Question

ABC Company currently has $300 million debt and $700 million equity (market value). You are hired by the company to analyze whether increasing the debt

ABC Company currently has $300 million debt and $700 million equity (market value). You are hired by the company to analyze whether increasing the debt ratio to 40% (the proceeds of borrowing will be used to buy back stocks) would increase the firm value. Assume the debt level will be permanent for the firm. You collected the following information:

- The company faces a marginal tax rate of 30%. The risk free rate is 4.5%.

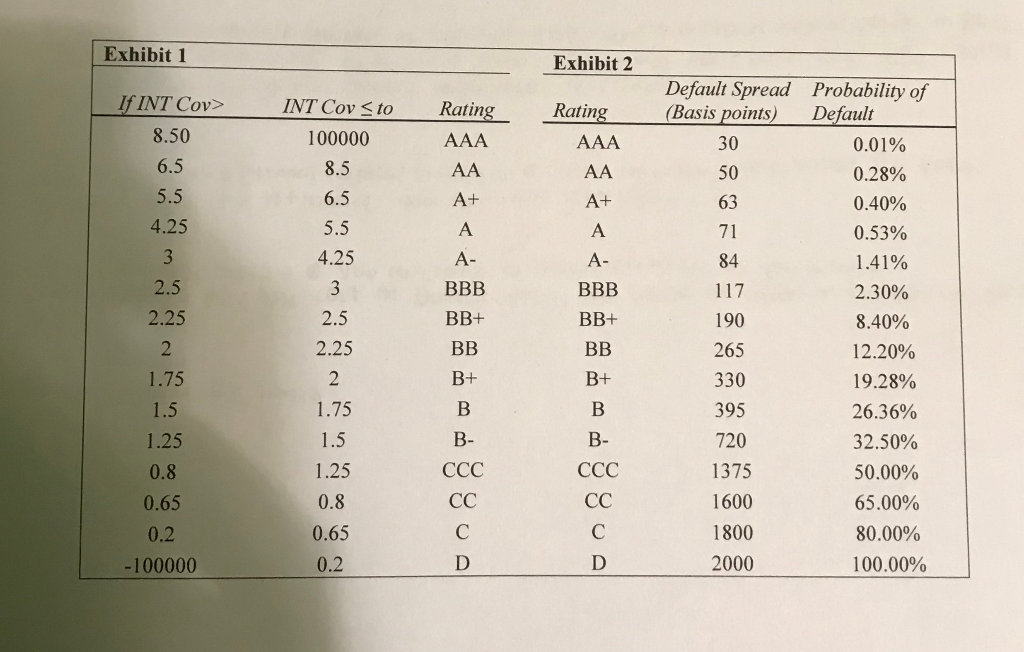

- The firms cost of debt is tied to the credit rating (Exhibit 2). The firms current credit rating is A-. The credit rating is determined by interest coverage ratio (Exhibit 1). Your company is expected to maintain EBIT of $60 million.

- The cost of bankruptcy of the firm is expected to be 30%. The probability of default is tied to credit rating (Exhibit 2). You decide to use the adjusted present value method to make the decision. To do so you are supposed to answer the following questions:

- 1. What is the current cost of debt (corresponding to A rating)?

- 2. If the debt ratio increases to 40%, what will be the interest coverage ratio, credit rating, and cost of debt?

PLEASE SHOW ALL WORK! NO EXCEL OR TABLES! PLEASE!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started