 10 year useful life 1,000,000 PPE Cash 1,000,000 12/31/3. Depreciation of the plant with Straight Line Method IFRS. Comprehensive Income x2 Gain 12/31/3. Impairment test & loss of the plant, (if not, no entry) Loss Undiscounted Future Cash Flow for 950,000 EURO; Fair Value for 900,000 EURO; Net Profit (Loss) Present Value of Future Cash Flow for 800,000 EURO; Selling Cost for 50,000 EURO 12/31/x2. a Goodwill impairment test & loss by the amount of 100,000 EURO IFRS. Comprehensive Income x3 Depreciation Exp Gain Lss 12/31/x3. By using revaluation allowance for assets under IFRS, ABC company recovers Goodwill to 300,000 EURO, which was the original cost, based on their internal valuation procedure. Journalize the recovery (if cannot, no entry) Net Profit (Loss)

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

11x1 Land purchase at 200000 Euro Debit Credit Land Ac 20000000 To Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started