ABC Company - Biographical Information ABC Company is a family owned business which Jonathan started 15 years ago, issuing 900 shares of the 1000 authorized,

ABC Company - Biographical Information ABC Company is a family owned business which Jonathan started 15 years ago, issuing 900 shares of the 1000 authorized, at a par value of $100 a share. ABC Company is a small manufacturer which produces ladies? sports apparel. The business has employed as many as 30 people; however, sales have slipped the last three years, according to Jonathan, due to competition in the marketplace, and the economy. Currently, the business employs nine people, including Jonathan and his son, Junior, who is the Plant Manager. The business appears to be on pace to produce about the same as last year, $800,000, which is down from their high of about $2,500,000 just four years ago. Jonathan?s family is personally in financial trouble, because Jonathan and Junior aren?t taking home the same salary they used to. Three years ago, each of them earned $200K per year. At the time of our arrival, Jonathan hadn?t taken any pay for a month, and Junior is being paid at the rate of $50K per year. Jonathan has a few health issues, and wants Junior to take over the business, but can?t afford to hire a new Plant Manager. Morale throughout the company is low, and productivity is suffering. ABC Company sold 12,307 units last year. 85% of the sales were in workout leggings. Remaining sales were from one order of sweatshirts by their oldest customer. They are behind in payables and past due receivables are at an all time high. Their customer base consists mainly of three local retailers who love working with Jonathan and Junior and have been customers for years. Vendors are getting tired of being paid late, and their primary fabric vendor has just recently put them on COD. There is a loan on the books from Junior?s mother-in-law for $30,000, with a pay plan of $750 a month, but the Company has missed the last three payments and Junior and his wife are becoming increasingly upset about the embarrassment and problems this is causing in their family life.

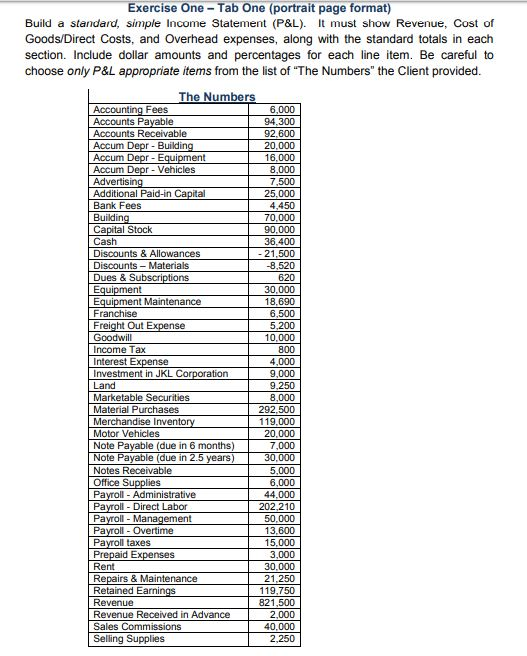

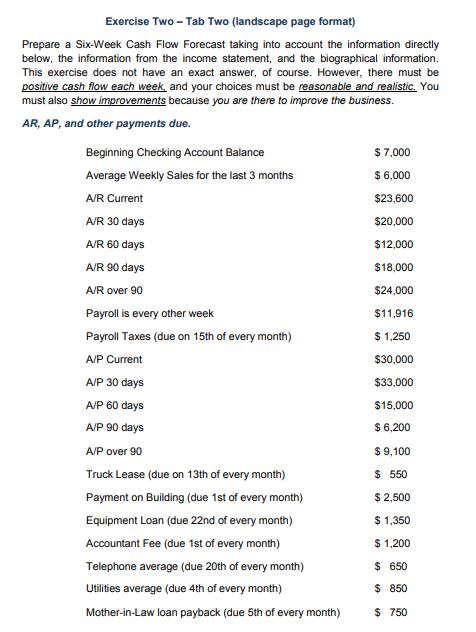

Exercise One - Tab One (portrait page format) Build a standard, simple Income Statement (P&L). It must show Revenue, Cost of Goods/Direct Costs, and Overhead expenses, along with the standard totals in each section. Include dollar amounts and percentages for each line item. Be careful to choose only P&L appropriate items from the list of "The Numbers" the Client provided. The Numbers Accounting Fees Accounts Payable Accounts Receivable Accum Depr - Building Accum Depr - Equipment Accum Depr - Vehicles Advertising Additional Paid-in Capital Bank Fees Building Capital Stock Cash Discounts & Allowances Discounts - Materials. Dues & Subscriptions Equipment Equipment Maintenance Franchise Freight Out Expense Goodwill Income Tax Interest Expense Investment in JKL Corporation Land Marketable Securities Material Purchases Merchandise Inventory Motor Vehicles Note Payable (due in 6 months) Note Payable (due in 2.5 years) Notes Receivable Office Supplies Payroll - Administrative Payroll - Direct Labor Payroll Management Payroll-Overtime Payroll taxes Prepaid Expenses Rent Repairs & Maintenance Retained Earnings Revenue Revenue Received in Advance Sales Commissions Selling Supplies 6,000 94,300 92,600 20,000 16,000 8,000 7,500 25,000 4,450 70,000 90,000 36,400 - 21,500 -8,520 620 30,000 18,690 6,500 5,200 10,000 800 4,000 9,000 9,250 8,000 292,500 119,000 20,000 7,000 30,000 5,000 6,000 44,000 202,210 50,000 13,600 15,000 3,000 30,000 21,250 119,750 821,500 2,000 40,000 2,250 Exercise Two - Tab Two (landscape page format) Prepare a Six-Week Cash Flow Forecast taking into account the information directly below, the information from the income statement, and the biographical information. This exercise does not have an exact answer, of course. However, there must be positive cash flow each week, and your choices must be reasonable and realistic. You must also show improvements because you are there to improve the business. AR, AP, and other payments due. Beginning Checking Account Balance Average Weekly Sales for the last 3 months A/R Current A/R 30 days A/R 60 days A/R 90 days A/R over 90 Payroll is every other week Payroll Taxes (due on 15th of every month) A/P Current A/P 30 days A/P 60 days A/P 90 days A/P over 90 Truck Lease (due on 13th of every month) Payment on Building (due 1st of every month) Equipment Loan (due 22nd of every month) Accountant Fee (due 1st of every month) Telephone average (due 20th of every month) Utilities average (due 4th of every month) Mother-in-Law loan payback (due 5th of every month) $ 7,000 $ 6,000 $23,600 $20,000 $12,000 $18,000 $24,000 $11,916 $ 1,250 $30,000 $33,000 $15,000 $ 6,200 $9,100 $ 550 $ 2,500 $ 1,350 $ 1,200 $ 650 $ 850 $ 750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ABC Company Statement of Profit and Loss Particulars Amount Revenue 821500 Less Discount and Allowan...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started