Question: ABC Ltd. Opened a large bakery operation on January 1, 2018 and picked a December 31 year end. Losses were experienced during the first

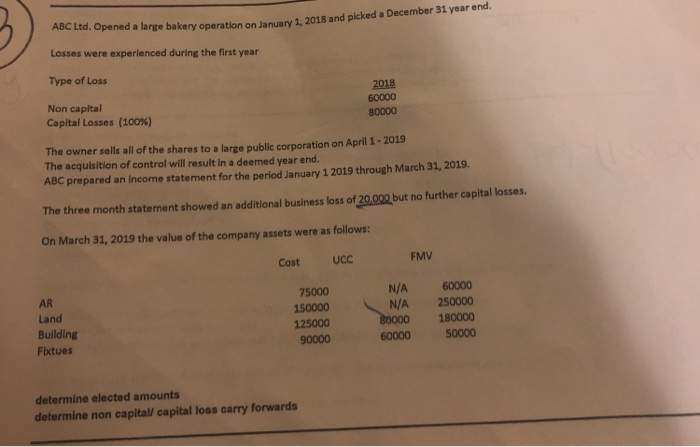

ABC Ltd. Opened a large bakery operation on January 1, 2018 and picked a December 31 year end. Losses were experienced during the first year Type of Loss Non capital Capital Losses (100 %) The owner sells all of the shares to a large public corporation on April 1-2019 The acquisition of control will result in a deemed year end. ABC prepared an income statement for the period January 1 2019 through March 31, 2019. The three month statement showed an additional business loss of 20,000 but no further capital losses. On March 31, 2019 the value of the company assets were as follows: AR Land Building Fixtues Cost 75000 150000 125000 90000 determine elected amounts determine non capital/ capital loss carry forwards 2018 60000 80000 UCC N/A N/A 80000 60000 FMV 60000 250000 180000 50000

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

To address the requirements well analyze the provided data to determine the elected amounts and the noncapitalcapital loss carry forwards Step 1 Under... View full answer

Get step-by-step solutions from verified subject matter experts